Value-add real estate investments focus on properties requiring moderate improvements to increase cash flow and asset value, appealing to investors seeking balanced risk and returns. Opportunistic investments involve higher-risk projects like development or significant repositioning, aiming for substantial appreciation but demanding deeper market expertise and capital commitment. Explore detailed strategies and risk profiles to determine the best fit for your investment goals.

Why it is important

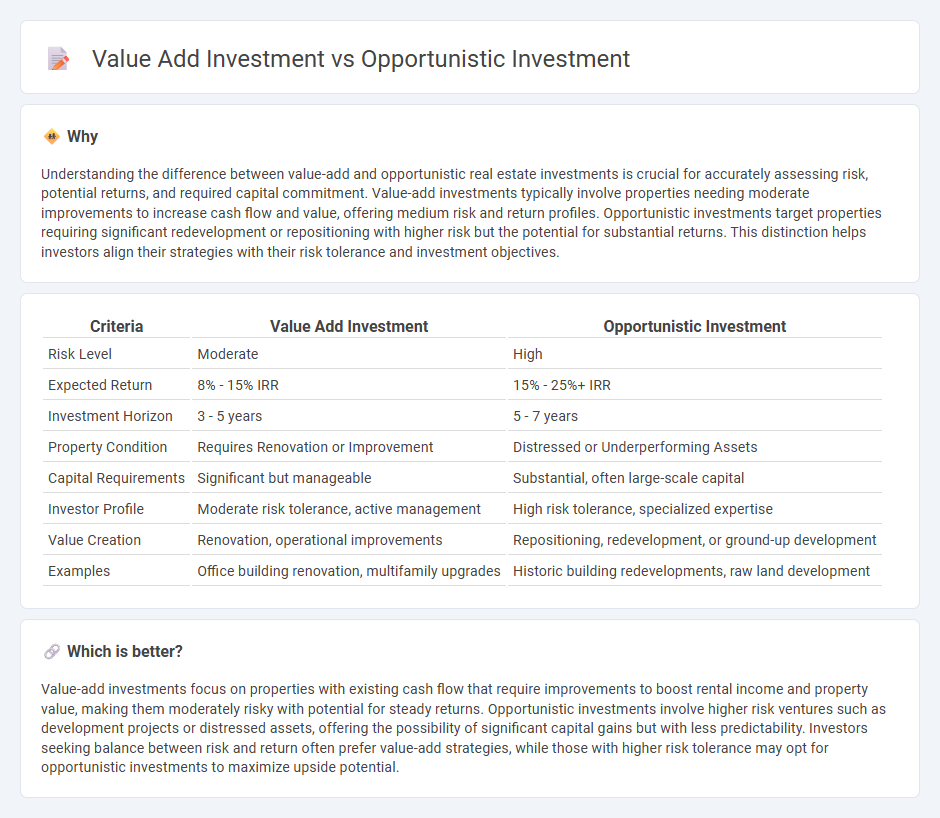

Understanding the difference between value-add and opportunistic real estate investments is crucial for accurately assessing risk, potential returns, and required capital commitment. Value-add investments typically involve properties needing moderate improvements to increase cash flow and value, offering medium risk and return profiles. Opportunistic investments target properties requiring significant redevelopment or repositioning with higher risk but the potential for substantial returns. This distinction helps investors align their strategies with their risk tolerance and investment objectives.

Comparison Table

| Criteria | Value Add Investment | Opportunistic Investment |

|---|---|---|

| Risk Level | Moderate | High |

| Expected Return | 8% - 15% IRR | 15% - 25%+ IRR |

| Investment Horizon | 3 - 5 years | 5 - 7 years |

| Property Condition | Requires Renovation or Improvement | Distressed or Underperforming Assets |

| Capital Requirements | Significant but manageable | Substantial, often large-scale capital |

| Investor Profile | Moderate risk tolerance, active management | High risk tolerance, specialized expertise |

| Value Creation | Renovation, operational improvements | Repositioning, redevelopment, or ground-up development |

| Examples | Office building renovation, multifamily upgrades | Historic building redevelopments, raw land development |

Which is better?

Value-add investments focus on properties with existing cash flow that require improvements to boost rental income and property value, making them moderately risky with potential for steady returns. Opportunistic investments involve higher risk ventures such as development projects or distressed assets, offering the possibility of significant capital gains but with less predictability. Investors seeking balance between risk and return often prefer value-add strategies, while those with higher risk tolerance may opt for opportunistic investments to maximize upside potential.

Connection

Value-add investment in real estate focuses on properties requiring improvements or operational enhancements to increase income and property value, while opportunistic investment involves higher-risk projects like development or repositioning with potential for substantial returns. Both strategies seek to maximize property value through active management and capital infusion, differing mainly in risk tolerance and required expertise. Investors often transition from value-add to opportunistic approaches as they gain experience and access to larger, more complex real estate opportunities.

Key Terms

**Opportunistic Investment:**

Opportunistic investment targets high-risk, high-reward opportunities often involving significant property repositioning, development, or distressed assets. These investments typically yield higher returns compared to value-add or core strategies, due to the complexity and market timing required. Explore further to understand how opportunistic investments can fit into your portfolio risk and return strategy.

High Risk

Opportunistic investments entail the highest risk level within real estate, targeting assets with significant challenges such as distress, redevelopment needs, or market dislocations, often promising substantial returns alongside uncertainty. Value-add investments present moderate to high risk by improving underperforming properties through renovations or operational improvements to increase value and income potential. Explore detailed risk profiles and strategic approaches to optimize your investment decisions.

Capital Appreciation

Opportunistic investments target high capital appreciation through aggressive strategies such as property repositioning, development, or significant asset enhancement, often involving higher risk and shorter investment horizons. Value-add investments seek moderate capital appreciation by improving underperforming assets via renovations, leasing, and operational efficiencies, balancing risk and return with medium-term horizons. Explore the differences in risk profiles, expected returns, and strategic approaches between these investment types to optimize your portfolio.

Source and External Links

What Makes Something an Opportunistic Investment - This article explains opportunistic investments by highlighting the strategy of buying assets at a low price and selling them at a higher intrinsic value, often through re-zoning or redevelopment.

Opportunistic Real Estate: A Guide to a Sophisticated Strategy - This guide outlines the complexities of opportunistic real estate investing, focusing on acquiring undervalued assets and enhancing their value through various strategies.

An Introduction to Opportunistic Real Estate - This article introduces the concept of opportunistic real estate investments, which involve acquiring distressed or underutilized properties to generate significant returns through renovations or new developments.

dowidth.com

dowidth.com