Automated valuation models (AVMs) use statistical techniques and property data to estimate real estate values quickly and consistently. Market pricing algorithms analyze real-time market trends and transaction data to offer dynamic property pricing insights tailored to current demand and supply conditions. Discover how these technologies transform property valuation for buyers, sellers, and investors.

Why it is important

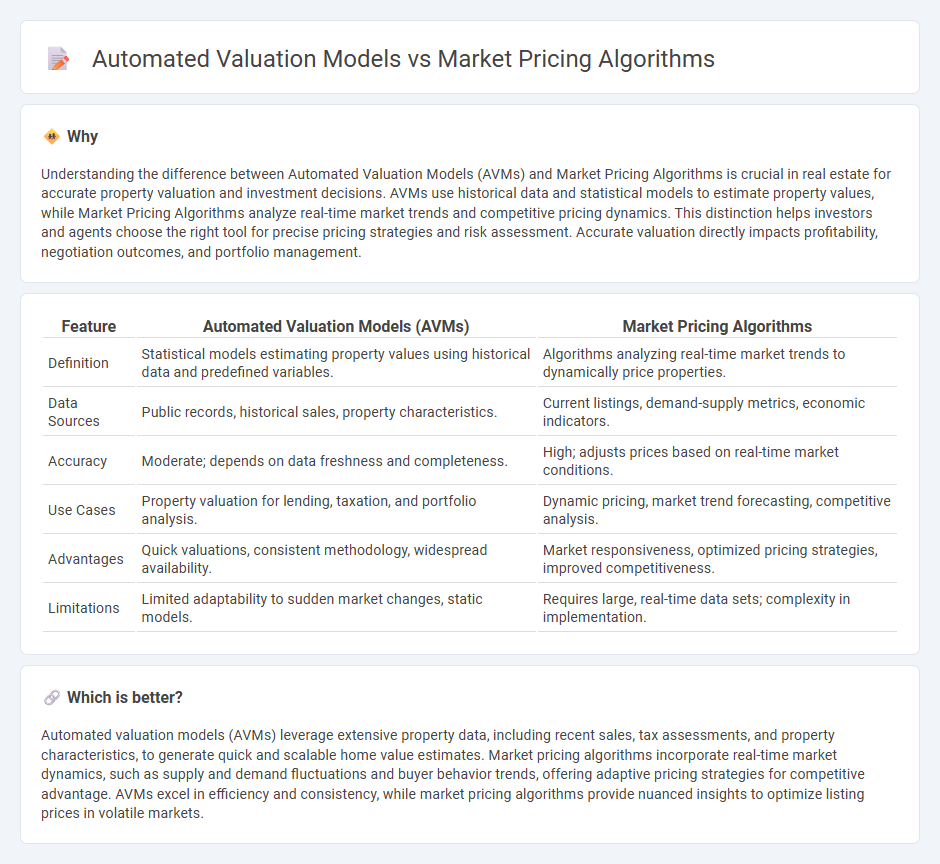

Understanding the difference between Automated Valuation Models (AVMs) and Market Pricing Algorithms is crucial in real estate for accurate property valuation and investment decisions. AVMs use historical data and statistical models to estimate property values, while Market Pricing Algorithms analyze real-time market trends and competitive pricing dynamics. This distinction helps investors and agents choose the right tool for precise pricing strategies and risk assessment. Accurate valuation directly impacts profitability, negotiation outcomes, and portfolio management.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Market Pricing Algorithms |

|---|---|---|

| Definition | Statistical models estimating property values using historical data and predefined variables. | Algorithms analyzing real-time market trends to dynamically price properties. |

| Data Sources | Public records, historical sales, property characteristics. | Current listings, demand-supply metrics, economic indicators. |

| Accuracy | Moderate; depends on data freshness and completeness. | High; adjusts prices based on real-time market conditions. |

| Use Cases | Property valuation for lending, taxation, and portfolio analysis. | Dynamic pricing, market trend forecasting, competitive analysis. |

| Advantages | Quick valuations, consistent methodology, widespread availability. | Market responsiveness, optimized pricing strategies, improved competitiveness. |

| Limitations | Limited adaptability to sudden market changes, static models. | Requires large, real-time data sets; complexity in implementation. |

Which is better?

Automated valuation models (AVMs) leverage extensive property data, including recent sales, tax assessments, and property characteristics, to generate quick and scalable home value estimates. Market pricing algorithms incorporate real-time market dynamics, such as supply and demand fluctuations and buyer behavior trends, offering adaptive pricing strategies for competitive advantage. AVMs excel in efficiency and consistency, while market pricing algorithms provide nuanced insights to optimize listing prices in volatile markets.

Connection

Automated Valuation Models (AVMs) utilize market pricing algorithms to analyze vast datasets of comparable property sales, recent market trends, and economic indicators for accurate property value estimation. These algorithms process factors such as location, property features, and neighborhood conditions to generate dynamic valuations in real time. Integration of AVMs with market pricing algorithms enhances efficiency, transparency, and precision in real estate appraisal and investment decision-making.

Key Terms

Comparative Market Analysis (CMA)

Market pricing algorithms leverage vast datasets and machine learning to analyze real-time market trends and buyer behavior, providing dynamic pricing recommendations. Automated Valuation Models (AVMs) focus on property-specific data and historical sales to estimate accurate home values but may lack market nuance captured by algorithms. Explore how integrating both approaches enhances Comparative Market Analysis (CMA) accuracy and effectiveness.

Machine Learning

Market pricing algorithms leverage machine learning techniques to analyze real-time data, adjusting prices dynamically based on supply, demand, and competitive factors. Automated valuation models (AVMs) employ machine learning to estimate property or asset values by assessing historical data, market trends, and comparable sales, enhancing accuracy and efficiency. Explore the differences in methodologies and applications between these approaches to optimize pricing strategies.

Hedonic Pricing Model

Market Pricing Algorithms leverage real-time transactional data to estimate asset values, incorporating dynamic market conditions and recent sales trends. Automated Valuation Models (AVMs), particularly those using the Hedonic Pricing Model, assess property or product value by analyzing factors such as size, location, and features, isolating the impact of each attribute on price. Explore detailed comparisons and applications to understand how the Hedonic Pricing Model enhances valuation accuracy.

Source and External Links

Dynamic Pricing Algorithms in 2025 - This article discusses dynamic pricing algorithms, including Bayesian, reinforcement learning, and decision tree models, which adjust prices based on market conditions.

Algorithms, Artificial Intelligence and Simple Rule-Based Pricing - This paper explores various pricing algorithms, including rule-based models that react to competitors' prices, sales volume changes, or time-based adjustments.

The Indispensable Pricing Algorithm - This article highlights how pricing algorithms analyze data and use AI to set optimal prices, adapting to market changes and competitor prices in real-time.

dowidth.com

dowidth.com