iBuyer platforms use technology and data analytics to provide instant offers on properties, streamlining the selling process with quick closings and minimal hassle. Wholesaling involves securing a property under contract and then assigning it to another buyer, often requiring a deep network and negotiation skills for successful transactions. Discover the key differences between iBuyer and wholesaling to determine which strategy suits your real estate goals.

Why it is important

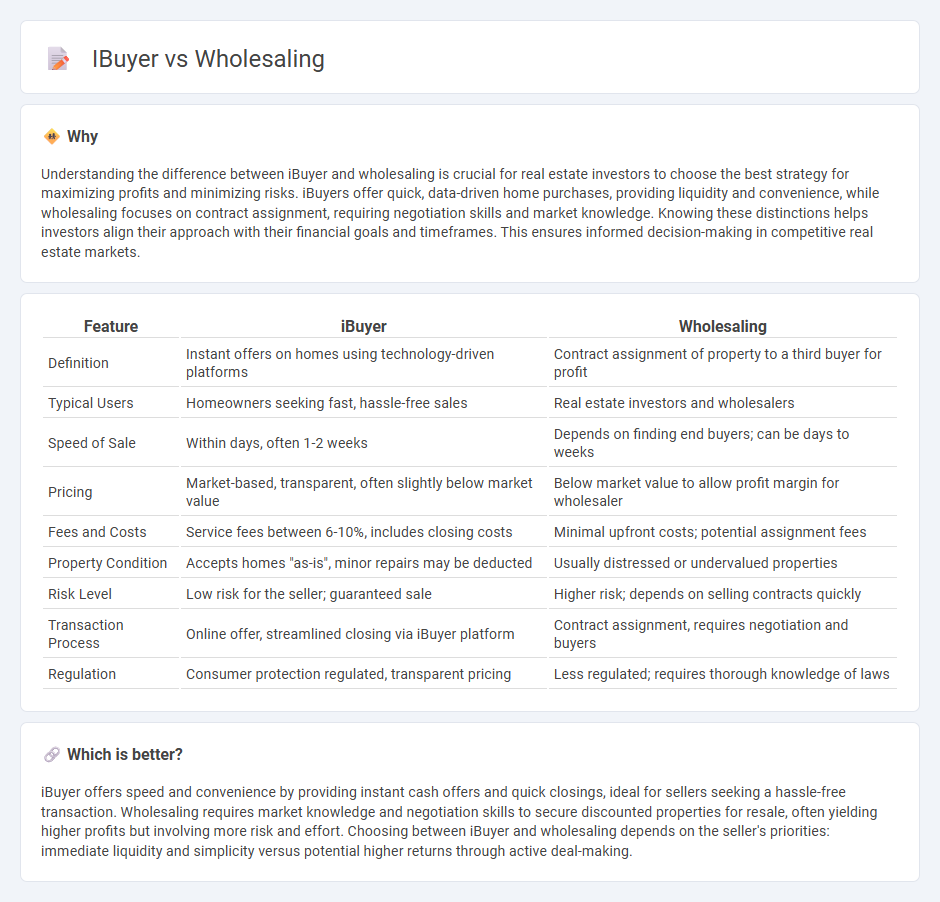

Understanding the difference between iBuyer and wholesaling is crucial for real estate investors to choose the best strategy for maximizing profits and minimizing risks. iBuyers offer quick, data-driven home purchases, providing liquidity and convenience, while wholesaling focuses on contract assignment, requiring negotiation skills and market knowledge. Knowing these distinctions helps investors align their approach with their financial goals and timeframes. This ensures informed decision-making in competitive real estate markets.

Comparison Table

| Feature | iBuyer | Wholesaling |

|---|---|---|

| Definition | Instant offers on homes using technology-driven platforms | Contract assignment of property to a third buyer for profit |

| Typical Users | Homeowners seeking fast, hassle-free sales | Real estate investors and wholesalers |

| Speed of Sale | Within days, often 1-2 weeks | Depends on finding end buyers; can be days to weeks |

| Pricing | Market-based, transparent, often slightly below market value | Below market value to allow profit margin for wholesaler |

| Fees and Costs | Service fees between 6-10%, includes closing costs | Minimal upfront costs; potential assignment fees |

| Property Condition | Accepts homes "as-is", minor repairs may be deducted | Usually distressed or undervalued properties |

| Risk Level | Low risk for the seller; guaranteed sale | Higher risk; depends on selling contracts quickly |

| Transaction Process | Online offer, streamlined closing via iBuyer platform | Contract assignment, requires negotiation and buyers |

| Regulation | Consumer protection regulated, transparent pricing | Less regulated; requires thorough knowledge of laws |

Which is better?

iBuyer offers speed and convenience by providing instant cash offers and quick closings, ideal for sellers seeking a hassle-free transaction. Wholesaling requires market knowledge and negotiation skills to secure discounted properties for resale, often yielding higher profits but involving more risk and effort. Choosing between iBuyer and wholesaling depends on the seller's priorities: immediate liquidity and simplicity versus potential higher returns through active deal-making.

Connection

iBuyer and wholesaling both focus on rapid real estate transactions to streamline property sales and minimize time on market. iBuyers use technology-driven algorithms to make instant cash offers, while wholesalers secure properties under contract and quickly assign those contracts to end buyers. Both methods prioritize speed and efficiency, reducing the traditional complexities of real estate deals.

Key Terms

Assignment Contract

Wholesaling leverages assignment contracts to transfer property purchase rights without closing, enabling investors to profit by assigning contracts to end buyers. iBuyers, by contrast, typically purchase homes directly for quick resale, rarely utilizing assignment contracts due to their streamlined transaction model. Explore the nuanced role of assignment contracts in wholesaling for a deeper understanding.

Instant Offer

Wholesaling involves purchasing properties below market value and quickly reselling to investors, whereas iBuyers provide an instant offer based on algorithm-driven valuations for a fast, hassle-free sale. iBuyer instant offers typically close within days, minimizing the time and effort compared to wholesaling's negotiation and assignment process. Discover how instant offers from iBuyers can streamline your real estate transactions and compare them with traditional wholesaling methods.

Service Fees

Wholesaling typically involves lower service fees as investors negotiate directly with sellers for discounted property purchases, minimizing intermediary costs. iBuyers charge higher service fees, often ranging from 6% to 12%, as they provide instant offers and streamlined transactions backed by technology platforms. Explore how service fees impact your real estate strategy to choose the best option for your needs.

Source and External Links

Wholesaling - Wikipedia - Wholesaling is the sale of goods in bulk, typically from manufacturers or sources to retailers, businesses, or other wholesalers, at discounted rates, often involving services like sorting, repackaging, and redistribution in smaller lots.

Retailing & Wholesaling - Food Markets & Prices (USDA) - Food wholesaling involves assembling, storing, and transporting food goods to various customers, including retailers, restaurants, and institutions, with distributors often specializing in broadline, specialty, or system food services such as Sysco and US Foods.

Wholesale Real Estate: A Beginner's Guide - In real estate, wholesaling is the practice of contracting to purchase a property, typically below market value, and then selling (assigning) that contract to an investor for a fee, without actually taking ownership of the property.

dowidth.com

dowidth.com