Community land trusts (CLTs) and limited equity housing cooperatives are innovative models designed to preserve affordable homeownership by separating land ownership from housing ownership. CLTs maintain public or nonprofit control over land to ensure long-term affordability, while limited equity cooperatives restrict resale prices to prevent market speculation. Explore the distinct benefits and mechanisms of these approaches to affordable real estate ownership.

Why it is important

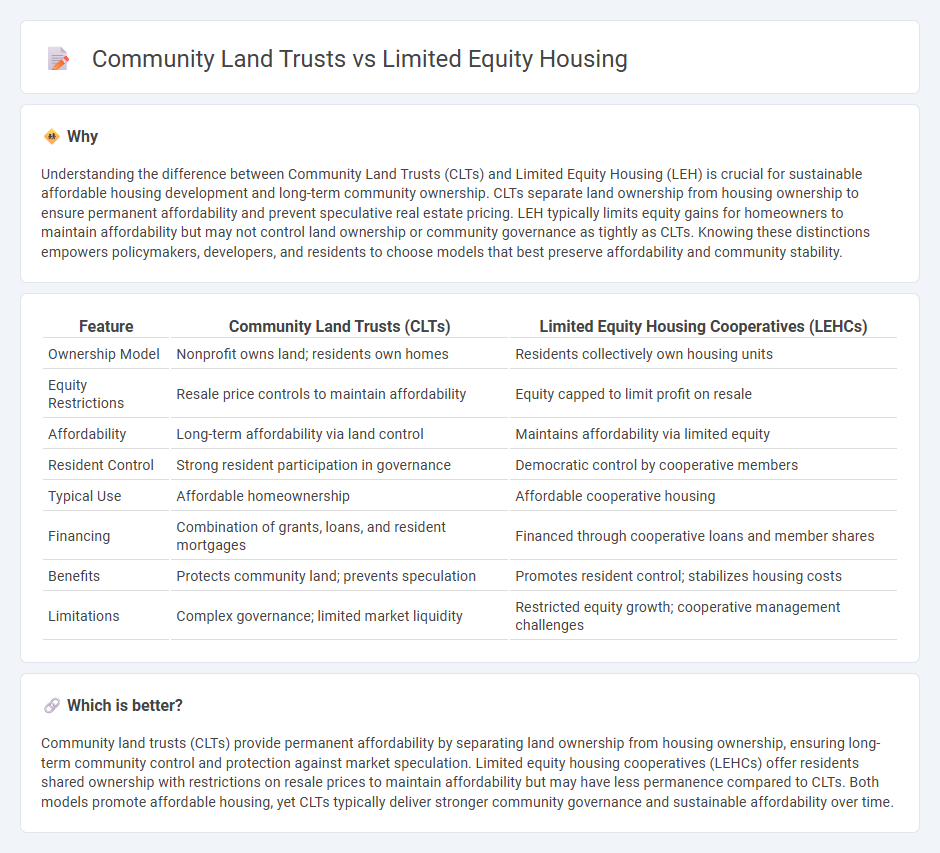

Understanding the difference between Community Land Trusts (CLTs) and Limited Equity Housing (LEH) is crucial for sustainable affordable housing development and long-term community ownership. CLTs separate land ownership from housing ownership to ensure permanent affordability and prevent speculative real estate pricing. LEH typically limits equity gains for homeowners to maintain affordability but may not control land ownership or community governance as tightly as CLTs. Knowing these distinctions empowers policymakers, developers, and residents to choose models that best preserve affordability and community stability.

Comparison Table

| Feature | Community Land Trusts (CLTs) | Limited Equity Housing Cooperatives (LEHCs) |

|---|---|---|

| Ownership Model | Nonprofit owns land; residents own homes | Residents collectively own housing units |

| Equity Restrictions | Resale price controls to maintain affordability | Equity capped to limit profit on resale |

| Affordability | Long-term affordability via land control | Maintains affordability via limited equity |

| Resident Control | Strong resident participation in governance | Democratic control by cooperative members |

| Typical Use | Affordable homeownership | Affordable cooperative housing |

| Financing | Combination of grants, loans, and resident mortgages | Financed through cooperative loans and member shares |

| Benefits | Protects community land; prevents speculation | Promotes resident control; stabilizes housing costs |

| Limitations | Complex governance; limited market liquidity | Restricted equity growth; cooperative management challenges |

Which is better?

Community land trusts (CLTs) provide permanent affordability by separating land ownership from housing ownership, ensuring long-term community control and protection against market speculation. Limited equity housing cooperatives (LEHCs) offer residents shared ownership with restrictions on resale prices to maintain affordability but may have less permanence compared to CLTs. Both models promote affordable housing, yet CLTs typically deliver stronger community governance and sustainable affordability over time.

Connection

Community land trusts (CLTs) and limited equity housing share a common goal of preserving long-term housing affordability by removing land costs from the housing price equation. CLTs acquire and hold land in trust, leasing it to homeowners under long-term, renewable agreements, while limited equity housing restricts resale prices to maintain affordability for subsequent buyers. Both models stabilize neighborhoods, prevent displacement, and promote equitable homeownership opportunities.

Key Terms

Ownership Structure

Limited equity housing operates under a cooperative ownership model where residents hold shares with restrictions on resale value to maintain affordability. Community land trusts separate ownership of land and housing, with the trust owning the land and residents owning the homes, ensuring long-term affordability through lease agreements. Explore the nuances of each model to understand how ownership structures impact sustainable affordable housing.

Affordability Mechanism

Limited equity housing cooperatives (LEHCs) maintain affordability by restricting resale prices based on a predetermined formula, ensuring long-term resident ownership at below-market rates. Community land trusts (CLTs) separate land ownership from housing ownership, holding land in trust to stabilize prices and control resale terms, effectively preserving affordability for future buyers. Explore the nuances of these affordability mechanisms to understand their impact on sustainable housing solutions.

Land Tenure

Limited equity housing cooperatives grant residents ownership shares with restricted resale values, ensuring long-term affordability while maintaining control over the land. Community land trusts separate land ownership from housing ownership, where a nonprofit holds the land and leases it to homeowners, preserving land tenure stability and preventing market-driven price surges. Explore the differences in land tenure models to understand which structure best supports sustainable affordable housing.

Source and External Links

limited equity housing | Wex | US Law | LII / Legal Information Institute - Limited equity housing is a residential arrangement managed by nonprofit cooperative corporations that restrict the equity shareholders can earn upon resale, preserving long-term affordability for low-income residents.

Limited equity cooperatives - Local Housing Solutions - Limited equity cooperatives are homeownership models where residents buy shares in a development with resale price restrictions, maintaining affordability while sometimes allowing limited equity growth, often supported by government subsidies or community land trusts.

The Limited Equity Cooperative: An Economic and Social Solution to Affordable Housing Crises - Limited equity cooperatives provide affordable housing by combining cooperative ownership with restrictions on equity appreciation, enabling low-income residents to build some wealth and participate in democratic management of their housing, while maintaining affordability over time.

dowidth.com

dowidth.com