Sale leaseback allows property owners to sell real estate while immediately leasing it back, maintaining operational control and generating capital without relocation. Sale with seller financing offers buyers flexible payment terms directly from the seller, bypassing traditional lenders and potentially expediting the transaction process. Explore the key differences and benefits of these real estate strategies to determine the best fit for your financial goals.

Why it is important

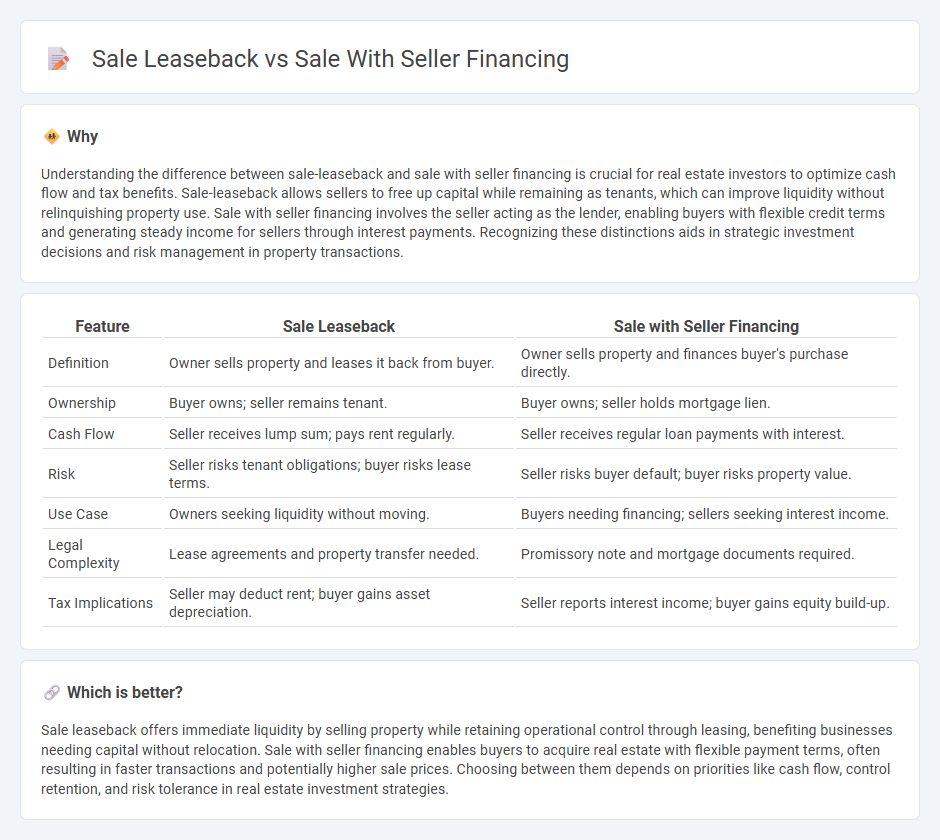

Understanding the difference between sale-leaseback and sale with seller financing is crucial for real estate investors to optimize cash flow and tax benefits. Sale-leaseback allows sellers to free up capital while remaining as tenants, which can improve liquidity without relinquishing property use. Sale with seller financing involves the seller acting as the lender, enabling buyers with flexible credit terms and generating steady income for sellers through interest payments. Recognizing these distinctions aids in strategic investment decisions and risk management in property transactions.

Comparison Table

| Feature | Sale Leaseback | Sale with Seller Financing |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer. | Owner sells property and finances buyer's purchase directly. |

| Ownership | Buyer owns; seller remains tenant. | Buyer owns; seller holds mortgage lien. |

| Cash Flow | Seller receives lump sum; pays rent regularly. | Seller receives regular loan payments with interest. |

| Risk | Seller risks tenant obligations; buyer risks lease terms. | Seller risks buyer default; buyer risks property value. |

| Use Case | Owners seeking liquidity without moving. | Buyers needing financing; sellers seeking interest income. |

| Legal Complexity | Lease agreements and property transfer needed. | Promissory note and mortgage documents required. |

| Tax Implications | Seller may deduct rent; buyer gains asset depreciation. | Seller reports interest income; buyer gains equity build-up. |

Which is better?

Sale leaseback offers immediate liquidity by selling property while retaining operational control through leasing, benefiting businesses needing capital without relocation. Sale with seller financing enables buyers to acquire real estate with flexible payment terms, often resulting in faster transactions and potentially higher sale prices. Choosing between them depends on priorities like cash flow, control retention, and risk tolerance in real estate investment strategies.

Connection

Sale leaseback and sale with seller financing are connected through their shared goal of providing flexible financing solutions in real estate transactions. In a sale leaseback, the seller sells the property and immediately leases it back, maintaining operational control while freeing up capital. Seller financing allows the buyer to purchase the property through direct payments to the seller, often facilitating deals where traditional financing is unavailable, and it can be combined with sale leaseback to optimize cash flow and investment returns.

Key Terms

**Sale with Seller Financing:**

Sale with seller financing enables buyers to purchase property directly from the seller while making payments over time, often with lower interest rates than traditional loans. This method provides sellers with steady income streams and potential tax benefits by spreading capital gains over several years. Explore how sale with seller financing can offer flexible terms and financial advantages tailored to your investment goals.

Promissory Note

Seller financing in a sale involves a Promissory Note that outlines the buyer's promise to repay the loan directly to the seller under agreed terms, often including interest rates and payment schedules. In a sale-leaseback, the Promissory Note is less central; the transaction instead focuses on the lease agreement where the seller becomes the tenant, paying rent to the purchaser who now owns the property. Explore more to understand how Promissory Notes shape these financial arrangements and affect risk allocation.

Down Payment

Seller financing often requires a lower down payment as the buyer borrows directly from the seller, making the transaction more flexible compared to traditional loans. In a sale-leaseback, the initial payment typically involves the full sale price upfront, with the seller turning into a tenant, freeing up capital but requiring substantial initial equity. Discover the nuances of down payment strategies in each option to optimize your real estate investment.

Source and External Links

M&A Seller Financing: A Complete Guide - This guide provides an overview of seller financing in business acquisitions, including structured payments and risks involved.

What Is Seller Financing? - Seller financing in real estate allows the seller to act as a lender, providing buyers with alternative financing options.

What to consider if you're financing the sale of your business - This article discusses the strategic benefits and complexities of using seller financing in business sales, including tax implications.

dowidth.com

dowidth.com