Leaseback programs offer property owners a steady income stream by leasing their real estate to investors, while maintaining personal use rights during specific periods. Timeshares, on the other hand, divide ownership of vacation properties among multiple individuals, granting shared usage without the complexities of full ownership. Explore the differences and benefits of leaseback programs versus timeshares to find the ideal real estate investment strategy.

Why it is important

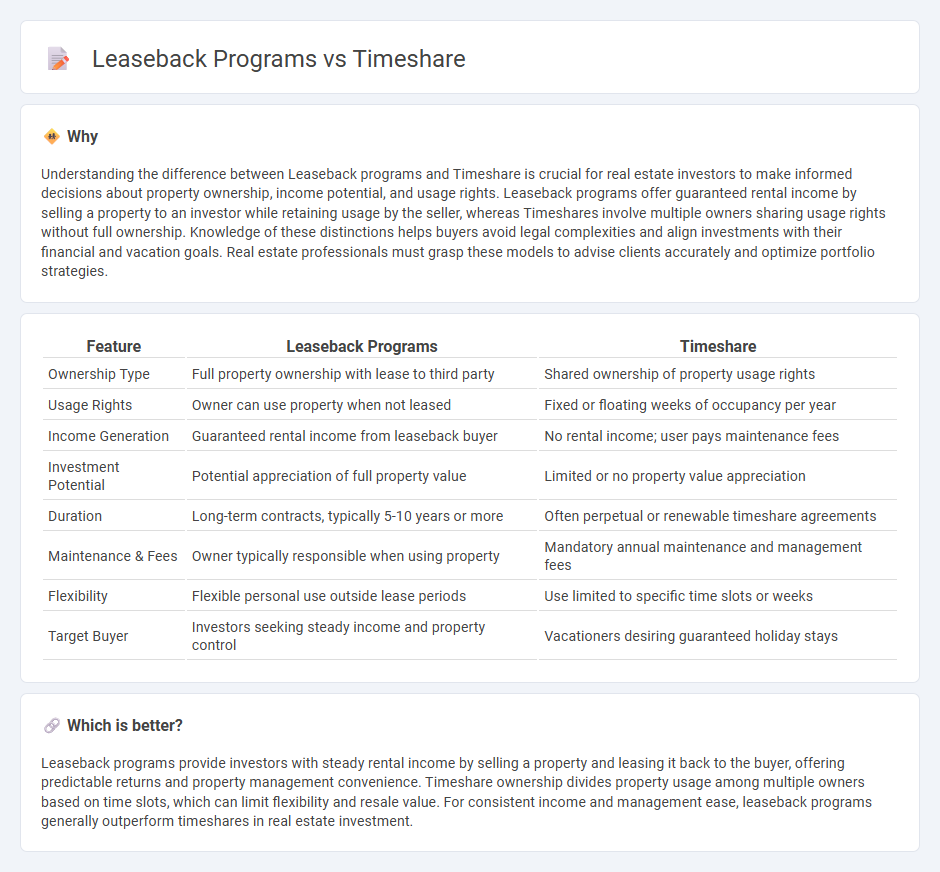

Understanding the difference between Leaseback programs and Timeshare is crucial for real estate investors to make informed decisions about property ownership, income potential, and usage rights. Leaseback programs offer guaranteed rental income by selling a property to an investor while retaining usage by the seller, whereas Timeshares involve multiple owners sharing usage rights without full ownership. Knowledge of these distinctions helps buyers avoid legal complexities and align investments with their financial and vacation goals. Real estate professionals must grasp these models to advise clients accurately and optimize portfolio strategies.

Comparison Table

| Feature | Leaseback Programs | Timeshare |

|---|---|---|

| Ownership Type | Full property ownership with lease to third party | Shared ownership of property usage rights |

| Usage Rights | Owner can use property when not leased | Fixed or floating weeks of occupancy per year |

| Income Generation | Guaranteed rental income from leaseback buyer | No rental income; user pays maintenance fees |

| Investment Potential | Potential appreciation of full property value | Limited or no property value appreciation |

| Duration | Long-term contracts, typically 5-10 years or more | Often perpetual or renewable timeshare agreements |

| Maintenance & Fees | Owner typically responsible when using property | Mandatory annual maintenance and management fees |

| Flexibility | Flexible personal use outside lease periods | Use limited to specific time slots or weeks |

| Target Buyer | Investors seeking steady income and property control | Vacationers desiring guaranteed holiday stays |

Which is better?

Leaseback programs provide investors with steady rental income by selling a property and leasing it back to the buyer, offering predictable returns and property management convenience. Timeshare ownership divides property usage among multiple owners based on time slots, which can limit flexibility and resale value. For consistent income and management ease, leaseback programs generally outperform timeshares in real estate investment.

Connection

Leaseback programs and timeshares are connected through their shared model of property use and ownership, allowing individuals to invest in real estate while retaining partial usage rights. Leaseback programs involve owners selling their property to an investor and leasing it back for a fixed period, often linked to vacation homes, similar to timeshares, where multiple parties hold usage rights for specific times. Both models optimize real estate investment by maximizing property utilization and offering flexible ownership without full-time occupancy.

Key Terms

Ownership Structure

Timeshare programs offer fractional ownership, granting multiple individuals shared rights to use a property at designated times, typically with deeded ownership or long-term leases. Leaseback programs involve property owners selling their asset to an investor while retaining the right to use it, generating income from the sale and ongoing lease agreements. Discover the detailed benefits and legal nuances of each ownership structure to make informed investment decisions.

Usage Rights

Timeshare programs grant multiple owners partial usage rights to a property, allowing scheduled vacations with defined time slots and shared maintenance costs. Leaseback programs involve owners leasing their property to a management company that rents it out, providing rental income while limiting the owner's personal usage rights. Explore more about how usage rights impact vacation flexibility and investment potential in each program.

Revenue Sharing

Timeshare programs enable owners to purchase a fraction of a property with shared usage rights, often generating consistent revenue through rental income and resale opportunities, while leaseback programs involve selling the property to an investor who leases it back to the original owner, providing an upfront capital injection and ongoing lease payments as a form of revenue sharing. Revenue sharing in timeshare models depends heavily on occupancy rates and resale market demand, whereas leaseback revenue is typically fixed and contractually guaranteed. Discover detailed financial comparisons and benefits of timeshare vs leaseback revenue sharing by exploring specialized real estate investment insights.

Source and External Links

RedWeek - A platform for renting or buying timeshare properties from over 5,000 resorts worldwide.

Wise: What is a Timeshare? - An overview of timeshares, including how they work and the costs involved.

Timeshare - Wikipedia - A detailed explanation of the history and concept of timeshares.

dowidth.com

dowidth.com