Tokenized real estate offers fractional ownership through blockchain technology, enabling direct investment in specific properties with increased liquidity and transparency. Real estate mutual funds pool investor capital to invest in diversified property portfolios managed by professionals, providing accessibility and risk mitigation. Explore the detailed comparisons between tokenized real estate and mutual funds to enhance your investment strategy.

Why it is important

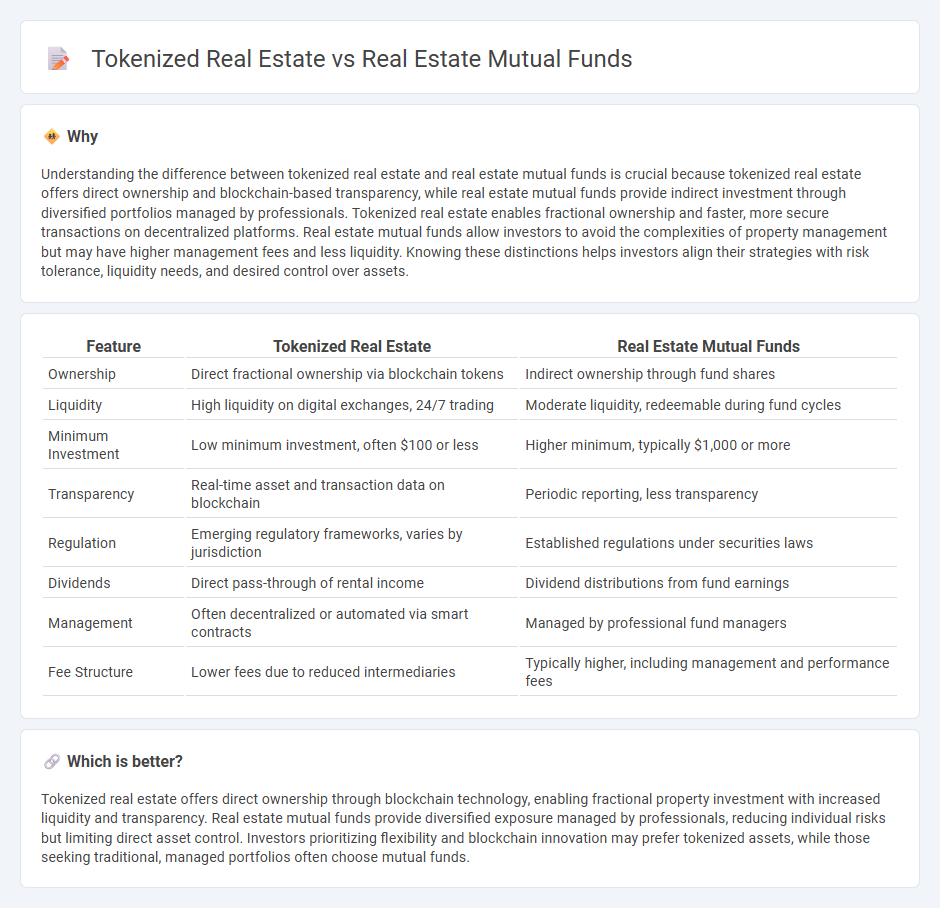

Understanding the difference between tokenized real estate and real estate mutual funds is crucial because tokenized real estate offers direct ownership and blockchain-based transparency, while real estate mutual funds provide indirect investment through diversified portfolios managed by professionals. Tokenized real estate enables fractional ownership and faster, more secure transactions on decentralized platforms. Real estate mutual funds allow investors to avoid the complexities of property management but may have higher management fees and less liquidity. Knowing these distinctions helps investors align their strategies with risk tolerance, liquidity needs, and desired control over assets.

Comparison Table

| Feature | Tokenized Real Estate | Real Estate Mutual Funds |

|---|---|---|

| Ownership | Direct fractional ownership via blockchain tokens | Indirect ownership through fund shares |

| Liquidity | High liquidity on digital exchanges, 24/7 trading | Moderate liquidity, redeemable during fund cycles |

| Minimum Investment | Low minimum investment, often $100 or less | Higher minimum, typically $1,000 or more |

| Transparency | Real-time asset and transaction data on blockchain | Periodic reporting, less transparency |

| Regulation | Emerging regulatory frameworks, varies by jurisdiction | Established regulations under securities laws |

| Dividends | Direct pass-through of rental income | Dividend distributions from fund earnings |

| Management | Often decentralized or automated via smart contracts | Managed by professional fund managers |

| Fee Structure | Lower fees due to reduced intermediaries | Typically higher, including management and performance fees |

Which is better?

Tokenized real estate offers direct ownership through blockchain technology, enabling fractional property investment with increased liquidity and transparency. Real estate mutual funds provide diversified exposure managed by professionals, reducing individual risks but limiting direct asset control. Investors prioritizing flexibility and blockchain innovation may prefer tokenized assets, while those seeking traditional, managed portfolios often choose mutual funds.

Connection

Tokenized real estate allows fractional ownership of properties through blockchain technology, enabling investors to buy and sell digital shares easily. Real estate mutual funds pool investor capital to diversify holdings across multiple properties, similar to how tokenized assets represent partial stakes in various real estate projects. Both investment models enhance liquidity and accessibility in the real estate market by offering scalable, divisible ownership options to a broader range of investors.

Key Terms

Liquidity

Real estate mutual funds offer moderate liquidity, allowing investors to buy or sell shares during trading hours but often with settlement delays. Tokenized real estate leverages blockchain technology, enabling near-instant trading and 24/7 market access, significantly enhancing liquidity for investors. Explore the advantages of tokenized real estate to understand how it transforms asset liquidity.

Fractional Ownership

Real estate mutual funds provide fractional ownership by pooling investors' capital into diversified property portfolios managed by professionals, offering liquidity and reduced risk. Tokenized real estate uses blockchain technology to represent property shares as digital tokens, enabling faster transactions, lower entry barriers, and increased transparency through smart contracts. Explore the benefits and innovations of fractional ownership by tokenizing real estate assets for modern investment opportunities.

Regulatory Framework

Real estate mutual funds operate under established securities regulations with strict compliance to national financial authorities, ensuring investor protection and transparency. Tokenized real estate leverages blockchain technology, presenting novel regulatory challenges due to its decentralized nature and varying global legal interpretations. Explore how regulatory frameworks are evolving to address the unique risks and opportunities in tokenized real estate investments.

Source and External Links

Understanding REITs and Mutual Funds - Multifamily Loans - Real estate mutual funds invest in diversified shares of REITs and real estate companies, offering potential capital appreciation with professional management but generally carry higher fees and less liquidity compared to REITs, which must distribute most income as dividends.

List of REITs & Real Estate Funds - Mutual funds and ETFs are common ways for investors to access the real estate sector, providing exposure to income-producing real estate through companies that own or finance properties nationwide with benefits including steady dividends and portfolio diversification.

PGIM US Real Estate Fund - This fund specifically targets domestic real estate securities aiming to deliver both capital appreciation and income, highlighting the type of specialized mutual funds available within the real estate asset class.

dowidth.com

dowidth.com