Community land trusts (CLTs) offer a nonprofit model focused on affordable housing by separating land ownership from property ownership, ensuring long-term community control and housing affordability. Real estate investment trusts (REITs) are for-profit entities that own, operate, or finance income-generating real estate, providing investors with liquidity and dividend-based returns. Discover how these distinct approaches shape real estate investment and community development.

Why it is important

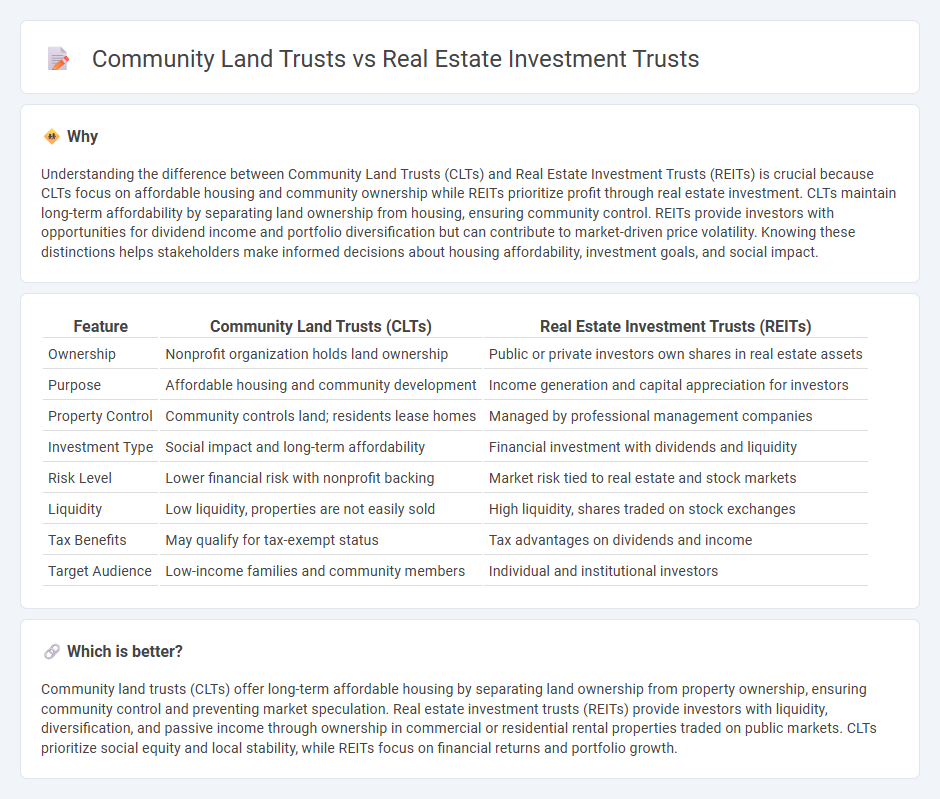

Understanding the difference between Community Land Trusts (CLTs) and Real Estate Investment Trusts (REITs) is crucial because CLTs focus on affordable housing and community ownership while REITs prioritize profit through real estate investment. CLTs maintain long-term affordability by separating land ownership from housing, ensuring community control. REITs provide investors with opportunities for dividend income and portfolio diversification but can contribute to market-driven price volatility. Knowing these distinctions helps stakeholders make informed decisions about housing affordability, investment goals, and social impact.

Comparison Table

| Feature | Community Land Trusts (CLTs) | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Ownership | Nonprofit organization holds land ownership | Public or private investors own shares in real estate assets |

| Purpose | Affordable housing and community development | Income generation and capital appreciation for investors |

| Property Control | Community controls land; residents lease homes | Managed by professional management companies |

| Investment Type | Social impact and long-term affordability | Financial investment with dividends and liquidity |

| Risk Level | Lower financial risk with nonprofit backing | Market risk tied to real estate and stock markets |

| Liquidity | Low liquidity, properties are not easily sold | High liquidity, shares traded on stock exchanges |

| Tax Benefits | May qualify for tax-exempt status | Tax advantages on dividends and income |

| Target Audience | Low-income families and community members | Individual and institutional investors |

Which is better?

Community land trusts (CLTs) offer long-term affordable housing by separating land ownership from property ownership, ensuring community control and preventing market speculation. Real estate investment trusts (REITs) provide investors with liquidity, diversification, and passive income through ownership in commercial or residential rental properties traded on public markets. CLTs prioritize social equity and local stability, while REITs focus on financial returns and portfolio growth.

Connection

Community land trusts (CLTs) and real estate investment trusts (REITs) are connected through their shared goal of enabling affordable and sustainable property ownership, but they operate with different structures and priorities. CLTs focus on community-driven, nonprofit land ownership to ensure long-term housing affordability, while REITs are investor-owned companies that manage income-producing real estate assets to generate returns. Both influence real estate markets by providing alternative models for access to land and property investment, addressing housing needs and market dynamics.

Key Terms

Ownership Structure

Real estate investment trusts (REITs) allow investors to own shares in a professionally managed portfolio of income-generating properties, providing liquidity and regular dividends. Community land trusts (CLTs) maintain collective ownership of land with long-term leases granted to individuals or organizations, ensuring affordability and preventing displacement. Discover how these distinct ownership structures impact control, benefits, and investment goals.

Income Distribution

Real estate investment trusts (REITs) distribute a significant portion of taxable income as dividends, typically around 90%, providing investors with regular income streams. Community land trusts (CLTs) focus on long-term affordability and community ownership, often reinvesting income into local development rather than maximizing immediate income distribution. Explore the distinct income strategies and investor benefits of REITs and CLTs to understand which model aligns best with your financial goals.

Land Use Control

Real estate investment trusts (REITs) primarily prioritize financial returns through ownership and management of income-generating properties, influencing land use by facilitating commercial and residential development aligned with market demands. Community land trusts (CLTs) emphasize permanent land stewardship, promoting affordable housing and community control by separating land ownership from property ownership to ensure long-term land use stability. Explore deeper insights into how these models impact urban development and community empowerment.

Source and External Links

Real Estate Investment Trust - Wikipedia - A real estate investment trust (REIT) is a company that owns or finances income-producing real estate, offering benefits like tax advantages and diversified investment opportunities.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, providing investors with regular income and long-term capital appreciation.

Real Estate Investment Trust (REIT) - Practical Law - A REIT allows participants to invest in a professionally managed portfolio of real property for long-term benefits, offering access to the real estate market.

dowidth.com

dowidth.com