Short-term rental arbitrage leverages leasing properties below market rates to generate high returns through platforms like Airbnb, capitalizing on transient demand and flexible pricing strategies. Co-living investment focuses on long-term, community-oriented rental models that optimize space utilization and cater to urban professionals seeking affordable, shared living environments. Explore more about maximizing returns in real estate through strategic investment models.

Why it is important

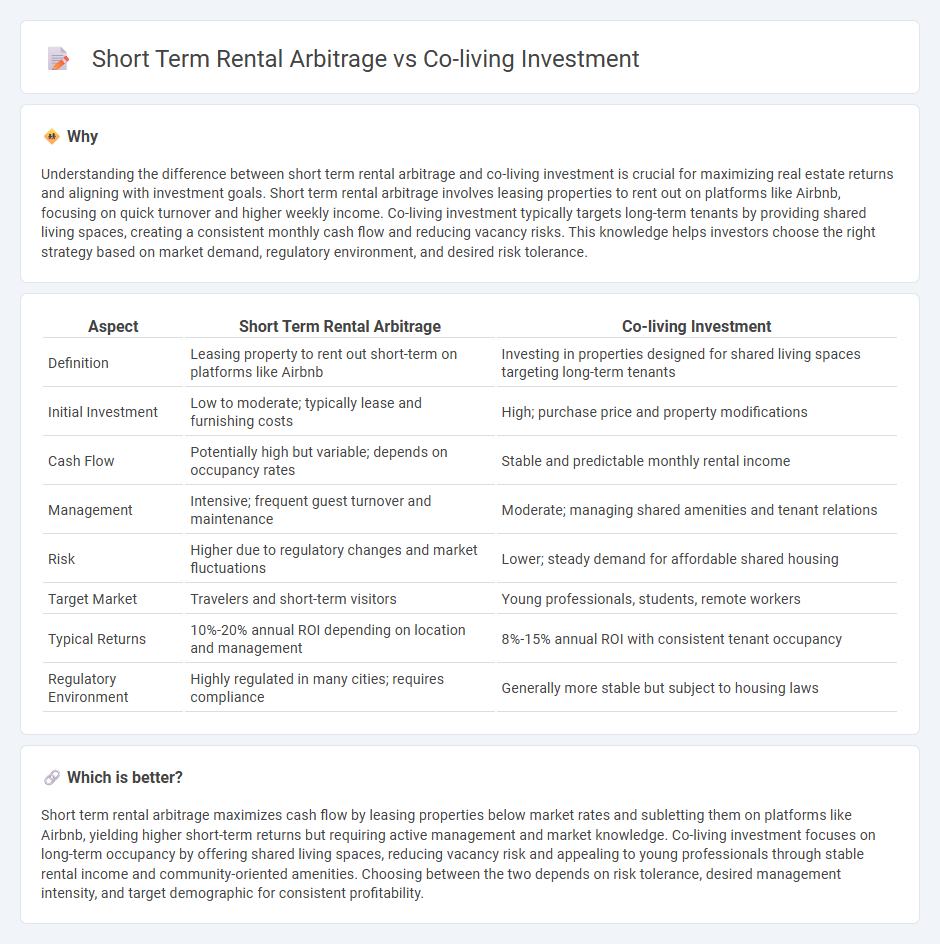

Understanding the difference between short term rental arbitrage and co-living investment is crucial for maximizing real estate returns and aligning with investment goals. Short term rental arbitrage involves leasing properties to rent out on platforms like Airbnb, focusing on quick turnover and higher weekly income. Co-living investment typically targets long-term tenants by providing shared living spaces, creating a consistent monthly cash flow and reducing vacancy risks. This knowledge helps investors choose the right strategy based on market demand, regulatory environment, and desired risk tolerance.

Comparison Table

| Aspect | Short Term Rental Arbitrage | Co-living Investment |

|---|---|---|

| Definition | Leasing property to rent out short-term on platforms like Airbnb | Investing in properties designed for shared living spaces targeting long-term tenants |

| Initial Investment | Low to moderate; typically lease and furnishing costs | High; purchase price and property modifications |

| Cash Flow | Potentially high but variable; depends on occupancy rates | Stable and predictable monthly rental income |

| Management | Intensive; frequent guest turnover and maintenance | Moderate; managing shared amenities and tenant relations |

| Risk | Higher due to regulatory changes and market fluctuations | Lower; steady demand for affordable shared housing |

| Target Market | Travelers and short-term visitors | Young professionals, students, remote workers |

| Typical Returns | 10%-20% annual ROI depending on location and management | 8%-15% annual ROI with consistent tenant occupancy |

| Regulatory Environment | Highly regulated in many cities; requires compliance | Generally more stable but subject to housing laws |

Which is better?

Short term rental arbitrage maximizes cash flow by leasing properties below market rates and subletting them on platforms like Airbnb, yielding higher short-term returns but requiring active management and market knowledge. Co-living investment focuses on long-term occupancy by offering shared living spaces, reducing vacancy risk and appealing to young professionals through stable rental income and community-oriented amenities. Choosing between the two depends on risk tolerance, desired management intensity, and target demographic for consistent profitability.

Connection

Short term rental arbitrage leverages leased properties to generate higher rental income through platforms like Airbnb, creating cash flow opportunities without property ownership. Co-living investment focuses on communal living spaces that maximize occupancy and rental yields by catering to demand for affordable, flexible housing. Both strategies capitalize on optimizing real estate assets for short-term, high-turnover rentals, enhancing profitability in urban markets.

Key Terms

Occupancy Rate

Co-living investments typically achieve higher occupancy rates, often exceeding 90%, due to shared living spaces appealing to long-term urban professionals and students. In contrast, short-term rental arbitrage depends heavily on fluctuating tourist demand and seasonal trends, resulting in variable occupancy rates averaging around 60-75%. Explore detailed data on occupancy trends and investment returns to determine the best strategy for your portfolio.

Lease Agreement

Co-living investment often involves long-term lease agreements with favorable terms tailored for group living arrangements, enabling stable rental income and reduced vacancy risk. Short-term rental arbitrage relies on short-term leases or month-to-month contracts, offering flexibility but exposing investors to higher turnover and inconsistent cash flow. Explore the benefits and challenges of each lease strategy to maximize your real estate investment returns.

Operational Costs

Operational costs in co-living investments are generally lower per unit due to shared amenities and bulk service agreements, optimizing maintenance and utility expenses across multiple residents. Short-term rental arbitrage often incurs higher variable costs, including frequent cleaning, guest turnover management, and platform fees, which reduce overall profitability. Explore detailed cost breakdowns to determine the most efficient strategy for your investment goals.

Source and External Links

Are co-living investments better than Airbnb for long-term gains? - Co-living investments are generally more stable and predictable, offering consistent cash flow compared to Airbnb rentals.

Coliving for Investors - This model combines private quarters with shared spaces, fostering collaboration and networking opportunities among investment professionals.

Understanding Different Approaches to Shared Living Investments - Co-living spaces offer various business models catering to different demographics and investor needs in the real estate market.

dowidth.com

dowidth.com