House hacking maximizes property utility by allowing owners to live in one portion while renting out the remaining space, reducing living expenses and building equity simultaneously. Long-term rental investing focuses on generating steady income by leasing entire properties to tenants for extended periods, providing consistent cash flow and potential property appreciation. Discover which investment strategy aligns with your financial goals and property management preferences.

Why it is important

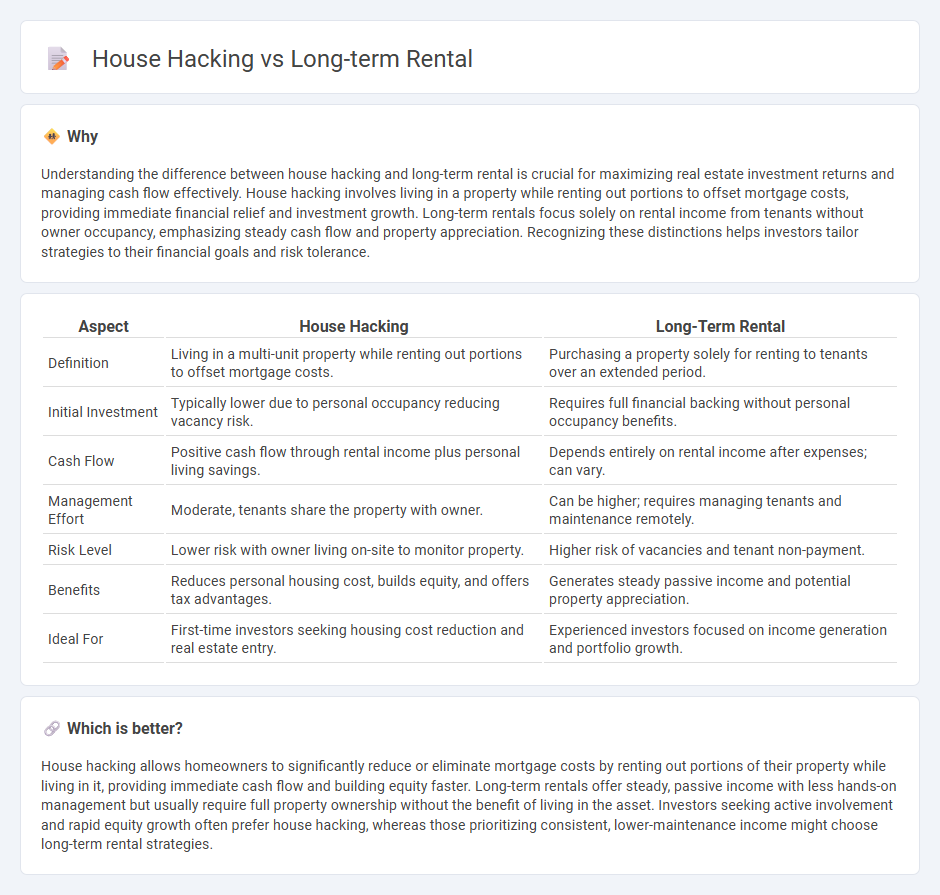

Understanding the difference between house hacking and long-term rental is crucial for maximizing real estate investment returns and managing cash flow effectively. House hacking involves living in a property while renting out portions to offset mortgage costs, providing immediate financial relief and investment growth. Long-term rentals focus solely on rental income from tenants without owner occupancy, emphasizing steady cash flow and property appreciation. Recognizing these distinctions helps investors tailor strategies to their financial goals and risk tolerance.

Comparison Table

| Aspect | House Hacking | Long-Term Rental |

|---|---|---|

| Definition | Living in a multi-unit property while renting out portions to offset mortgage costs. | Purchasing a property solely for renting to tenants over an extended period. |

| Initial Investment | Typically lower due to personal occupancy reducing vacancy risk. | Requires full financial backing without personal occupancy benefits. |

| Cash Flow | Positive cash flow through rental income plus personal living savings. | Depends entirely on rental income after expenses; can vary. |

| Management Effort | Moderate, tenants share the property with owner. | Can be higher; requires managing tenants and maintenance remotely. |

| Risk Level | Lower risk with owner living on-site to monitor property. | Higher risk of vacancies and tenant non-payment. |

| Benefits | Reduces personal housing cost, builds equity, and offers tax advantages. | Generates steady passive income and potential property appreciation. |

| Ideal For | First-time investors seeking housing cost reduction and real estate entry. | Experienced investors focused on income generation and portfolio growth. |

Which is better?

House hacking allows homeowners to significantly reduce or eliminate mortgage costs by renting out portions of their property while living in it, providing immediate cash flow and building equity faster. Long-term rentals offer steady, passive income with less hands-on management but usually require full property ownership without the benefit of living in the asset. Investors seeking active involvement and rapid equity growth often prefer house hacking, whereas those prioritizing consistent, lower-maintenance income might choose long-term rental strategies.

Connection

House hacking allows property owners to live in one part of a home while renting out other units, generating consistent rental income that supports long-term investment goals. This strategy reduces personal housing costs and builds equity, creating a foundation for sustainable long-term rentals. Investors leverage house hacking to gain hands-on experience managing rental properties, enhancing their ability to maintain profitable long-term rental portfolios.

Key Terms

Cash Flow

Long-term rental properties generate consistent cash flow through steady monthly rent, benefiting investors seeking stable income and lower turnover costs. House hacking maximizes cash flow by reducing personal housing expenses, often allowing owners to live mortgage-free while renting out spare rooms or units. Explore detailed strategies and financial outcomes to optimize your investment approach.

Occupancy

Long-term rental properties typically maintain higher occupancy rates due to stable lease agreements lasting six months to a year or more, reducing vacancy risk and ensuring consistent cash flow for landlords. House hacking, involving renting out portions of a primary residence while living on-site, can lead to variable occupancy influenced by personal circumstances and tenant turnover but often maximizes property utility and offsets mortgage costs effectively. Explore detailed occupancy trends and financial impacts to determine the optimal rental strategy for your investment goals.

Mortgage

Long-term rental properties typically involve a steady mortgage payment supported by rental income, offering financial stability and potential equity growth over time. House hacking leverages living in part of the property while renting out other units or rooms, reducing or eliminating mortgage expenses and enabling accelerated wealth building. Explore the benefits and strategies of mortgage management in both approaches to maximize your real estate investment.

Source and External Links

Philadelphia Furnished Monthly Rentals Long and Short-Stays - Offers fully furnished rentals in Philadelphia with discounts for longer stays, ideal for families and professionals looking for comfort and flexibility.

Philadelphia Furnished Monthly Rentals and Extended Stays - Provides fully furnished rentals with amenities like kitchens and Wi-Fi, suitable for both personal and corporate housing needs.

Furnished Home & Apartment Rentals in Philadelphia, PA - Offers extended-stay rentals perfect for families, business travelers, and medical tourists seeking convenient locations and amenities in Philadelphia.

dowidth.com

dowidth.com