Opportunity Zones offer tax incentives for long-term investments in designated low-income communities, targeting capital gains tax deferral and potential exclusion. Enterprise Zones provide state-level benefits such as tax credits, reduced regulations, and workforce development support aimed at stimulating economic growth in distressed areas. Explore how these zone programs can maximize real estate investment returns and community impact.

Why it is important

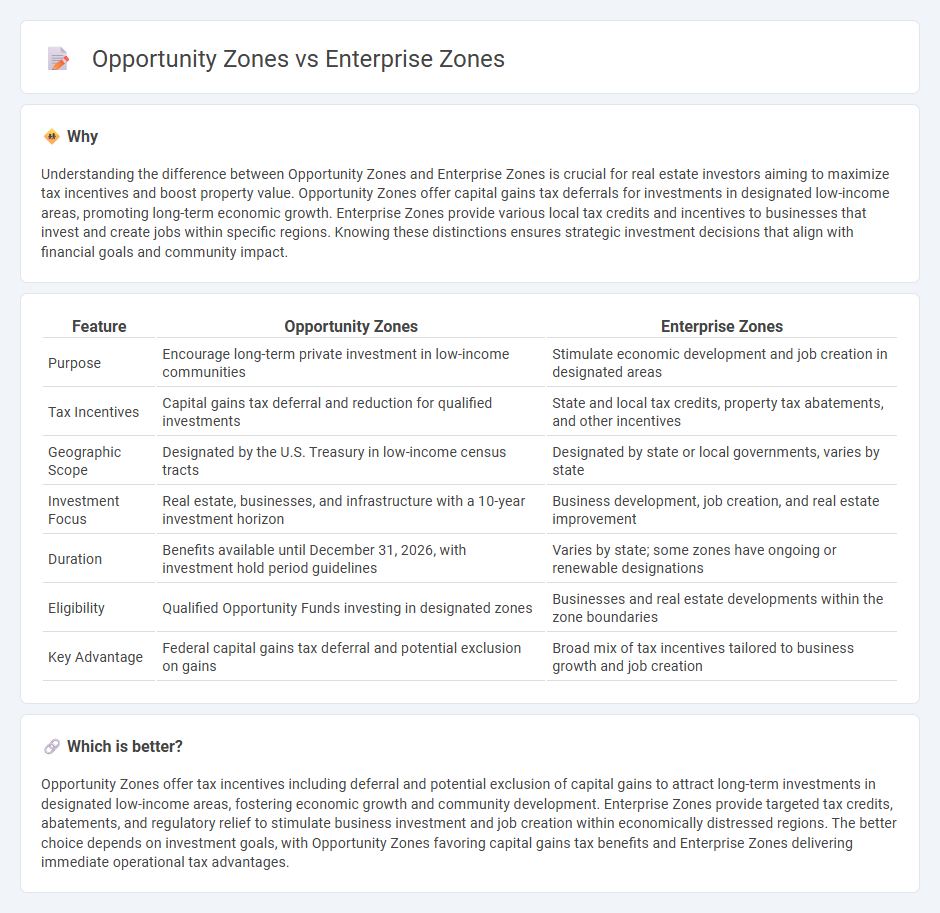

Understanding the difference between Opportunity Zones and Enterprise Zones is crucial for real estate investors aiming to maximize tax incentives and boost property value. Opportunity Zones offer capital gains tax deferrals for investments in designated low-income areas, promoting long-term economic growth. Enterprise Zones provide various local tax credits and incentives to businesses that invest and create jobs within specific regions. Knowing these distinctions ensures strategic investment decisions that align with financial goals and community impact.

Comparison Table

| Feature | Opportunity Zones | Enterprise Zones |

|---|---|---|

| Purpose | Encourage long-term private investment in low-income communities | Stimulate economic development and job creation in designated areas |

| Tax Incentives | Capital gains tax deferral and reduction for qualified investments | State and local tax credits, property tax abatements, and other incentives |

| Geographic Scope | Designated by the U.S. Treasury in low-income census tracts | Designated by state or local governments, varies by state |

| Investment Focus | Real estate, businesses, and infrastructure with a 10-year investment horizon | Business development, job creation, and real estate improvement |

| Duration | Benefits available until December 31, 2026, with investment hold period guidelines | Varies by state; some zones have ongoing or renewable designations |

| Eligibility | Qualified Opportunity Funds investing in designated zones | Businesses and real estate developments within the zone boundaries |

| Key Advantage | Federal capital gains tax deferral and potential exclusion on gains | Broad mix of tax incentives tailored to business growth and job creation |

Which is better?

Opportunity Zones offer tax incentives including deferral and potential exclusion of capital gains to attract long-term investments in designated low-income areas, fostering economic growth and community development. Enterprise Zones provide targeted tax credits, abatements, and regulatory relief to stimulate business investment and job creation within economically distressed regions. The better choice depends on investment goals, with Opportunity Zones favoring capital gains tax benefits and Enterprise Zones delivering immediate operational tax advantages.

Connection

Opportunity Zones and Enterprise Zones both stimulate economic development by offering tax incentives to encourage investment in designated distressed areas. Opportunity Zones provide capital gains tax deferrals for investments held in qualified funds, while Enterprise Zones offer credits and exemptions related to property taxes, employment, and business expenses. These zones collectively promote revitalization, job creation, and long-term community growth within targeted real estate markets.

Key Terms

Tax Incentives

Enterprise Zones offer targeted tax incentives such as property tax abatements, sales tax exemptions, and income tax credits to stimulate economic growth in designated distressed areas. Opportunity Zones provide tax deferral and potential exclusion on capital gains for investors who reinvest in low-income communities through Qualified Opportunity Funds. Explore detailed comparisons of tax savings and eligibility criteria to maximize investment benefits.

Economic Development

Enterprise Zones offer targeted tax incentives and regulatory relief to stimulate business growth and job creation in economically distressed areas, fostering urban revitalization and industrial expansion. Opportunity Zones provide tax advantages on capital gains investments aimed at long-term economic development in underserved communities, encouraging private investment and infrastructure improvement. Explore the distinct benefits and impacts of these zones to understand their roles in driving economic growth.

Geographic Designation

Enterprise Zones are specifically designated areas where governments offer tax incentives and regulatory relief to stimulate economic development, often targeting distressed urban or rural communities. Opportunity Zones, created under the Tax Cuts and Jobs Act of 2017, focus on encouraging long-term investments in economically disadvantaged census tracts through capital gains tax deferrals and exclusions. Explore the distinct geographic criteria and benefits of each zone to understand how they drive regional economic growth.

Source and External Links

Enterprise Zone Program | Colorado Office of Economic Development - The Colorado Enterprise Zone Program aims to promote economic development in distressed areas by offering businesses state income tax credits and sales tax exemptions, with zones renewed every 10 years and enhanced tax credits available in rural zones.

State Enterprise Zones - Good Jobs First - Enterprise zones are designated geographic areas where companies qualify for subsidies such as tax credits and abatements, established to encourage business investment and job growth in economically depressed regions.

Enterprise Zone Program - City of Chicago - Chicago's Enterprise Zone Program, started in 1982, provides tax incentives and regulatory relief aimed at stimulating growth and revitalization in economically distressed parts of the city covering about 30% of the area.

dowidth.com

dowidth.com