Opportunity Zone investing offers significant tax incentives by allowing deferral and potential exclusion of capital gains, making it an efficient strategy for long-term wealth growth in designated low-income areas. Direct ownership provides full control over property management and rental income but lacks the built-in tax advantages associated with Opportunity Zones. Discover how Opportunity Zone investing can enhance your real estate portfolio's profitability and tax efficiency.

Why it is important

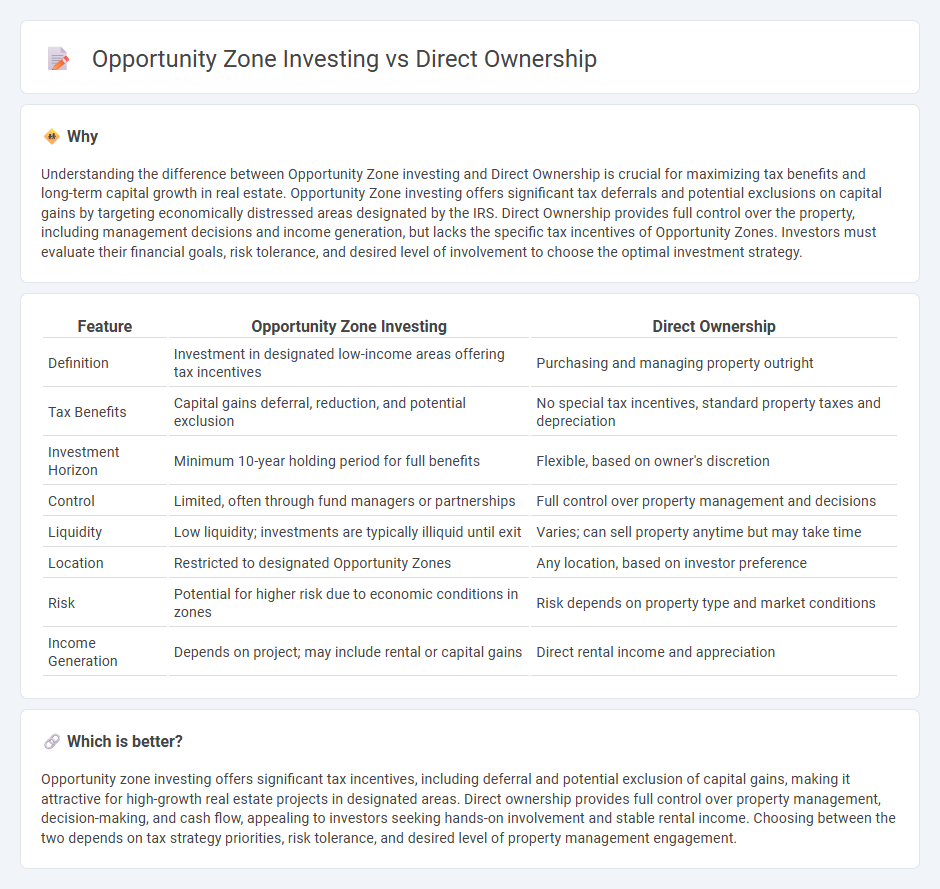

Understanding the difference between Opportunity Zone investing and Direct Ownership is crucial for maximizing tax benefits and long-term capital growth in real estate. Opportunity Zone investing offers significant tax deferrals and potential exclusions on capital gains by targeting economically distressed areas designated by the IRS. Direct Ownership provides full control over the property, including management decisions and income generation, but lacks the specific tax incentives of Opportunity Zones. Investors must evaluate their financial goals, risk tolerance, and desired level of involvement to choose the optimal investment strategy.

Comparison Table

| Feature | Opportunity Zone Investing | Direct Ownership |

|---|---|---|

| Definition | Investment in designated low-income areas offering tax incentives | Purchasing and managing property outright |

| Tax Benefits | Capital gains deferral, reduction, and potential exclusion | No special tax incentives, standard property taxes and depreciation |

| Investment Horizon | Minimum 10-year holding period for full benefits | Flexible, based on owner's discretion |

| Control | Limited, often through fund managers or partnerships | Full control over property management and decisions |

| Liquidity | Low liquidity; investments are typically illiquid until exit | Varies; can sell property anytime but may take time |

| Location | Restricted to designated Opportunity Zones | Any location, based on investor preference |

| Risk | Potential for higher risk due to economic conditions in zones | Risk depends on property type and market conditions |

| Income Generation | Depends on project; may include rental or capital gains | Direct rental income and appreciation |

Which is better?

Opportunity zone investing offers significant tax incentives, including deferral and potential exclusion of capital gains, making it attractive for high-growth real estate projects in designated areas. Direct ownership provides full control over property management, decision-making, and cash flow, appealing to investors seeking hands-on involvement and stable rental income. Choosing between the two depends on tax strategy priorities, risk tolerance, and desired level of property management engagement.

Connection

Opportunity Zone investing allows real estate investors to defer and potentially reduce capital gains taxes by purchasing property in designated low-income areas, promoting economic development. Direct Ownership in these zones enables investors to have tangible control over the asset, ensuring property management aligns with their financial goals and compliance requirements. This connection maximizes tax benefits while fostering direct involvement in revitalizing Opportunity Zone communities.

Key Terms

Title (Direct Ownership)

Direct ownership in real estate provides investors with full control over property management, financing decisions, and asset disposition, allowing for personalized strategies and immediate decision-making. Unlike opportunity zone investing, which offers tax incentives for investments in designated areas, direct ownership doesn't rely on geographic restrictions or government programs, emphasizing independent asset growth and flexibility. Explore how direct ownership can align with your investment goals and compare it with opportunity zone benefits to make informed decisions.

Qualified Opportunity Fund (Opportunity Zone Investing)

Qualified Opportunity Funds (QOFs) offer targeted tax incentives for investments in designated Opportunity Zones, enabling deferred capital gains and potential tax forgiveness on gains accrued from investments held for over ten years. Direct ownership involves purchasing property or assets outright, but lacks the built-in tax advantages and pooled investment benefits that QOFs provide. Explore the strategic benefits of Opportunity Zone investing through QOFs to optimize tax savings and community impact.

Capital Gains Tax Deferral

Direct ownership of real estate offers limited options for capital gains tax deferral, typically requiring like-kind exchanges under IRS Section 1031 to postpone taxes. Opportunity zone investing allows investors to defer capital gains taxes by reinvesting proceeds into Qualified Opportunity Funds, enabling tax benefits and potential appreciation growth over time. Explore how these strategies compare to optimize your capital gains tax deferral opportunities.

Source and External Links

Direct Ownership and Ultimate Beneficial Ownership - MyKYCBank - Direct ownership refers to individuals or entities who directly hold shares or partnership interests in a legal entity, such as owning 10% of shares, and it can be by a natural person or another entity like a parent company in a subsidiary.

How would you differentiate between direct or indirect ownership or control? - SECP - A direct owner is anyone who directly owns shares in a legal entity, for example owning 20% shares directly, while indirect ownership occurs when ownership is through another company or entity in the ownership chain.

Indirect vs direct employee ownership - Shorts Accountants - In the context of employee ownership, direct employee ownership means employees own shares *directly* in the company, giving them a stronger personal stake and alignment with company success, unlike indirect ownership via a trust or fund.

dowidth.com

dowidth.com