Smart contract leasing leverages blockchain technology to automate rental agreements, ensuring transparency, security, and reduced administrative costs compared to traditional leasing methods. Traditional leasing relies heavily on manual processes, paperwork, and intermediaries, which can lead to delays and increased potential for errors or disputes. Discover how smart contract leasing is transforming real estate transactions by enhancing efficiency and trust in property management.

Why it is important

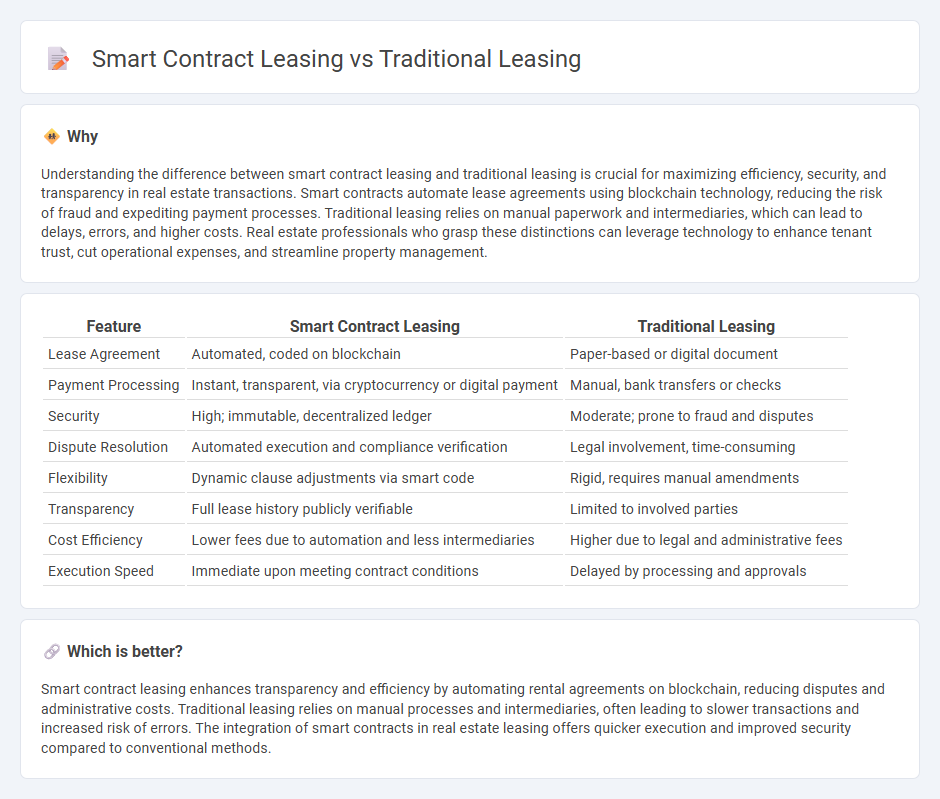

Understanding the difference between smart contract leasing and traditional leasing is crucial for maximizing efficiency, security, and transparency in real estate transactions. Smart contracts automate lease agreements using blockchain technology, reducing the risk of fraud and expediting payment processes. Traditional leasing relies on manual paperwork and intermediaries, which can lead to delays, errors, and higher costs. Real estate professionals who grasp these distinctions can leverage technology to enhance tenant trust, cut operational expenses, and streamline property management.

Comparison Table

| Feature | Smart Contract Leasing | Traditional Leasing |

|---|---|---|

| Lease Agreement | Automated, coded on blockchain | Paper-based or digital document |

| Payment Processing | Instant, transparent, via cryptocurrency or digital payment | Manual, bank transfers or checks |

| Security | High; immutable, decentralized ledger | Moderate; prone to fraud and disputes |

| Dispute Resolution | Automated execution and compliance verification | Legal involvement, time-consuming |

| Flexibility | Dynamic clause adjustments via smart code | Rigid, requires manual amendments |

| Transparency | Full lease history publicly verifiable | Limited to involved parties |

| Cost Efficiency | Lower fees due to automation and less intermediaries | Higher due to legal and administrative fees |

| Execution Speed | Immediate upon meeting contract conditions | Delayed by processing and approvals |

Which is better?

Smart contract leasing enhances transparency and efficiency by automating rental agreements on blockchain, reducing disputes and administrative costs. Traditional leasing relies on manual processes and intermediaries, often leading to slower transactions and increased risk of errors. The integration of smart contracts in real estate leasing offers quicker execution and improved security compared to conventional methods.

Connection

Smart contract leasing integrates blockchain technology to automate rental agreements, ensuring transparency, security, and real-time execution of lease terms in real estate transactions. Traditional leasing relies on manual processes and paperwork, which can lead to delays, disputes, and inefficiencies in contract enforcement. The connection between the two lies in smart contracts enhancing traditional leasing by digitizing agreements, reducing intermediaries, and providing immutable records for landlords and tenants.

Key Terms

Lease Agreement

Traditional lease agreements involve paper-based contracts requiring manual signatures and physical storage, often leading to delays and increased risk of errors. Smart contract leasing automates lease terms enforcement through blockchain technology, ensuring transparent, tamper-proof, and self-executing agreements that reduce administrative overhead. Explore how smart contract leasing revolutionizes lease agreements by enhancing security and efficiency.

Automation

Traditional leasing relies heavily on manual processes, with paper-based contracts and human intervention for payment tracking and contract enforcement. Smart contract leasing uses blockchain technology to automate lease agreements, instantly executing and verifying contract terms without intermediaries, reducing errors and speeding up transactions. Explore how smart contract leasing transforms property management with enhanced automation and efficiency.

Blockchain

Traditional leasing relies on paper-based contracts and manual processing, often leading to delays, errors, and increased administrative costs. Smart contract leasing leverages blockchain technology to automate agreements, ensuring transparency, security, and real-time execution of lease terms without intermediaries. Explore how blockchain transforms leasing by enhancing efficiency, reducing fraud, and enabling programmable lease conditions.

Source and External Links

Should Your Business Choose Flexible or Traditional Leasing? - Traditional leasing is a classic commercial rental method where businesses sign a contract for a set period (usually 3-10 years), paying fixed rent and managing utilities, maintenance, and taxes, often with private customizable spaces and higher upfront costs like deposits and renovation fees.

Cost Comparison: Managed Offices vs Traditional Leasing - Traditional leasing involves long-term contracts with high security deposits and separate costs for maintenance and utilities, placing operational and financial responsibility on tenants, unlike all-inclusive managed offices which offer more flexibility and lower upfront costs.

Why traditional leases don't measure up and what we need instead - Traditional leases often lead to energy inefficiencies due to rigid terms requiring landlords to maintain utilities even when spaces are unoccupied; better cooperation and transparency between landlords and tenants are needed to improve energy usage and accountability.

dowidth.com

dowidth.com