Smart contracts in real estate automate property transfers using blockchain technology, ensuring transparency, security, and reduced processing times compared to legacy transfer systems reliant on manual paperwork and intermediaries. Legacy systems often involve multiple stakeholders, such as title companies and government offices, which can cause delays and increase costs. Explore how smart contracts are revolutionizing property transactions by eliminating inefficiencies and enhancing trust in the transfer process.

Why it is important

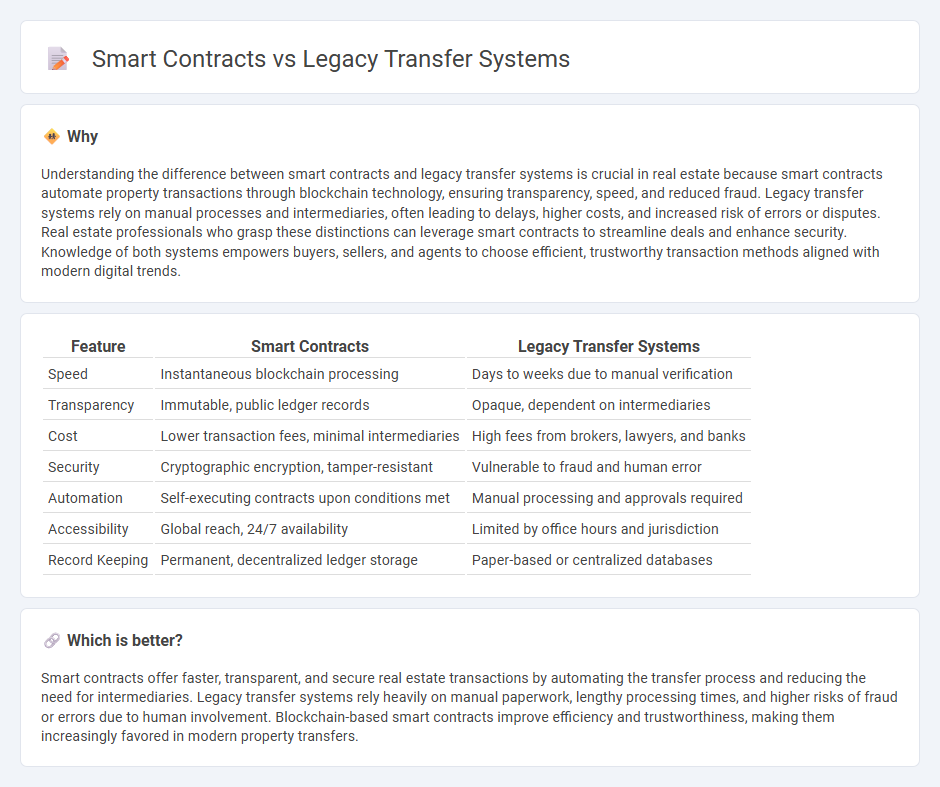

Understanding the difference between smart contracts and legacy transfer systems is crucial in real estate because smart contracts automate property transactions through blockchain technology, ensuring transparency, speed, and reduced fraud. Legacy transfer systems rely on manual processes and intermediaries, often leading to delays, higher costs, and increased risk of errors or disputes. Real estate professionals who grasp these distinctions can leverage smart contracts to streamline deals and enhance security. Knowledge of both systems empowers buyers, sellers, and agents to choose efficient, trustworthy transaction methods aligned with modern digital trends.

Comparison Table

| Feature | Smart Contracts | Legacy Transfer Systems |

|---|---|---|

| Speed | Instantaneous blockchain processing | Days to weeks due to manual verification |

| Transparency | Immutable, public ledger records | Opaque, dependent on intermediaries |

| Cost | Lower transaction fees, minimal intermediaries | High fees from brokers, lawyers, and banks |

| Security | Cryptographic encryption, tamper-resistant | Vulnerable to fraud and human error |

| Automation | Self-executing contracts upon conditions met | Manual processing and approvals required |

| Accessibility | Global reach, 24/7 availability | Limited by office hours and jurisdiction |

| Record Keeping | Permanent, decentralized ledger storage | Paper-based or centralized databases |

Which is better?

Smart contracts offer faster, transparent, and secure real estate transactions by automating the transfer process and reducing the need for intermediaries. Legacy transfer systems rely heavily on manual paperwork, lengthy processing times, and higher risks of fraud or errors due to human involvement. Blockchain-based smart contracts improve efficiency and trustworthiness, making them increasingly favored in modern property transfers.

Connection

Smart contracts revolutionize real estate by automating legacy transfer systems, ensuring secure and transparent property transactions without intermediaries. These blockchain-based agreements eliminate errors and reduce processing time traditionally associated with paper-heavy legacy methods. Integrating smart contracts with existing legal frameworks enhances efficiency in title transfers and inheritance processes.

Key Terms

Title Deeds

Legacy transfer systems for title deeds rely heavily on paper-based records, manual verification, and intermediaries, causing delays and increasing the risk of fraud or errors. Smart contracts automate the transfer process using blockchain technology, ensuring transparency, security, and instant execution without the need for third parties. Discover how smart contracts are revolutionizing property ownership transfers and enhancing trust in title deed management.

Escrow Agents

Legacy transfer systems rely heavily on escrow agents to securely manage and release funds during transactions, often involving manual verification and intermediaries that increase processing time and costs. Smart contracts automate the escrow process by executing predefined conditions on decentralized blockchain networks, ensuring transparency, security, and reduced risk of human error. Discover how integrating smart contracts can revolutionize escrow services and streamline legacy transfer processes.

Blockchain

Legacy transfer systems rely on centralized intermediaries, resulting in slower transaction speeds and higher fees compared to blockchain-based smart contracts. Smart contracts automate and enforce agreements directly on the blockchain, enhancing transparency, security, and reducing the risk of fraud. Explore how blockchain technology revolutionizes asset transfers by visiting our detailed resources on smart contract applications.

Source and External Links

Legacy System Migration Step-by-Step - Cprime - Legacy transfer systems involve migrating data from outdated platforms and require careful planning, stakeholder communication, business process analysis, timeline definition, technology selection, and continuous monitoring after the migration to ensure performance.

Legacy System Application Migration Benefits and Challenges - Legacy transfer systems migrate applications and data from legacy platforms to modern cloud or hybrid environments, using approaches like OpenLegacy's core-to-cloud integration to reduce risks, lower costs, and modernize operations.

Data Migrations for Legacy Systems: How Does it Work? - Ramotion - Legacy transfer systems require a step-by-step data migration process including strategy definition, building a skilled team, detailed planning, choosing data to migrate, and secure backups to minimize risks and ensure smooth transition.

dowidth.com

dowidth.com