iBuyer platforms streamline the home selling process by using algorithms to provide instant cash offers, enabling quick and convenient transactions without traditional agent involvement. Real estate crowdfunding allows multiple investors to pool funds online to finance properties, offering diversified access to real estate markets with lower capital requirements. Explore how these innovative models transform real estate investment and selling strategies.

Why it is important

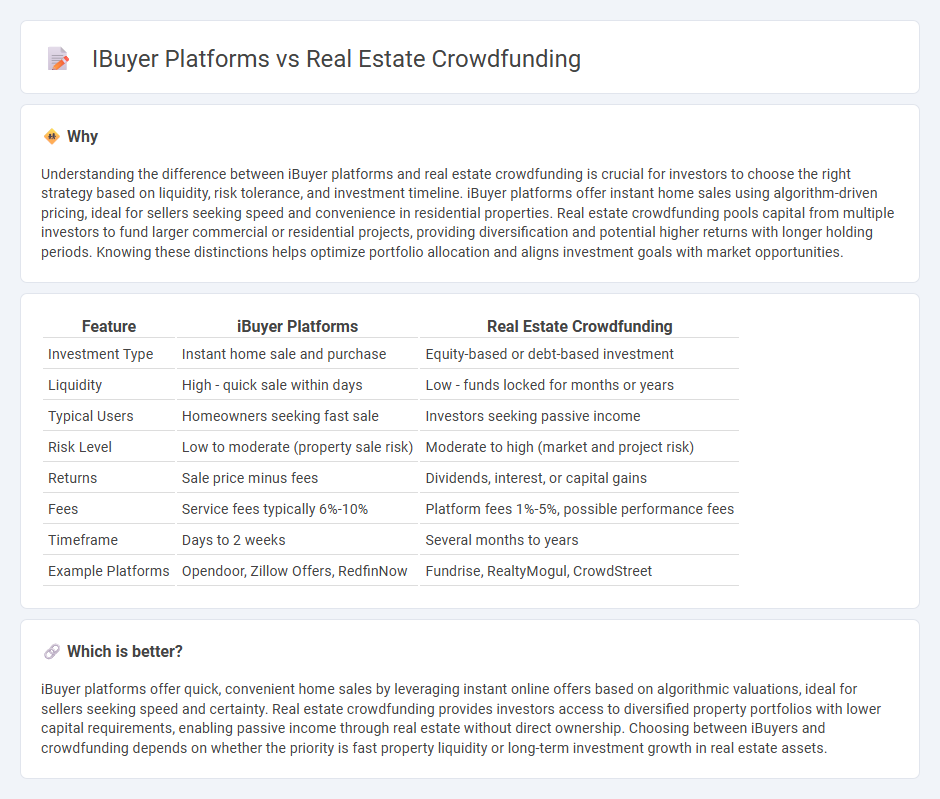

Understanding the difference between iBuyer platforms and real estate crowdfunding is crucial for investors to choose the right strategy based on liquidity, risk tolerance, and investment timeline. iBuyer platforms offer instant home sales using algorithm-driven pricing, ideal for sellers seeking speed and convenience in residential properties. Real estate crowdfunding pools capital from multiple investors to fund larger commercial or residential projects, providing diversification and potential higher returns with longer holding periods. Knowing these distinctions helps optimize portfolio allocation and aligns investment goals with market opportunities.

Comparison Table

| Feature | iBuyer Platforms | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Instant home sale and purchase | Equity-based or debt-based investment |

| Liquidity | High - quick sale within days | Low - funds locked for months or years |

| Typical Users | Homeowners seeking fast sale | Investors seeking passive income |

| Risk Level | Low to moderate (property sale risk) | Moderate to high (market and project risk) |

| Returns | Sale price minus fees | Dividends, interest, or capital gains |

| Fees | Service fees typically 6%-10% | Platform fees 1%-5%, possible performance fees |

| Timeframe | Days to 2 weeks | Several months to years |

| Example Platforms | Opendoor, Zillow Offers, RedfinNow | Fundrise, RealtyMogul, CrowdStreet |

Which is better?

iBuyer platforms offer quick, convenient home sales by leveraging instant online offers based on algorithmic valuations, ideal for sellers seeking speed and certainty. Real estate crowdfunding provides investors access to diversified property portfolios with lower capital requirements, enabling passive income through real estate without direct ownership. Choosing between iBuyers and crowdfunding depends on whether the priority is fast property liquidity or long-term investment growth in real estate assets.

Connection

iBuyer platforms utilize technology to provide instant home buying offers, streamlining transactions and increasing market liquidity, which attracts real estate crowdfunding investors seeking faster turnover on assets. Real estate crowdfunding leverages these digital platforms by pooling capital from multiple investors to fund iBuyer purchases, enhancing access to diverse property portfolios. This synergy accelerates property acquisition and disposition cycles, optimizing returns and expanding investment opportunities within the real estate ecosystem.

Key Terms

Investment Model

Real estate crowdfunding platforms pool capital from multiple investors to fund properties, offering fractional ownership and shared returns based on rental income or property appreciation. iBuyer platforms operate by purchasing homes directly from sellers using proprietary algorithms, renovating if needed, and reselling them quickly for a profit, focusing on rapid transactions rather than shared investment. Explore how these distinct investment models impact risk, liquidity, and potential returns in real estate.

Liquidity

Real estate crowdfunding offers investors fractional ownership with the potential for steady income but generally involves longer lock-in periods, limiting immediate liquidity. iBuyer platforms provide homeowners with quick, cash-based home sales, significantly enhancing liquidity by reducing transaction time from months to days. Explore these options further to determine which liquidity model best suits your investment or selling needs.

Transaction Speed

Real estate crowdfunding platforms offer investors access to diversified property portfolios but may involve longer transaction times due to due diligence and regulatory processes. iBuyer platforms provide near-instant home sales by leveraging technology and data analytics, often closing transactions in a matter of days. Explore the benefits and speed differences between these innovative real estate solutions to find the best fit for your investment strategy.

Source and External Links

Crowdfunding Real Estate: What to Know - This article explains how real estate crowdfunding allows multiple investors to pool their funds to invest in properties they couldn't afford alone, providing a way to diversify portfolios with less effort.

Crowdfunding - National Association of REALTORS - Crowdfunding in real estate involves pooling money to fund projects and earn passive income, often through platforms like Crowdstreet and Fundrise.

Arrived | Easily Invest in Real Estate - Arrived offers a platform for investing in real estate starting from $100, allowing users to earn passive income and property appreciation without the hassle of direct management.

dowidth.com

dowidth.com