Single family rental portfolios offer stable, long-term income through consistent tenant occupancy and lower turnover rates compared to vacation rental portfolios, which rely on short-term stays and seasonal demand fluctuations. Vacation rental portfolios often generate higher per-night revenue but require intensive management and marketing efforts to maintain occupancy rates in competitive tourist markets. Explore the key differences and benefits of each portfolio type to determine the best investment strategy for your real estate goals.

Why it is important

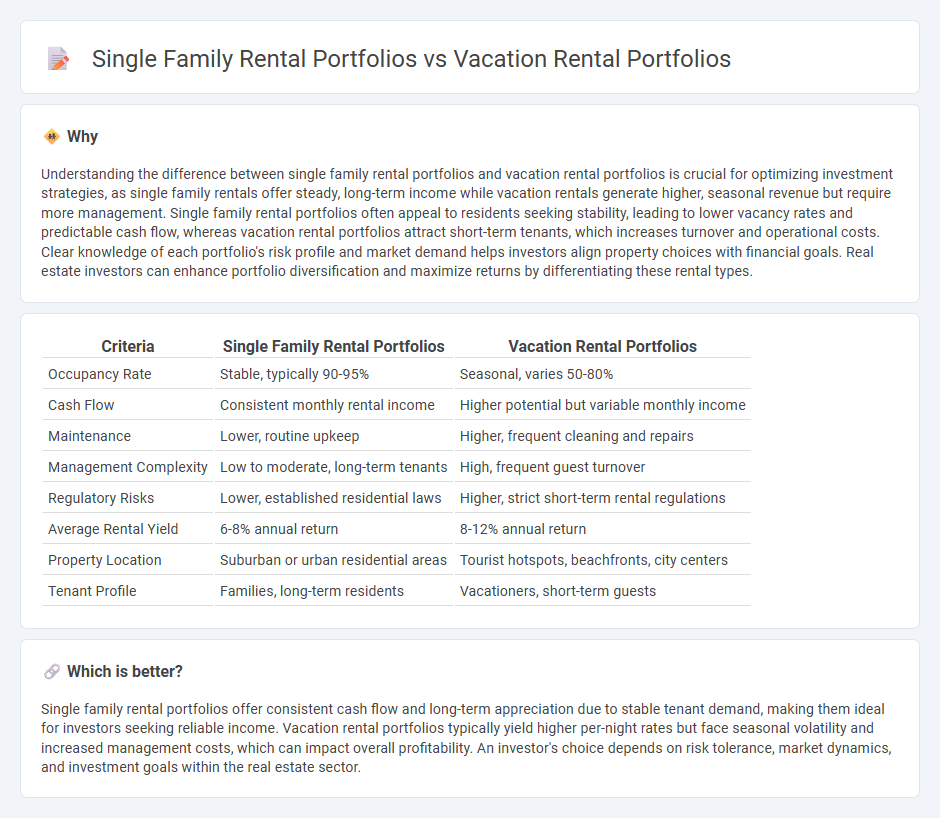

Understanding the difference between single family rental portfolios and vacation rental portfolios is crucial for optimizing investment strategies, as single family rentals offer steady, long-term income while vacation rentals generate higher, seasonal revenue but require more management. Single family rental portfolios often appeal to residents seeking stability, leading to lower vacancy rates and predictable cash flow, whereas vacation rental portfolios attract short-term tenants, which increases turnover and operational costs. Clear knowledge of each portfolio's risk profile and market demand helps investors align property choices with financial goals. Real estate investors can enhance portfolio diversification and maximize returns by differentiating these rental types.

Comparison Table

| Criteria | Single Family Rental Portfolios | Vacation Rental Portfolios |

|---|---|---|

| Occupancy Rate | Stable, typically 90-95% | Seasonal, varies 50-80% |

| Cash Flow | Consistent monthly rental income | Higher potential but variable monthly income |

| Maintenance | Lower, routine upkeep | Higher, frequent cleaning and repairs |

| Management Complexity | Low to moderate, long-term tenants | High, frequent guest turnover |

| Regulatory Risks | Lower, established residential laws | Higher, strict short-term rental regulations |

| Average Rental Yield | 6-8% annual return | 8-12% annual return |

| Property Location | Suburban or urban residential areas | Tourist hotspots, beachfronts, city centers |

| Tenant Profile | Families, long-term residents | Vacationers, short-term guests |

Which is better?

Single family rental portfolios offer consistent cash flow and long-term appreciation due to stable tenant demand, making them ideal for investors seeking reliable income. Vacation rental portfolios typically yield higher per-night rates but face seasonal volatility and increased management costs, which can impact overall profitability. An investor's choice depends on risk tolerance, market dynamics, and investment goals within the real estate sector.

Connection

Single family rental portfolios and vacation rental portfolios share similarities in asset management, focusing on maximizing occupancy rates and optimizing rental income through strategic marketing and pricing algorithms. Both portfolio types benefit from leveraging data analytics to forecast demand patterns and enhance tenant or guest experiences, driving higher returns on investment. Efficient property maintenance and tailored customer service contribute to sustaining asset value and competitive positioning within the real estate rental market.

Key Terms

Occupancy Rate

Vacation rental portfolios typically achieve higher occupancy rates compared to single-family rental portfolios due to their flexibility, diverse property locations, and appeal to short-term travelers. Single-family rental portfolios often experience lower turnover rates but face challenges in maintaining consistent occupancy throughout the year. Discover how optimizing occupancy rate strategies can maximize returns in both portfolio types.

Lease Term

Vacation rental portfolios typically offer short-term lease agreements ranging from a few days to several weeks, providing flexibility for travelers and higher turnover rates that can increase income potential. Single family rental portfolios generally involve long-term leases, often spanning 12 months or more, ensuring stable, predictable income and reduced vacancy risks. Explore the advantages and challenges of each lease term model to optimize your real estate investment strategy.

Property Management

Vacation rental portfolios require dynamic property management strategies including frequent guest turnover, stringent cleaning protocols, and real-time booking coordination, differing significantly from the long-term tenant-focused management of single family rental portfolios that emphasize consistent rent collection and maintenance scheduling. Efficient management software and experienced teams are essential to handle the complexities of vacation rentals, optimizing occupancy rates and guest satisfaction while single-family portfolios benefit from stable cash flow and lower management intensity. Explore comprehensive property management solutions to maximize returns for both vacation and single-family rental portfolios.

Source and External Links

Building a Successful Vacation Rental Portfolio: Tips for Real Estate Agents and their Clients - Shares valuable tips for planning, budgeting, location choosing, and defining investment goals to build a thriving vacation rental portfolio.

Investment Strategies: How to Profitably Scale Your Vacation Rental Portfolio - Explores strategies including market research, financial planning, financing options, and staying current with industry trends to successfully scale a vacation rental portfolio.

How to Grow and Scale Your Rental Property Portfolio - Provides advice on scaling from single to multiple rental properties by choosing between short-term and long-term rentals based on goals, with a step-by-step guide to growing the business.

dowidth.com

dowidth.com