Leaseback programs provide property owners with immediate capital by selling their property and leasing it back, ensuring continued use without ownership burdens. Build-to-suit involves custom constructing a property tailored to a tenant's specific needs, offering long-term control and operational efficiency. Explore the key differences and benefits of each model to determine the ideal real estate strategy.

Why it is important

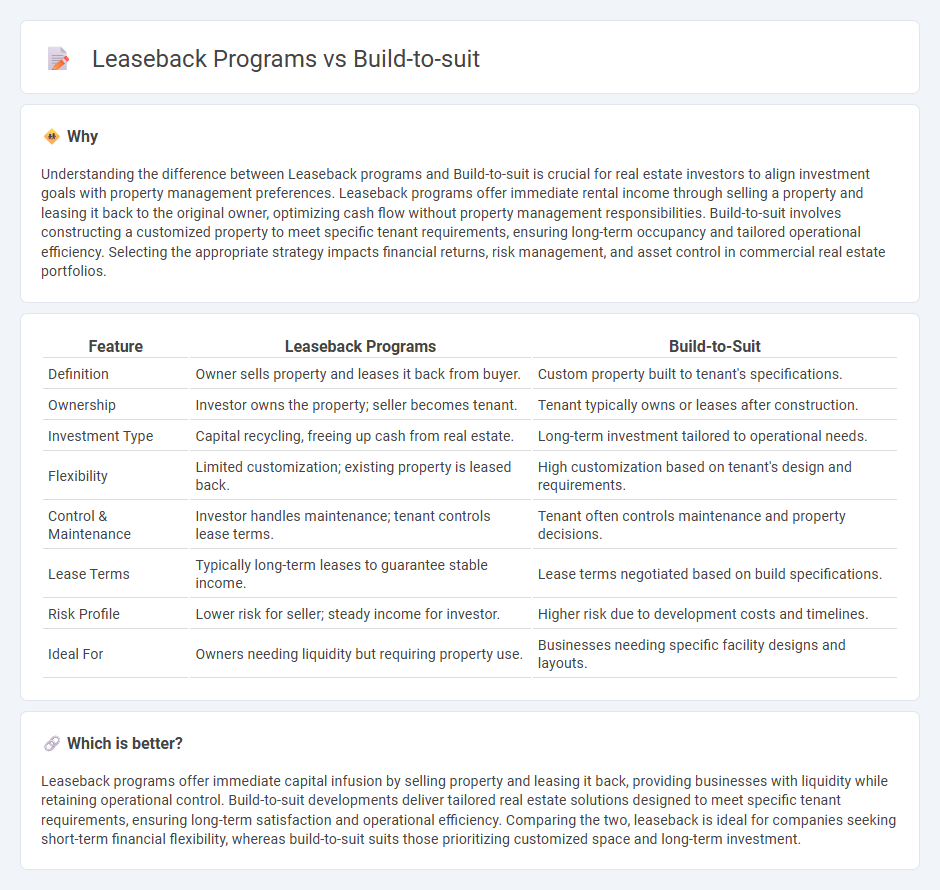

Understanding the difference between Leaseback programs and Build-to-suit is crucial for real estate investors to align investment goals with property management preferences. Leaseback programs offer immediate rental income through selling a property and leasing it back to the original owner, optimizing cash flow without property management responsibilities. Build-to-suit involves constructing a customized property to meet specific tenant requirements, ensuring long-term occupancy and tailored operational efficiency. Selecting the appropriate strategy impacts financial returns, risk management, and asset control in commercial real estate portfolios.

Comparison Table

| Feature | Leaseback Programs | Build-to-Suit |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer. | Custom property built to tenant's specifications. |

| Ownership | Investor owns the property; seller becomes tenant. | Tenant typically owns or leases after construction. |

| Investment Type | Capital recycling, freeing up cash from real estate. | Long-term investment tailored to operational needs. |

| Flexibility | Limited customization; existing property is leased back. | High customization based on tenant's design and requirements. |

| Control & Maintenance | Investor handles maintenance; tenant controls lease terms. | Tenant often controls maintenance and property decisions. |

| Lease Terms | Typically long-term leases to guarantee stable income. | Lease terms negotiated based on build specifications. |

| Risk Profile | Lower risk for seller; steady income for investor. | Higher risk due to development costs and timelines. |

| Ideal For | Owners needing liquidity but requiring property use. | Businesses needing specific facility designs and layouts. |

Which is better?

Leaseback programs offer immediate capital infusion by selling property and leasing it back, providing businesses with liquidity while retaining operational control. Build-to-suit developments deliver tailored real estate solutions designed to meet specific tenant requirements, ensuring long-term satisfaction and operational efficiency. Comparing the two, leaseback is ideal for companies seeking short-term financial flexibility, whereas build-to-suit suits those prioritizing customized space and long-term investment.

Connection

Leaseback programs and build-to-suit projects are interconnected through their focus on customized real estate solutions that optimize asset utilization and cash flow. In leaseback arrangements, property owners sell their real estate and lease it back, freeing capital while maintaining operational control, often benefiting tenants seeking tailored spaces. Build-to-suit developments complement this by constructing properties specifically designed to meet tenant requirements, making leaseback an attractive strategy for tenants to occupy purpose-built facilities without upfront capital investment.

Key Terms

Customization

Build-to-suit programs offer tailored real estate solutions designed specifically to meet the unique operational needs and specifications of businesses, ensuring optimal space utilization and functionality. Leaseback programs provide companies with immediate capital by selling custom-built properties and leasing them back, allowing operational continuity while unlocking asset value. Explore the advantages of each approach to determine the best fit for your business strategy.

Long-term Lease

Build-to-suit developments offer customized spaces tailored to specific tenant needs, ensuring operational efficiency and brand consistency over long-term leases. Leaseback programs provide companies with immediate capital by selling property and leasing it back, often under extended lease agreements that secure predictable occupancy costs. Explore detailed comparisons to determine which long-term lease strategy aligns best with your business goals.

Ownership Transfer

Build-to-suit programs provide tenants with customized properties tailored to their specific operational needs, enhancing long-term ownership value. Leaseback programs facilitate immediate capital recovery by selling the property and leasing it back, transferring ownership to investors while tenants retain usage rights. Explore detailed insights into how ownership transfer impacts financial and operational strategies in both programs.

Source and External Links

WHAT IS A BUILD TO SUIT? - A build-to-suit involves designing and constructing a property to meet a tenant's specific needs, often seen in large retail or franchise operations.

Build-to-Suit (BTS) Definition - Build-to-suit is a leasing method where a developer constructs a building tailored to a tenant's specifications, common in retail and industrial properties.

Understanding Build to Suit Development - Build-to-suit developments are commercial buildings constructed to meet a single user's design and physical specifications, often involving either a sale-leaseback or partnering with a developer.

dowidth.com

dowidth.com