Green leases promote sustainability by incorporating energy efficiency and environmental standards into rental agreements, encouraging tenants and landlords to reduce carbon footprints and utility costs. Gross leases involve a fixed rent where landlords cover most property expenses, offering tenants predictable costs but less incentive to manage resource consumption. Explore the key differences and benefits of green leases versus gross leases to make informed real estate decisions.

Why it is important

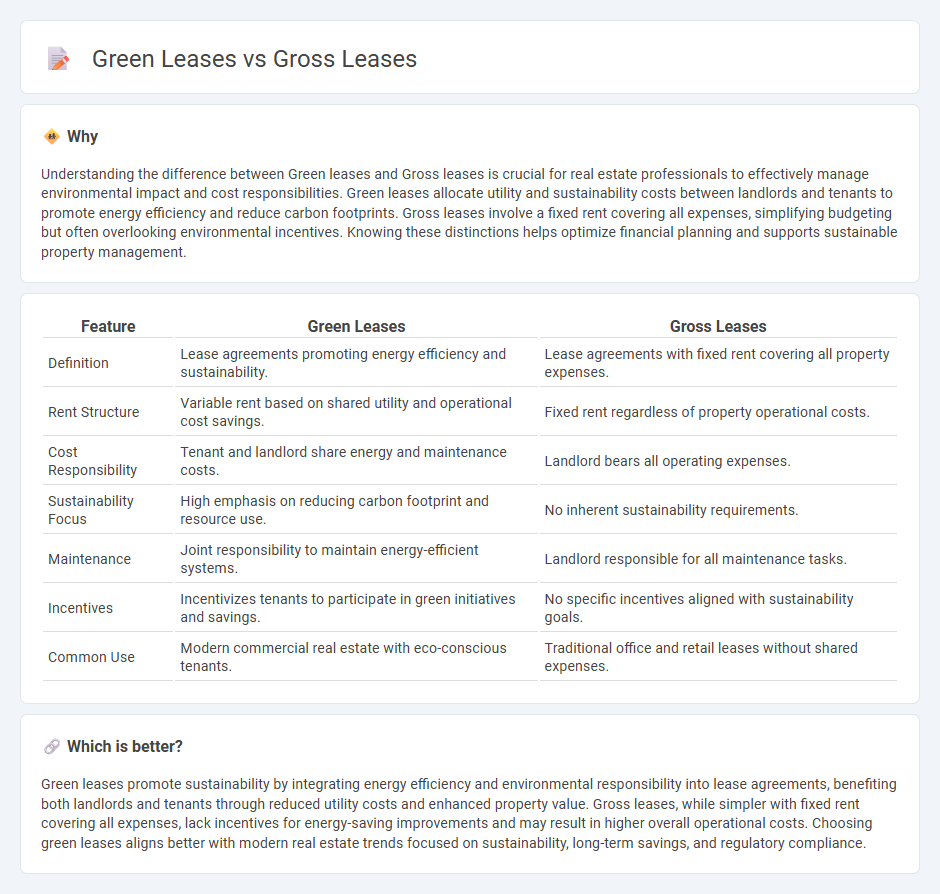

Understanding the difference between Green leases and Gross leases is crucial for real estate professionals to effectively manage environmental impact and cost responsibilities. Green leases allocate utility and sustainability costs between landlords and tenants to promote energy efficiency and reduce carbon footprints. Gross leases involve a fixed rent covering all expenses, simplifying budgeting but often overlooking environmental incentives. Knowing these distinctions helps optimize financial planning and supports sustainable property management.

Comparison Table

| Feature | Green Leases | Gross Leases |

|---|---|---|

| Definition | Lease agreements promoting energy efficiency and sustainability. | Lease agreements with fixed rent covering all property expenses. |

| Rent Structure | Variable rent based on shared utility and operational cost savings. | Fixed rent regardless of property operational costs. |

| Cost Responsibility | Tenant and landlord share energy and maintenance costs. | Landlord bears all operating expenses. |

| Sustainability Focus | High emphasis on reducing carbon footprint and resource use. | No inherent sustainability requirements. |

| Maintenance | Joint responsibility to maintain energy-efficient systems. | Landlord responsible for all maintenance tasks. |

| Incentives | Incentivizes tenants to participate in green initiatives and savings. | No specific incentives aligned with sustainability goals. |

| Common Use | Modern commercial real estate with eco-conscious tenants. | Traditional office and retail leases without shared expenses. |

Which is better?

Green leases promote sustainability by integrating energy efficiency and environmental responsibility into lease agreements, benefiting both landlords and tenants through reduced utility costs and enhanced property value. Gross leases, while simpler with fixed rent covering all expenses, lack incentives for energy-saving improvements and may result in higher overall operational costs. Choosing green leases aligns better with modern real estate trends focused on sustainability, long-term savings, and regulatory compliance.

Connection

Green leases incorporate sustainability clauses that encourage energy efficiency and reduced environmental impact, while gross leases include fixed rent covering all operating expenses. The connection lies in their integration, where green lease provisions can be embedded within gross leases to ensure shared responsibility for sustainability costs and benefits between landlords and tenants. This synergy promotes eco-friendly property management without altering the fundamental gross lease structure.

Key Terms

Operating Expenses

Gross leases bundle operating expenses such as property taxes, insurance, and maintenance into a fixed rent amount, simplifying budgeting for tenants but often leading to less transparency in actual costs. Green leases incorporate provisions requiring both landlords and tenants to share the responsibility for operational efficiencies and sustainable practices, actively managing energy, water, and waste expenses to reduce environmental impact. Discover how these lease structures influence cost control and sustainability efforts in commercial real estate.

Sustainability Clauses

Gross leases typically involve a fixed rent covering base rent and operating expenses, whereas green leases integrate sustainability clauses that allocate environmental responsibilities between landlords and tenants to promote energy efficiency and resource conservation. These sustainability clauses often include mandates for waste reduction, energy use reporting, and adherence to green building standards such as LEED or BREEAM certifications. Explore the specifics of how green leases can enhance your property's environmental performance and long-term value.

Expense Pass-Through

Gross leases typically include all operating expenses within the base rent, minimizing tenant responsibility for costs like maintenance, taxes, and insurance, whereas green leases incorporate expense pass-through clauses that hold tenants accountable for their share of environmental or sustainability-related expenses. The pass-through approach in green leases promotes energy efficiency by aligning tenant and landlord incentives to reduce utility consumption and improve building performance. Explore further to understand how these lease structures impact financial planning and sustainability goals.

Source and External Links

Gross Lease - Wikipedia - A gross lease is a type of commercial lease where the tenant pays a flat rental amount, and the landlord covers all operating expenses.

Lease Types: Gross vs. Net - This article explains gross leases as a type where the tenant pays one total rent amount that includes all occupancy costs, contrasting with net leases.

Commercial Real Estate: Gross Leases - Gross leases are full-service agreements where the landlord covers most operating expenses, including utilities and property taxes, in exchange for a fixed monthly rent.

dowidth.com

dowidth.com