Opportunity Zones offer investors tax incentives to stimulate economic development in designated low-income communities, encouraging long-term capital investment. Federal Housing Administration (FHA) Loans provide government-backed mortgage options designed to help low-to-moderate income individuals and first-time homebuyers secure affordable financing with lower down payment requirements. Explore how these programs can maximize your real estate investment strategy and homeownership potential.

Why it is important

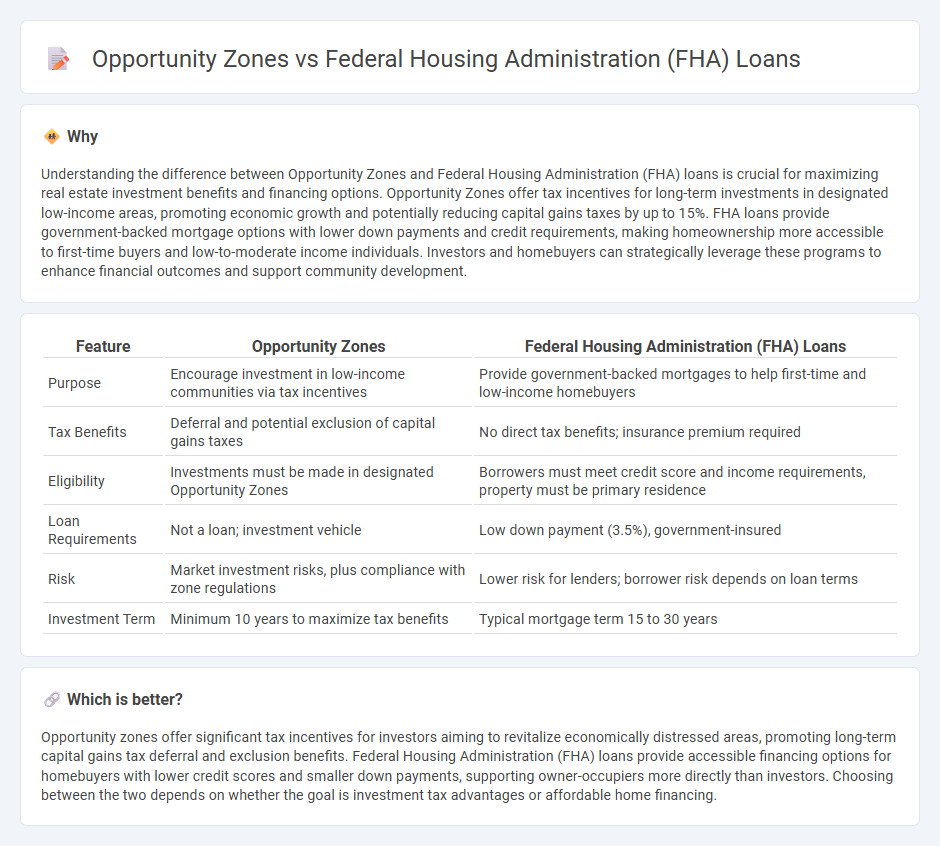

Understanding the difference between Opportunity Zones and Federal Housing Administration (FHA) loans is crucial for maximizing real estate investment benefits and financing options. Opportunity Zones offer tax incentives for long-term investments in designated low-income areas, promoting economic growth and potentially reducing capital gains taxes by up to 15%. FHA loans provide government-backed mortgage options with lower down payments and credit requirements, making homeownership more accessible to first-time buyers and low-to-moderate income individuals. Investors and homebuyers can strategically leverage these programs to enhance financial outcomes and support community development.

Comparison Table

| Feature | Opportunity Zones | Federal Housing Administration (FHA) Loans |

|---|---|---|

| Purpose | Encourage investment in low-income communities via tax incentives | Provide government-backed mortgages to help first-time and low-income homebuyers |

| Tax Benefits | Deferral and potential exclusion of capital gains taxes | No direct tax benefits; insurance premium required |

| Eligibility | Investments must be made in designated Opportunity Zones | Borrowers must meet credit score and income requirements, property must be primary residence |

| Loan Requirements | Not a loan; investment vehicle | Low down payment (3.5%), government-insured |

| Risk | Market investment risks, plus compliance with zone regulations | Lower risk for lenders; borrower risk depends on loan terms |

| Investment Term | Minimum 10 years to maximize tax benefits | Typical mortgage term 15 to 30 years |

Which is better?

Opportunity zones offer significant tax incentives for investors aiming to revitalize economically distressed areas, promoting long-term capital gains tax deferral and exclusion benefits. Federal Housing Administration (FHA) loans provide accessible financing options for homebuyers with lower credit scores and smaller down payments, supporting owner-occupiers more directly than investors. Choosing between the two depends on whether the goal is investment tax advantages or affordable home financing.

Connection

Opportunity Zones offer tax incentives for investments in economically distressed areas, encouraging real estate development and revitalization. Federal Housing Administration (FHA) Loans facilitate homeownership in these zones by providing low down payment options and flexible credit requirements. Together, they stimulate affordable housing growth and community investment in underserved neighborhoods.

Key Terms

Mortgage Insurance Premium (FHA Loans)

FHA loans require borrowers to pay Mortgage Insurance Premiums (MIP) both upfront and annually, which protects lenders from default risk and increases overall loan costs. Opportunity Zones offer tax incentives for investments in designated low-income areas but do not directly affect mortgage insurance premiums. Learn more about how FHA loan MIP impacts home financing costs compared to Opportunity Zone advantages.

Loan-to-Value Ratio (FHA Loans)

FHA loans typically have a maximum loan-to-value (LTV) ratio of 96.5%, allowing borrowers to finance up to 96.5% of the property's value with a low down payment. Opportunity zones do not directly impact loan-to-value ratios but provide tax incentives for investments in designated low-income areas, attracting capital for real estate projects. Explore how leveraging FHA loan LTV limits can optimize financing in opportunity zone developments to maximize investment potential.

Capital Gains Tax Deferral (Opportunity Zones)

Federal Housing Administration (FHA) loans provide low-down-payment options for homebuyers primarily focused on residential property financing, without direct benefits for capital gains tax deferral. Opportunity Zones offer significant tax incentives, including capital gains tax deferral and potential exclusion, when investors reinvest profits into designated economically-distressed areas. Explore detailed strategies to leverage Opportunity Zones for optimizing tax advantages beyond traditional FHA loan benefits.

Source and External Links

FHA Loans: Requirements, Limits, and Rates - Provides detailed information on FHA loan requirements, limits, and rates, along with the benefits and how they compare to conventional loans.

FHA Loan Refinance and Home Purchase Loans - Offers insights into the FHA loan program, including low down payments and flexible guidelines for home purchases and refinances.

FHA Loans - Consumer Financial Protection Bureau - Explains how FHA loans work, including their advantages such as low down payments and lenient credit score requirements.

dowidth.com

dowidth.com