Proptech revolutionizes real estate through digital platforms, smart home technology, and property management software, enhancing market efficiency and user experience. Fintech transforms real estate financing with innovative lending solutions, blockchain for transactions, and digital mortgages, streamlining capital access and investment processes. Explore in-depth how Proptech and Fintech together reshape the future of real estate.

Why it is important

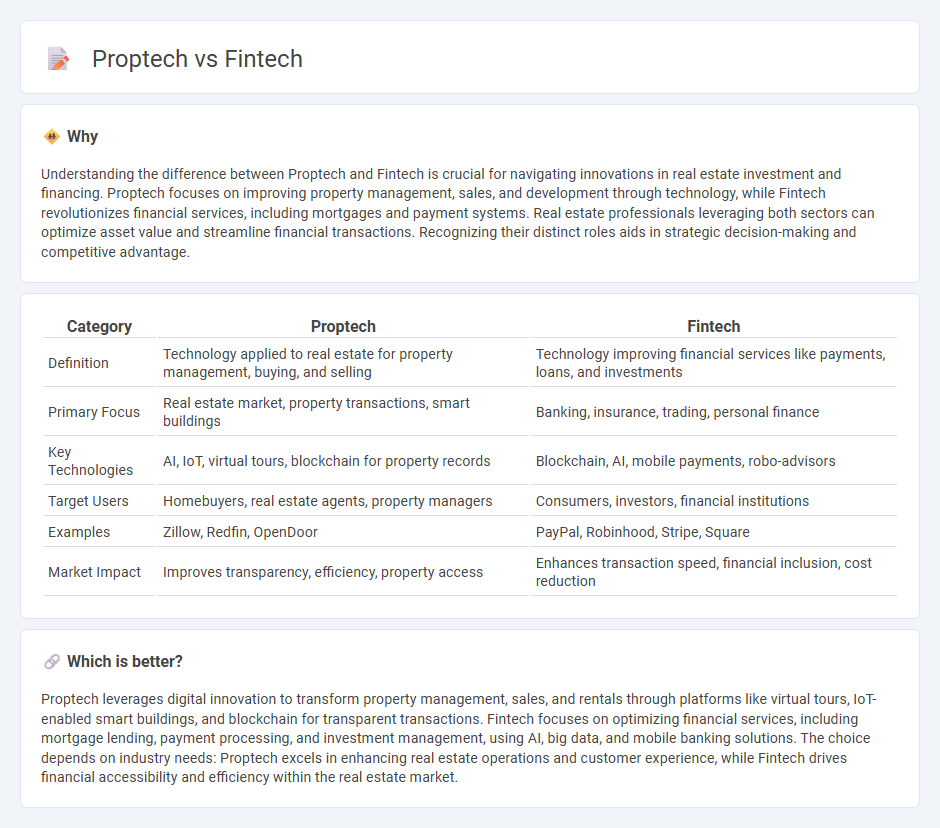

Understanding the difference between Proptech and Fintech is crucial for navigating innovations in real estate investment and financing. Proptech focuses on improving property management, sales, and development through technology, while Fintech revolutionizes financial services, including mortgages and payment systems. Real estate professionals leveraging both sectors can optimize asset value and streamline financial transactions. Recognizing their distinct roles aids in strategic decision-making and competitive advantage.

Comparison Table

| Category | Proptech | Fintech |

|---|---|---|

| Definition | Technology applied to real estate for property management, buying, and selling | Technology improving financial services like payments, loans, and investments |

| Primary Focus | Real estate market, property transactions, smart buildings | Banking, insurance, trading, personal finance |

| Key Technologies | AI, IoT, virtual tours, blockchain for property records | Blockchain, AI, mobile payments, robo-advisors |

| Target Users | Homebuyers, real estate agents, property managers | Consumers, investors, financial institutions |

| Examples | Zillow, Redfin, OpenDoor | PayPal, Robinhood, Stripe, Square |

| Market Impact | Improves transparency, efficiency, property access | Enhances transaction speed, financial inclusion, cost reduction |

Which is better?

Proptech leverages digital innovation to transform property management, sales, and rentals through platforms like virtual tours, IoT-enabled smart buildings, and blockchain for transparent transactions. Fintech focuses on optimizing financial services, including mortgage lending, payment processing, and investment management, using AI, big data, and mobile banking solutions. The choice depends on industry needs: Proptech excels in enhancing real estate operations and customer experience, while Fintech drives financial accessibility and efficiency within the real estate market.

Connection

Proptech and fintech intersect in real estate by combining digital technology with financial services to streamline property transactions, enhance investment analysis, and improve access to financing solutions. Technologies such as blockchain enable secure property records and automated smart contracts, while fintech innovations facilitate mortgage approvals, crowdfunding, and real-time payment processing. This integration accelerates market transparency, reduces transaction costs, and expands opportunities for buyers, sellers, and investors.

Key Terms

Digital Payments

Digital payments in fintech revolutionize financial transactions by enabling seamless, secure money transfers and mobile wallets, driving global adoption of cashless solutions. Proptech integrates digital payment systems within real estate, streamlining rent collection, property management fees, and transaction settlements. Explore how these industries transform payment experiences and fuel innovation in digital transaction ecosystems.

Blockchain

Fintech leverages blockchain technology to enhance financial services through secure, transparent transactions and decentralized finance solutions, while Proptech integrates blockchain for improved property management, smart contracts, and transparent real estate transactions. Blockchain's immutable ledger facilitates trust and efficiency across both sectors, enabling faster payments, tokenized assets, and reduced fraud risks. Discover how blockchain transforms Fintech and Proptech by exploring detailed innovations and industry impacts.

Smart Contracts

Smart contracts revolutionize both fintech and proptech by automating transactions with enhanced security and transparency on blockchain platforms. In fintech, smart contracts streamline payment processing, reduce fraud, and facilitate decentralized finance (DeFi) applications, while in proptech, they enable seamless property transactions, escrow management, and automated lease agreements. Explore how smart contracts are transforming these industries and driving innovation.

Source and External Links

What is Fintech? | IBM - Fintech refers to the use of technology to improve and automate financial services, including mobile apps and software for managing finances digitally.

What is fintech? 6 main types of fintech and how they work - Fintech is a term that combines "financial" and "technology," encompassing apps, software, and technologies that enable digital financial transactions and management.

Financial technology - Financial technology involves the application of innovative technologies to create new financial products and services across various sectors like banking, payments, and investment.

dowidth.com

dowidth.com