Escrow crowdfunding in real estate allows multiple investors to pool funds into a secure escrow account before the deal closes, enhancing transparency and reducing risk. Private equity real estate involves institutional or accredited investors directly purchasing or managing properties with greater control and potentially higher returns. Explore the key differences and benefits of these investment methods to determine which suits your financial goals best.

Why it is important

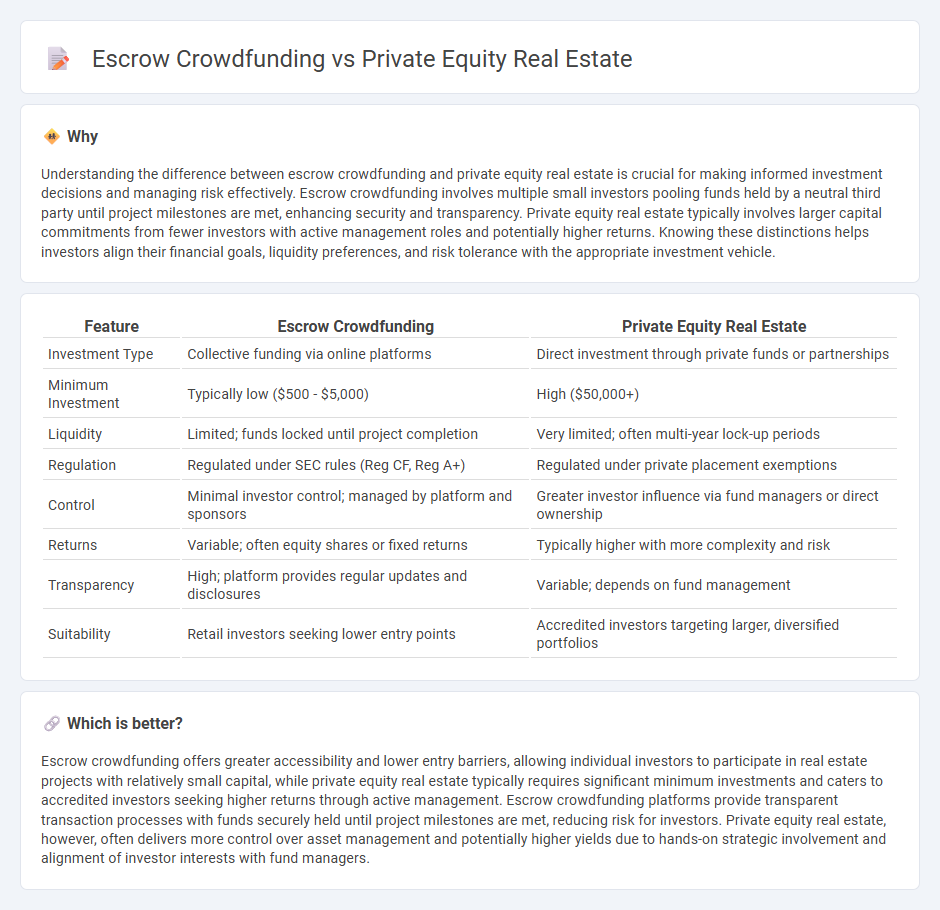

Understanding the difference between escrow crowdfunding and private equity real estate is crucial for making informed investment decisions and managing risk effectively. Escrow crowdfunding involves multiple small investors pooling funds held by a neutral third party until project milestones are met, enhancing security and transparency. Private equity real estate typically involves larger capital commitments from fewer investors with active management roles and potentially higher returns. Knowing these distinctions helps investors align their financial goals, liquidity preferences, and risk tolerance with the appropriate investment vehicle.

Comparison Table

| Feature | Escrow Crowdfunding | Private Equity Real Estate |

|---|---|---|

| Investment Type | Collective funding via online platforms | Direct investment through private funds or partnerships |

| Minimum Investment | Typically low ($500 - $5,000) | High ($50,000+) |

| Liquidity | Limited; funds locked until project completion | Very limited; often multi-year lock-up periods |

| Regulation | Regulated under SEC rules (Reg CF, Reg A+) | Regulated under private placement exemptions |

| Control | Minimal investor control; managed by platform and sponsors | Greater investor influence via fund managers or direct ownership |

| Returns | Variable; often equity shares or fixed returns | Typically higher with more complexity and risk |

| Transparency | High; platform provides regular updates and disclosures | Variable; depends on fund management |

| Suitability | Retail investors seeking lower entry points | Accredited investors targeting larger, diversified portfolios |

Which is better?

Escrow crowdfunding offers greater accessibility and lower entry barriers, allowing individual investors to participate in real estate projects with relatively small capital, while private equity real estate typically requires significant minimum investments and caters to accredited investors seeking higher returns through active management. Escrow crowdfunding platforms provide transparent transaction processes with funds securely held until project milestones are met, reducing risk for investors. Private equity real estate, however, often delivers more control over asset management and potentially higher yields due to hands-on strategic involvement and alignment of investor interests with fund managers.

Connection

Escrow crowdfunding acts as a secure financial intermediary that holds investor funds until real estate deals in private equity are verified, ensuring transparent transactions. Private equity real estate relies on escrow crowdfunding platforms to aggregate capital from multiple investors, facilitating access to high-value property investments. This connection streamlines funding processes, enhances investor trust, and promotes efficient asset acquisition in the real estate market.

Key Terms

Capital Structure

Private equity real estate often involves a complex capital structure with multiple layers of equity and debt financing, allowing for greater leverage and potential returns. Escrow crowdfunding typically features simpler capital arrangements where funds from numerous investors are pooled in an escrow account before being deployed, reducing risk exposure and increasing transparency. Explore further to understand how these capital structures impact investment risks and returns.

Escrow Account

Private equity real estate investments typically involve substantial capital commitments and longer holding periods, with funds managed directly by professional firms. Escrow crowdfunding leverages an escrow account to securely hold investor contributions until project milestones or funding targets are met, minimizing risk by ensuring funds are only released under pre-agreed conditions. Discover how escrow accounts enhance transparency and investor protection in real estate crowdfunding by learning more.

Investor Liquidity

Private equity real estate typically offers limited investor liquidity due to long lock-in periods and secondary market restrictions, making immediate fund withdrawal challenging. Escrow crowdfunding platforms enhance investor liquidity by holding funds in escrow accounts until project milestones are met, allowing investors more control and transparency over their capital. Explore detailed comparisons to understand which investment suits your liquidity needs best.

Source and External Links

Real Estate Private Equity: Overview, Careers, Salaries & Interviews - This article provides an overview of real estate private equity, including its definition, career paths, and comparison with other investment vehicles like REITs.

Global Real Estate Private Equity Firm | ACRE - ACRE is a real estate private equity firm specializing in multifamily housing investments, managing over $4.1 billion in assets and focusing on value-add and development strategies.

How to Set Up a Private Equity Real Estate Fund - This guide outlines the steps to create and manage a private equity real estate fund, discussing the structure and key considerations for investors and sponsors.

dowidth.com

dowidth.com