Single family rental portfolios offer diversified market exposure and long-term appreciation potential through individual homes in various neighborhoods, while senior housing portfolios focus on specialized care facilities addressing the growing demand from aging populations. Real estate investors weigh factors such as occupancy stability, tenant demographics, and operational complexity when choosing between these distinct asset classes. Explore the unique benefits and challenges of single family rentals versus senior housing to make informed investment decisions.

Why it is important

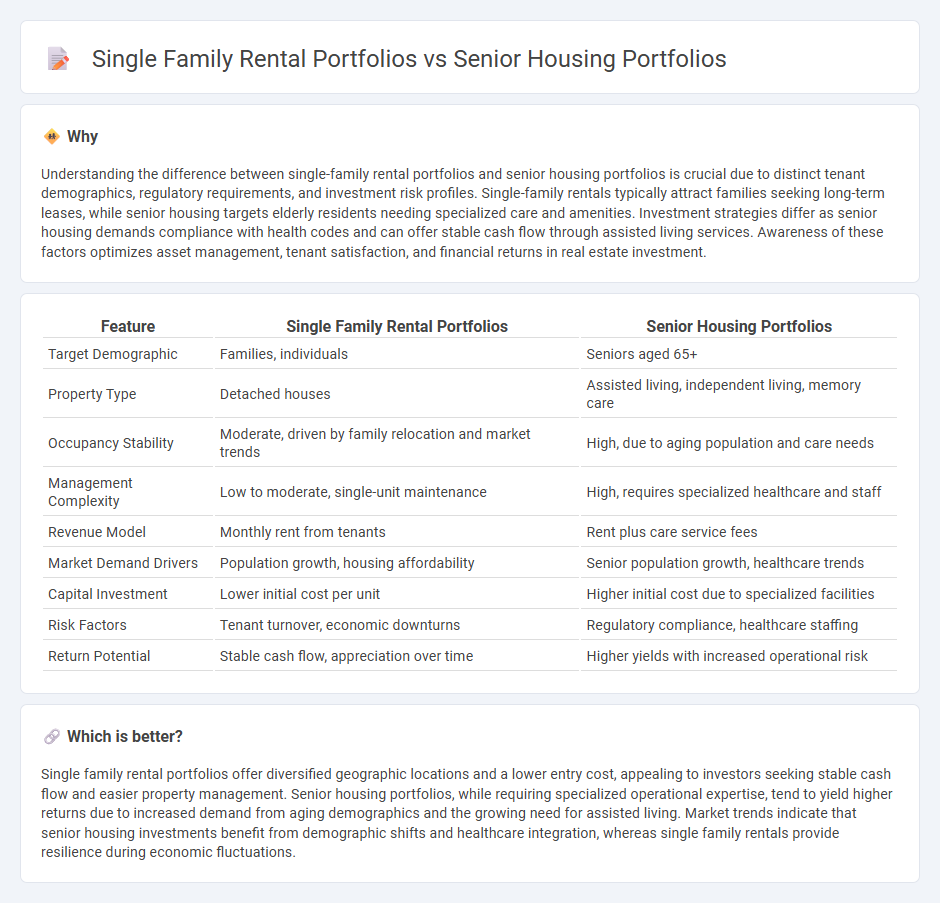

Understanding the difference between single-family rental portfolios and senior housing portfolios is crucial due to distinct tenant demographics, regulatory requirements, and investment risk profiles. Single-family rentals typically attract families seeking long-term leases, while senior housing targets elderly residents needing specialized care and amenities. Investment strategies differ as senior housing demands compliance with health codes and can offer stable cash flow through assisted living services. Awareness of these factors optimizes asset management, tenant satisfaction, and financial returns in real estate investment.

Comparison Table

| Feature | Single Family Rental Portfolios | Senior Housing Portfolios |

|---|---|---|

| Target Demographic | Families, individuals | Seniors aged 65+ |

| Property Type | Detached houses | Assisted living, independent living, memory care |

| Occupancy Stability | Moderate, driven by family relocation and market trends | High, due to aging population and care needs |

| Management Complexity | Low to moderate, single-unit maintenance | High, requires specialized healthcare and staff |

| Revenue Model | Monthly rent from tenants | Rent plus care service fees |

| Market Demand Drivers | Population growth, housing affordability | Senior population growth, healthcare trends |

| Capital Investment | Lower initial cost per unit | Higher initial cost due to specialized facilities |

| Risk Factors | Tenant turnover, economic downturns | Regulatory compliance, healthcare staffing |

| Return Potential | Stable cash flow, appreciation over time | Higher yields with increased operational risk |

Which is better?

Single family rental portfolios offer diversified geographic locations and a lower entry cost, appealing to investors seeking stable cash flow and easier property management. Senior housing portfolios, while requiring specialized operational expertise, tend to yield higher returns due to increased demand from aging demographics and the growing need for assisted living. Market trends indicate that senior housing investments benefit from demographic shifts and healthcare integration, whereas single family rentals provide resilience during economic fluctuations.

Connection

Single family rental portfolios and senior housing portfolios share a strong connection through demographic targeting and stable income generation, as aging populations increase demand for both types of housing. Both portfolios benefit from long-term leases and lower tenant turnover rates, driven by the preference for stable, community-based living environments. Investors leverage these synergies to diversify risk and capitalize on the growing need for affordable and accessible housing options within aging communities.

Key Terms

Occupancy Rates

Senior housing portfolios typically exhibit higher occupancy rates compared to single family rental portfolios due to consistent demand driven by an aging population and specialized care services. Single family rental portfolios often experience more variable occupancy influenced by local market conditions, tenant turnover, and maintenance cycles. Explore detailed occupancy rate trends and investment implications for both housing types to optimize your portfolio strategy.

Lease Structures

Senior housing portfolios often utilize triple-net leases, where tenants cover property taxes, insurance, and maintenance, ensuring predictable income for landlords. Single family rental portfolios typically employ standard lease agreements with tenants responsible primarily for rent and basic upkeep, offering more flexibility but increased management needs. Explore detailed comparisons of lease structures to optimize investment strategies in housing portfolios.

Resident Demographics

Senior housing portfolios predominantly cater to individuals aged 65 and older, often featuring amenities tailored to assisted living and healthcare support that address aging-related needs. Single family rental portfolios attract a more diverse age group, including young families, professionals, and retirees, emphasizing space, community, and affordability. Discover detailed insights on how resident demographics shape investment strategies in both housing sectors.

Source and External Links

25 Largest Senior Housing Companies - Property Manager Insider - Profiles of major senior housing companies including Milestone Retirement Communities (8,426 units), Discovery Senior Living (7,416 units), and Leisure Care (7,112 units) along with their portfolio sizes and specializations.

Private equity behind top senior housing operators - Overview of private equity-owned senior housing portfolios, highlighting Benchmark Senior Living with 67 properties (6,373 units) and Spectrum Retirement Communities with 38 properties (5,782 units), including their geographic reach and care types offered.

Seniors Housing - Kayne Anderson - Details on Kayne Anderson Real Estate's investment in 110+ private-pay senior housing communities across 25 states totaling over 15,000 units, emphasizing consolidation of a fragmented sector and partnerships with operators like Discovery Senior Living.

dowidth.com

dowidth.com