Blockchain technology enhances transparency and security in real estate transactions by providing immutable, timestamped records that reduce fraud and streamline property transfers. Traditional escrow services act as neutral third parties to hold funds and documents until contract conditions are met, ensuring financial safeguards during the sale process. Explore how combining blockchain with escrow services can revolutionize real estate deals for faster, safer transactions.

Why it is important

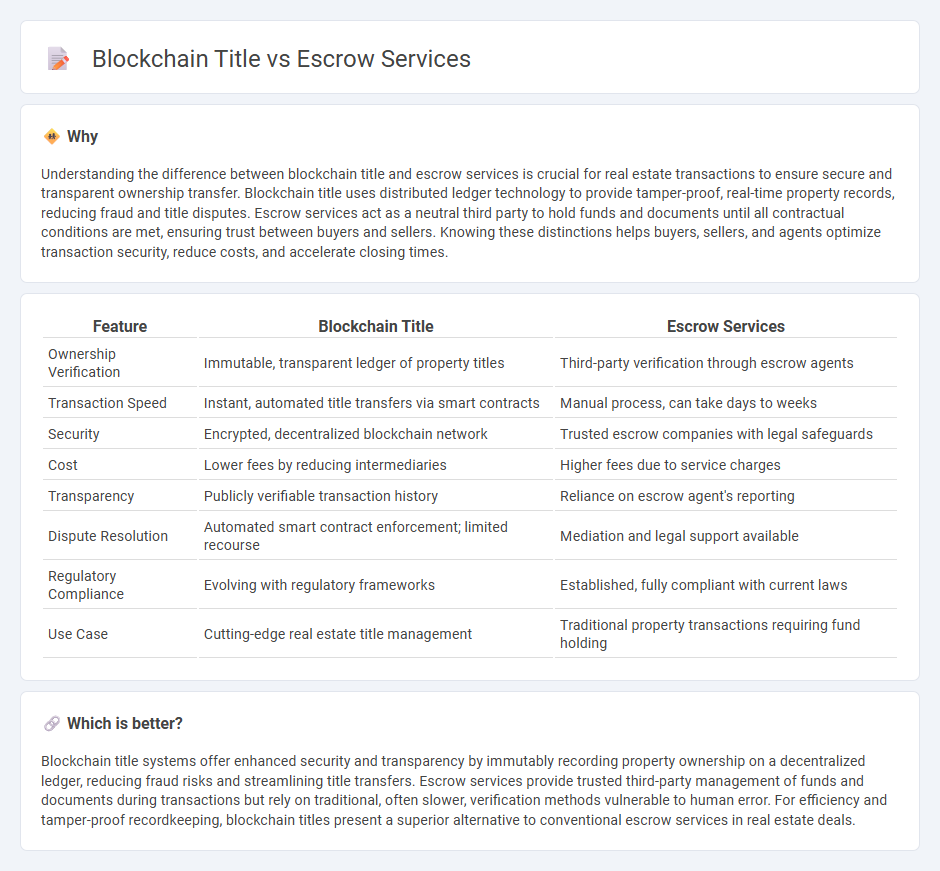

Understanding the difference between blockchain title and escrow services is crucial for real estate transactions to ensure secure and transparent ownership transfer. Blockchain title uses distributed ledger technology to provide tamper-proof, real-time property records, reducing fraud and title disputes. Escrow services act as a neutral third party to hold funds and documents until all contractual conditions are met, ensuring trust between buyers and sellers. Knowing these distinctions helps buyers, sellers, and agents optimize transaction security, reduce costs, and accelerate closing times.

Comparison Table

| Feature | Blockchain Title | Escrow Services |

|---|---|---|

| Ownership Verification | Immutable, transparent ledger of property titles | Third-party verification through escrow agents |

| Transaction Speed | Instant, automated title transfers via smart contracts | Manual process, can take days to weeks |

| Security | Encrypted, decentralized blockchain network | Trusted escrow companies with legal safeguards |

| Cost | Lower fees by reducing intermediaries | Higher fees due to service charges |

| Transparency | Publicly verifiable transaction history | Reliance on escrow agent's reporting |

| Dispute Resolution | Automated smart contract enforcement; limited recourse | Mediation and legal support available |

| Regulatory Compliance | Evolving with regulatory frameworks | Established, fully compliant with current laws |

| Use Case | Cutting-edge real estate title management | Traditional property transactions requiring fund holding |

Which is better?

Blockchain title systems offer enhanced security and transparency by immutably recording property ownership on a decentralized ledger, reducing fraud risks and streamlining title transfers. Escrow services provide trusted third-party management of funds and documents during transactions but rely on traditional, often slower, verification methods vulnerable to human error. For efficiency and tamper-proof recordkeeping, blockchain titles present a superior alternative to conventional escrow services in real estate deals.

Connection

Blockchain technology enhances real estate title and escrow services by providing a secure, transparent ledger for recording property ownership and transaction histories. This digital ledger minimizes fraud risks and expedites the verification process by allowing instant access to verified title records. Escrow services benefit from blockchain's automated smart contracts, ensuring funds are securely held and released only when contract conditions are met, streamlining the transaction process.

Key Terms

Third-party Custodian

Third-party custodians in escrow services provide secure asset holding and transaction mediation, ensuring trust and dispute resolution through regulated intermediaries. Blockchain eliminates the need for these custodians by leveraging decentralized, transparent smart contracts that automatically enforce terms without human intervention. Explore the differences in security, cost, and efficiency between third-party escrow custodians and blockchain-based title solutions.

Smart Contracts

Smart contracts automate escrow services by securely executing terms without intermediaries, enhancing transparency and reducing fraud risks. Traditional escrow depends on trusted third parties to hold funds, while blockchain's decentralized ledger ensures immutable transaction records. Explore how smart contracts revolutionize escrow processes and improve trust in digital transactions.

Decentralized Ledger

Decentralized ledger technology offers a transparent, tamper-resistant alternative to traditional escrow services by securely recording transactions without intermediaries. Blockchain enhances trust and reduces settlement times through cryptographic validation and distributed consensus mechanisms. Explore how decentralized ledger innovations are revolutionizing secure asset management beyond conventional escrow solutions.

Source and External Links

Escrow.com | Never buy or sell online without using Escrow.com. - Escrow.com provides secure online escrow services where a neutral third party holds funds while goods or services are delivered, releasing payment only upon buyer approval to ensure safe transactions.

How does online escrow work? - Online escrow involves a five-step process where funds are held in trust until the buyer receives and accepts goods or services, protecting both buyer and seller in the transaction.

Escrow: What is it and how does it work? - Rocket Mortgage - Escrow is a financial arrangement where a neutral third party holds funds or assets on behalf of two parties until certain conditions are met, commonly used in real estate transactions managed by escrow companies or mortgage servicers.

dowidth.com

dowidth.com