Micro flipping involves purchasing undervalued properties, making minimal improvements, and quickly reselling them for profit, focusing on rapid turnaround and capital gain. House hacking entails buying a multi-unit property, living in one unit, and renting out the others to offset mortgage expenses, creating a steady income stream. Discover more about these real estate strategies to maximize your investment potential.

Why it is important

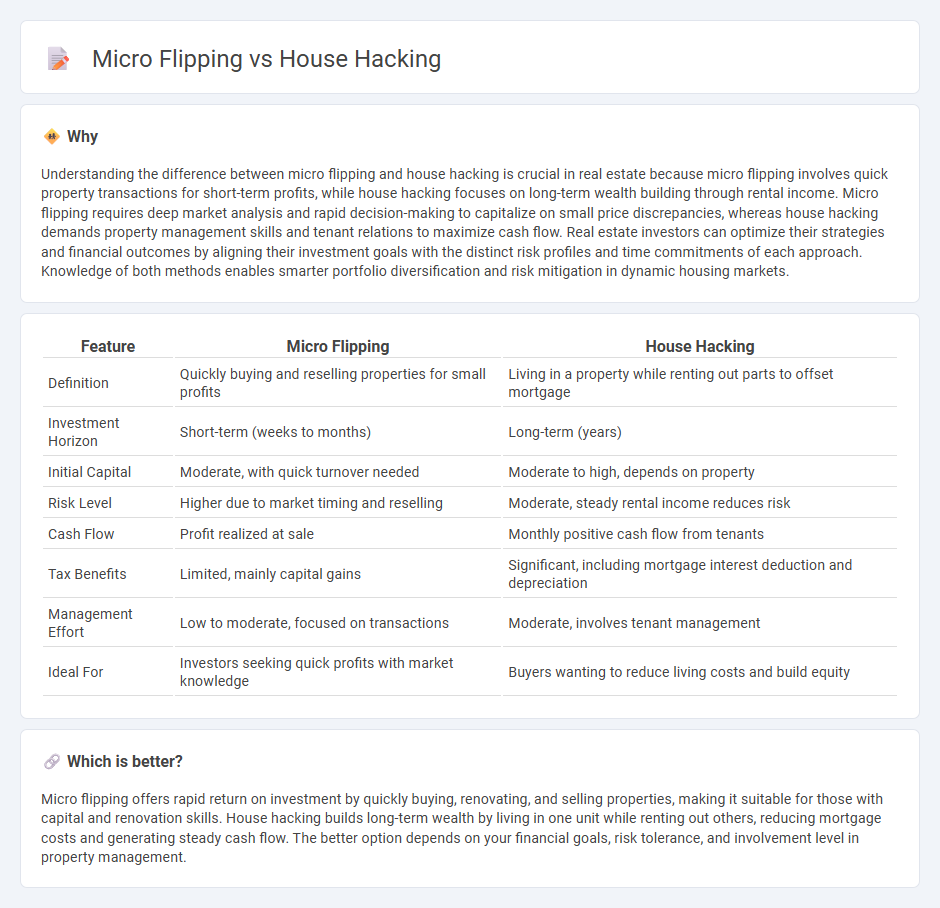

Understanding the difference between micro flipping and house hacking is crucial in real estate because micro flipping involves quick property transactions for short-term profits, while house hacking focuses on long-term wealth building through rental income. Micro flipping requires deep market analysis and rapid decision-making to capitalize on small price discrepancies, whereas house hacking demands property management skills and tenant relations to maximize cash flow. Real estate investors can optimize their strategies and financial outcomes by aligning their investment goals with the distinct risk profiles and time commitments of each approach. Knowledge of both methods enables smarter portfolio diversification and risk mitigation in dynamic housing markets.

Comparison Table

| Feature | Micro Flipping | House Hacking |

|---|---|---|

| Definition | Quickly buying and reselling properties for small profits | Living in a property while renting out parts to offset mortgage |

| Investment Horizon | Short-term (weeks to months) | Long-term (years) |

| Initial Capital | Moderate, with quick turnover needed | Moderate to high, depends on property |

| Risk Level | Higher due to market timing and reselling | Moderate, steady rental income reduces risk |

| Cash Flow | Profit realized at sale | Monthly positive cash flow from tenants |

| Tax Benefits | Limited, mainly capital gains | Significant, including mortgage interest deduction and depreciation |

| Management Effort | Low to moderate, focused on transactions | Moderate, involves tenant management |

| Ideal For | Investors seeking quick profits with market knowledge | Buyers wanting to reduce living costs and build equity |

Which is better?

Micro flipping offers rapid return on investment by quickly buying, renovating, and selling properties, making it suitable for those with capital and renovation skills. House hacking builds long-term wealth by living in one unit while renting out others, reducing mortgage costs and generating steady cash flow. The better option depends on your financial goals, risk tolerance, and involvement level in property management.

Connection

Micro flipping and house hacking both leverage small-scale real estate investments to maximize cash flow and property value. Micro flipping involves quickly buying, renovating, and reselling properties within a short time frame, while house hacking focuses on purchasing multi-unit properties or homes with rentable spaces to generate income while living onsite. Both strategies capitalize on market trends, property improvements, and rental income to build wealth in real estate with lower upfront capital and risk.

Key Terms

Owner-occupancy

House hacking leverages owner-occupancy by allowing homeowners to live in a property while renting out parts to cover mortgage costs, optimizing cash flow and equity building. Micro flipping involves quick resale of properties, often without living in them, emphasizing short-term profit over long-term residence benefits. Explore detailed strategies and financial advantages of each approach to determine which suits your investment goals best.

Quick resale

House hacking leverages owner-occupied properties to generate rental income while minimizing living expenses, whereas micro flipping involves rapid purchase and resale of undervalued properties for quick profit. Investors targeting quick resale benefit from micro flipping's short turnaround but face higher market risk compared to house hacking's long-term cash flow stability. Explore detailed strategies and market trends to optimize your quick resale investment approach.

Cash flow

House hacking generates consistent cash flow by leveraging rental income from multi-unit properties or extra rooms in a primary residence, reducing monthly housing expenses. Micro flipping targets quick profits through rapid renovation and resale of small properties, with cash flow being less predictable and more dependent on market conditions. Explore detailed strategies and financial comparisons to maximize your real estate investment returns.

Source and External Links

What Is House Hacking In Real Estate? | Quicken Loans - House hacking is generating passive income by renting part of your property while living there, using options like a single-family home, multifamily homes, accessory dwelling units (ADUs), or vacation rentals to offset costs.

What is House Hacking? Definition and Strategies - House hacking commonly involves buying a multifamily home, living in one unit, and renting out the others so tenants pay a major part or all of your mortgage, helping especially millennials and Gen Z afford homeownership.

What is house hacking and is it something you should be doing? - House hacking methods include finding housemates to share rent and utilities or building an ADU to rent out separately, reducing living expenses while maintaining flexibility as a real estate investment approach.

dowidth.com

dowidth.com