Short term rental arbitrage leverages leasing properties to rent them out on platforms like Airbnb, generating steady income with lower upfront costs compared to fix and flip, which involves purchasing, renovating, and selling homes for profit. Investors prioritize cash flow and market demand in arbitrage, while fix and flip investors focus on renovation costs, property appreciation, and resale timing. Explore the advantages and risks of each strategy to determine the best fit for your real estate investment goals.

Why it is important

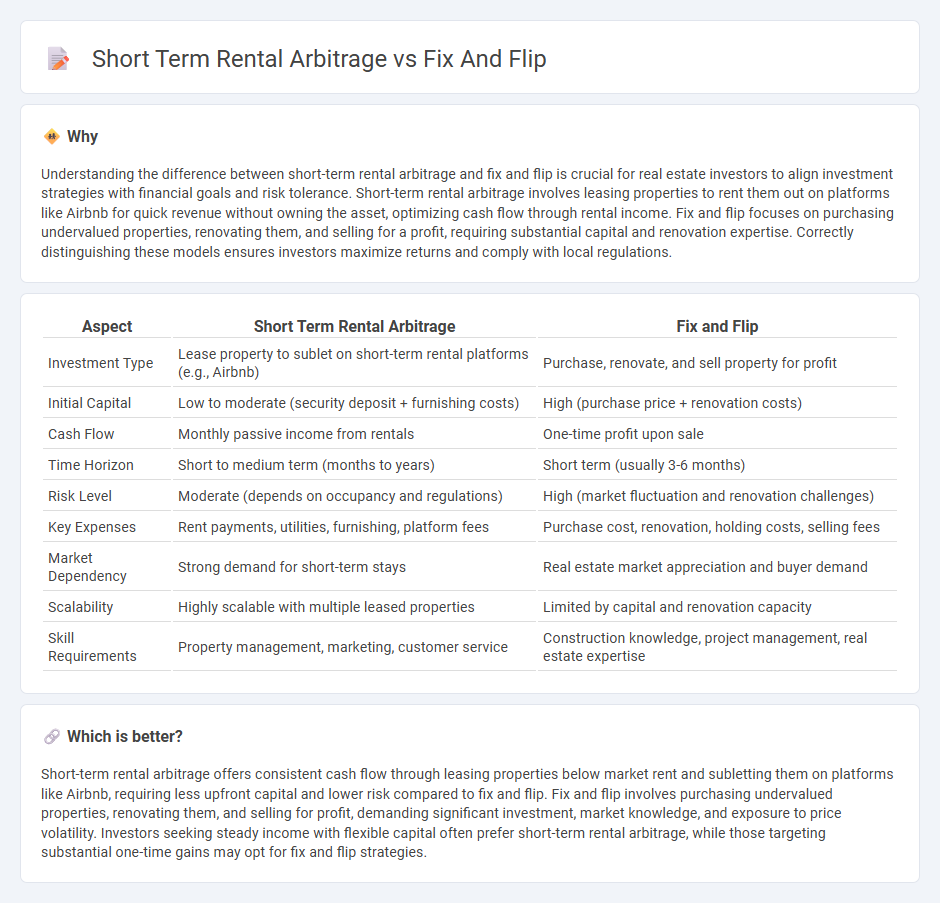

Understanding the difference between short-term rental arbitrage and fix and flip is crucial for real estate investors to align investment strategies with financial goals and risk tolerance. Short-term rental arbitrage involves leasing properties to rent them out on platforms like Airbnb for quick revenue without owning the asset, optimizing cash flow through rental income. Fix and flip focuses on purchasing undervalued properties, renovating them, and selling for a profit, requiring substantial capital and renovation expertise. Correctly distinguishing these models ensures investors maximize returns and comply with local regulations.

Comparison Table

| Aspect | Short Term Rental Arbitrage | Fix and Flip |

|---|---|---|

| Investment Type | Lease property to sublet on short-term rental platforms (e.g., Airbnb) | Purchase, renovate, and sell property for profit |

| Initial Capital | Low to moderate (security deposit + furnishing costs) | High (purchase price + renovation costs) |

| Cash Flow | Monthly passive income from rentals | One-time profit upon sale |

| Time Horizon | Short to medium term (months to years) | Short term (usually 3-6 months) |

| Risk Level | Moderate (depends on occupancy and regulations) | High (market fluctuation and renovation challenges) |

| Key Expenses | Rent payments, utilities, furnishing, platform fees | Purchase cost, renovation, holding costs, selling fees |

| Market Dependency | Strong demand for short-term stays | Real estate market appreciation and buyer demand |

| Scalability | Highly scalable with multiple leased properties | Limited by capital and renovation capacity |

| Skill Requirements | Property management, marketing, customer service | Construction knowledge, project management, real estate expertise |

Which is better?

Short-term rental arbitrage offers consistent cash flow through leasing properties below market rent and subletting them on platforms like Airbnb, requiring less upfront capital and lower risk compared to fix and flip. Fix and flip involves purchasing undervalued properties, renovating them, and selling for profit, demanding significant investment, market knowledge, and exposure to price volatility. Investors seeking steady income with flexible capital often prefer short-term rental arbitrage, while those targeting substantial one-time gains may opt for fix and flip strategies.

Connection

Short term rental arbitrage and Fix and Flip connect through real estate investment strategies targeting property value enhancement and income generation. Investors often renovate properties for Fix and Flip, then convert them into short term rentals to capitalize on higher rental income before eventual resale. This synergy maximizes profit potential by leveraging market demand for both temporary lodging and upgraded housing stock.

Key Terms

Purchase Price

Fix and flip properties typically require a lower initial purchase price to allow room for renovation costs and profit margin, whereas short-term rental arbitrage emphasizes location quality and rental demand over the purchase price since the property is leased, not owned. Fix and flip investors target undervalued or distressed properties to maximize resale gains, while arbitrage operators prioritize competitive rent rates relative to the expected short-term rental income. To learn more about the financial dynamics and investment potential of both strategies, explore our detailed comparison guide.

Renovation Costs

Fix and flip projects demand significant upfront renovation costs, often ranging from 10% to 20% of the property's purchase price, to ensure the home is market-ready and appraised at a higher value. In contrast, short-term rental arbitrage involves minimal renovation expenses since properties are leased and furnished without major structural changes, focusing instead on interior design and amenities upgrades. Dive deeper into the financial implications and strategic benefits of both approaches to optimize your real estate investment.

Cash Flow

Fix and flip real estate investments generate cash flow primarily through property appreciation and renovation profits, while short-term rental arbitrage relies on consistent rental income with minimal upfront capital. Fix and flip projects offer lump-sum returns after property sale, whereas rental arbitrage provides ongoing cash flow through nightly or weekly tenant payments. Explore which strategy aligns with your financial goals and risk tolerance to optimize cash flow management.

Source and External Links

Fix & Flip: The Complete Guide to Flipping Houses - Fix & Flip is a real estate investing strategy where an investor buys a property in need of repair, renovates it, and then resells it at a higher price for profit, focusing on improving the property efficiently to maximize returns.

Fix-and-flip - This strategy involves purchasing undervalued or distressed properties at discount prices, renovating them to increase their market value, and selling quickly for a profit that exceeds renovation costs.

How to Fix and Flip a Property in 8 Steps - The process of fix and flip includes buying discounted properties needing repairs, renovating them efficiently, and selling within a short timeframe (often under 12 months) to maximize profit and reduce holding costs.

dowidth.com

dowidth.com