iBuyers use advanced algorithms and technology to provide quick, cash offers for homes, streamlining the selling process for homeowners. Institutional investors deploy vast capital to acquire large portfolios of properties, focusing on long-term rental income and market appreciation. Explore the differences in strategies, benefits, and impacts on the real estate market.

Why it is important

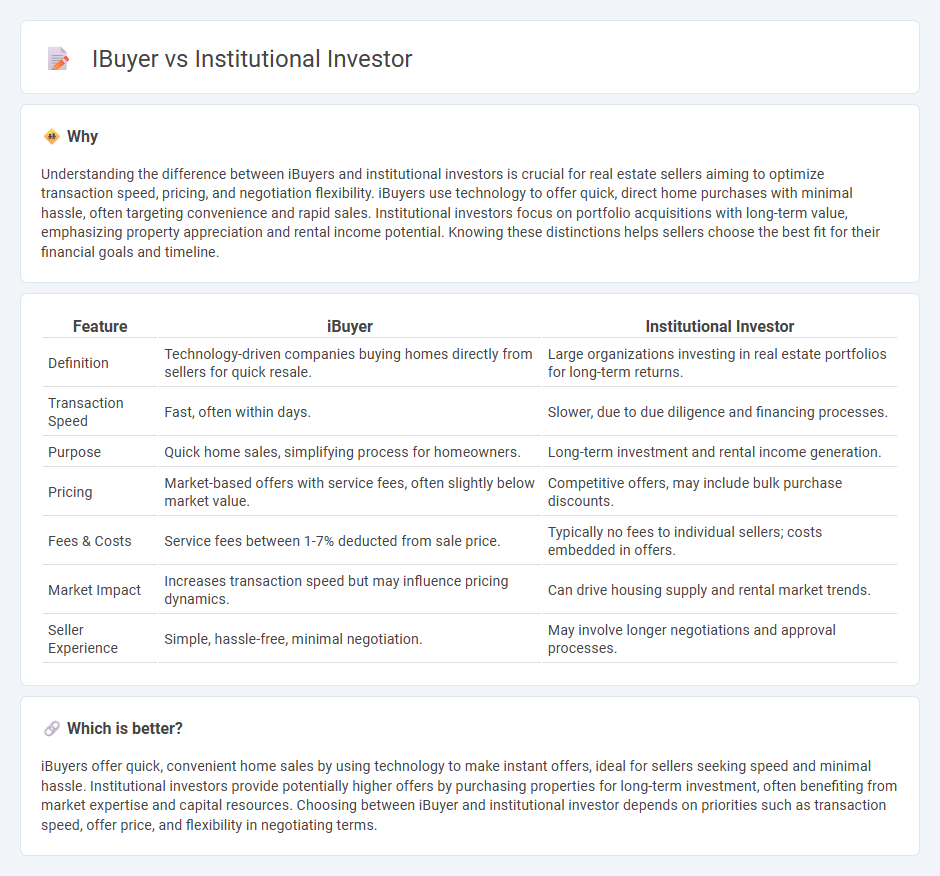

Understanding the difference between iBuyers and institutional investors is crucial for real estate sellers aiming to optimize transaction speed, pricing, and negotiation flexibility. iBuyers use technology to offer quick, direct home purchases with minimal hassle, often targeting convenience and rapid sales. Institutional investors focus on portfolio acquisitions with long-term value, emphasizing property appreciation and rental income potential. Knowing these distinctions helps sellers choose the best fit for their financial goals and timeline.

Comparison Table

| Feature | iBuyer | Institutional Investor |

|---|---|---|

| Definition | Technology-driven companies buying homes directly from sellers for quick resale. | Large organizations investing in real estate portfolios for long-term returns. |

| Transaction Speed | Fast, often within days. | Slower, due to due diligence and financing processes. |

| Purpose | Quick home sales, simplifying process for homeowners. | Long-term investment and rental income generation. |

| Pricing | Market-based offers with service fees, often slightly below market value. | Competitive offers, may include bulk purchase discounts. |

| Fees & Costs | Service fees between 1-7% deducted from sale price. | Typically no fees to individual sellers; costs embedded in offers. |

| Market Impact | Increases transaction speed but may influence pricing dynamics. | Can drive housing supply and rental market trends. |

| Seller Experience | Simple, hassle-free, minimal negotiation. | May involve longer negotiations and approval processes. |

Which is better?

iBuyers offer quick, convenient home sales by using technology to make instant offers, ideal for sellers seeking speed and minimal hassle. Institutional investors provide potentially higher offers by purchasing properties for long-term investment, often benefiting from market expertise and capital resources. Choosing between iBuyer and institutional investor depends on priorities such as transaction speed, offer price, and flexibility in negotiating terms.

Connection

iBuyers streamline real estate transactions by using data analytics and technology to offer instant property purchases, attracting institutional investors who seek scalable, low-risk investment opportunities in the housing market. Institutional investors provide substantial capital to iBuyer platforms, enabling them to expand inventory and improve pricing models while benefiting from the consistent transaction volume generated. This synergy accelerates market liquidity and transforms traditional real estate investment strategies through enhanced data-driven decision-making and operational efficiency.

Key Terms

Capital Deployment

Institutional investors deploy capital through diversified portfolios targeting long-term asset appreciation and steady income streams, often investing in residential, commercial, and multifamily real estate sectors. iBuyers utilize technology-driven algorithms to acquire and resell residential properties quickly, optimizing capital turnover and liquidity with shorter holding periods. Discover how these contrasting capital deployment strategies impact market dynamics and investment returns by exploring detailed analyses.

Automated Valuation Models (AVMs)

Institutional investors leverage Automated Valuation Models (AVMs) to analyze vast datasets for precise property valuations, enhancing portfolio management and risk assessment. iBuyers utilize AVMs to rapidly generate competitive offers, streamlining home sales through algorithm-driven pricing and minimizing human intervention. Explore how the evolving role of AVMs transforms real estate investment strategies and home selling efficiency.

Holding Period

Institutional investors typically maintain longer holding periods, aiming for steady appreciation and rental income over several years, while iBuyers focus on quick resale, often holding properties for just days or weeks to capitalize on market efficiency and fast turnover. Understanding the differing holding periods highlights their distinct investment strategies and risk profiles in the real estate market. Explore more to see how holding period influences profitability and market dynamics.

Source and External Links

Institutional Investor - Corporate Finance Institute - Institutional investors are organizations that pool funds from multiple investors to invest in various financial instruments, often enjoying preferential treatment and greater access to investment opportunities than individual investors.

Institutional investor - Wikipedia - Institutional investors include entities like banks, insurance companies, pension funds, and mutual funds that invest large pools of capital in securities, real estate, and other assets, and can influence corporate governance through their substantial holdings.

institutional investor | Wex - Law.Cornell.Edu - Institutional investors manage clients' investments and, due to their sophistication, can access private placements and certain securities not available to the general public.

dowidth.com

dowidth.com