Smart contract leasing automates rental agreements through blockchain technology, ensuring transparency and reducing intermediaries, while fractional ownership allows multiple investors to share property rights and profits proportionally. Both approaches leverage digital innovations to enhance property management efficiency and investment accessibility. Discover how these models are transforming real estate by exploring their unique benefits and use cases.

Why it is important

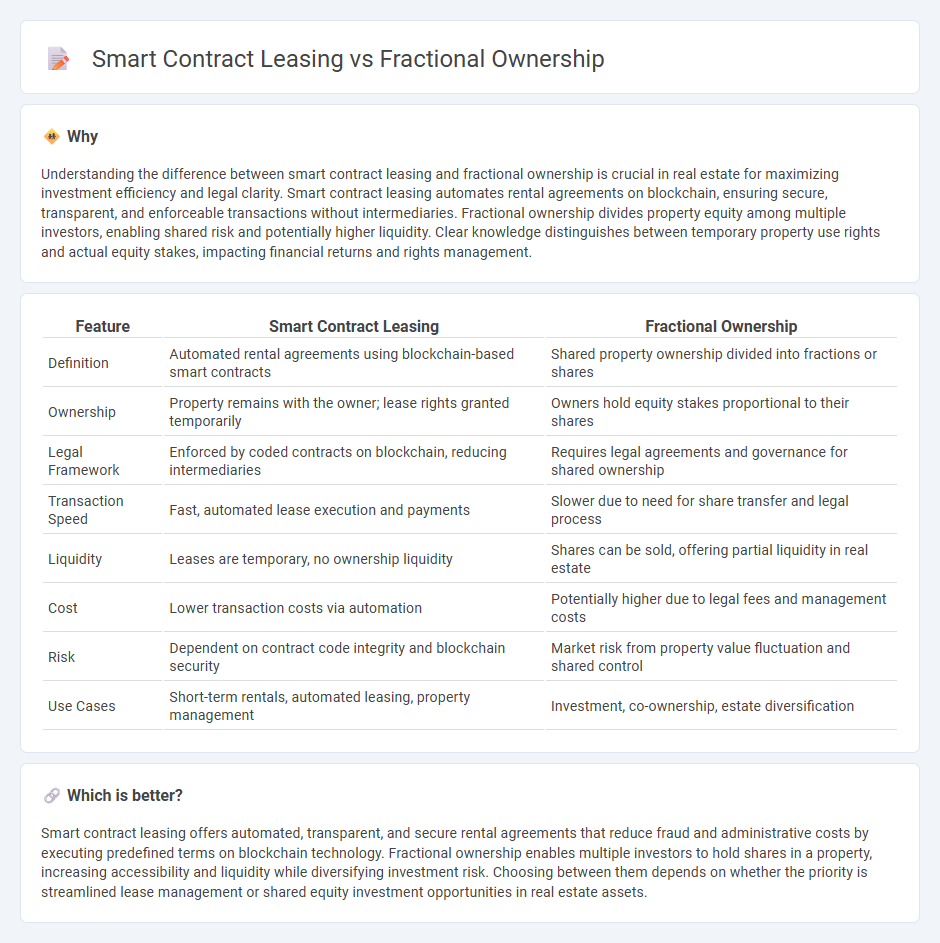

Understanding the difference between smart contract leasing and fractional ownership is crucial in real estate for maximizing investment efficiency and legal clarity. Smart contract leasing automates rental agreements on blockchain, ensuring secure, transparent, and enforceable transactions without intermediaries. Fractional ownership divides property equity among multiple investors, enabling shared risk and potentially higher liquidity. Clear knowledge distinguishes between temporary property use rights and actual equity stakes, impacting financial returns and rights management.

Comparison Table

| Feature | Smart Contract Leasing | Fractional Ownership |

|---|---|---|

| Definition | Automated rental agreements using blockchain-based smart contracts | Shared property ownership divided into fractions or shares |

| Ownership | Property remains with the owner; lease rights granted temporarily | Owners hold equity stakes proportional to their shares |

| Legal Framework | Enforced by coded contracts on blockchain, reducing intermediaries | Requires legal agreements and governance for shared ownership |

| Transaction Speed | Fast, automated lease execution and payments | Slower due to need for share transfer and legal process |

| Liquidity | Leases are temporary, no ownership liquidity | Shares can be sold, offering partial liquidity in real estate |

| Cost | Lower transaction costs via automation | Potentially higher due to legal fees and management costs |

| Risk | Dependent on contract code integrity and blockchain security | Market risk from property value fluctuation and shared control |

| Use Cases | Short-term rentals, automated leasing, property management | Investment, co-ownership, estate diversification |

Which is better?

Smart contract leasing offers automated, transparent, and secure rental agreements that reduce fraud and administrative costs by executing predefined terms on blockchain technology. Fractional ownership enables multiple investors to hold shares in a property, increasing accessibility and liquidity while diversifying investment risk. Choosing between them depends on whether the priority is streamlined lease management or shared equity investment opportunities in real estate assets.

Connection

Smart contract leasing leverages blockchain technology to automate and enforce rental agreements with transparent, tamper-proof terms, reducing disputes and streamlining payments. Fractional ownership divides property rights into shares, enabling multiple investors to hold and trade portions of real estate assets efficiently on a secure digital ledger. Both innovations integrate to create a decentralized ecosystem where leasing and ownership transactions become seamless, accessible, and trustworthy for all stakeholders.

Key Terms

Ownership Shares

Fractional ownership divides property into ownership shares, allowing multiple investors to hold equity and share profits and responsibilities proportionally. Smart contract leasing automates rental agreements on blockchain, offering transparent, tamper-proof management without transferring ownership interests. Explore the detailed pros and cons of each model to determine the best fit for your investment goals.

Tokenization

Fractional ownership allows multiple investors to hold a percentage of an asset, offering shared control and profits, while smart contract leasing uses blockchain protocols to automate leasing terms and payments securely. Tokenization enhances both models by converting assets into digital tokens, enabling seamless transfer, liquidity, and transparency. Explore how tokenization transforms asset management through fractional ownership and smart contract leasing.

Lease Agreements

Lease agreements in fractional ownership involve multiple parties holding shared rights to a property, outlined through structured contracts that specify usage schedules and responsibilities. Smart contract leasing automates lease terms on blockchain, ensuring transparent, tamper-proof agreements with real-time compliance verification and automated payment processing. Explore how these innovative methods transform traditional lease agreements to maximize security and efficiency.

Source and External Links

Fractional Ownership - Fractional ownership is a method where multiple parties share ownership and costs of a high-value asset, such as jets, yachts, or real estate, often managed by a company.

Fractional Ownership FAQ - This webpage provides answers to frequently asked questions about fractional ownership, including its application to vacation properties and multi-unit developments.

Fractional Ownership: Pros and Cons - This article describes fractional ownership as a collaborative investment strategy, highlighting its benefits and drawbacks, particularly in real estate investments.

dowidth.com

dowidth.com