Escrow crowdfunding allows investors to pool funds securely under a neutral third-party account, reducing individual risk while gaining access to diverse real estate projects. Direct property investment involves purchasing and managing properties independently, offering greater control and the potential for higher returns but requiring more capital and hands-on involvement. Discover detailed comparisons and insights to choose the best real estate investment strategy for your goals.

Why it is important

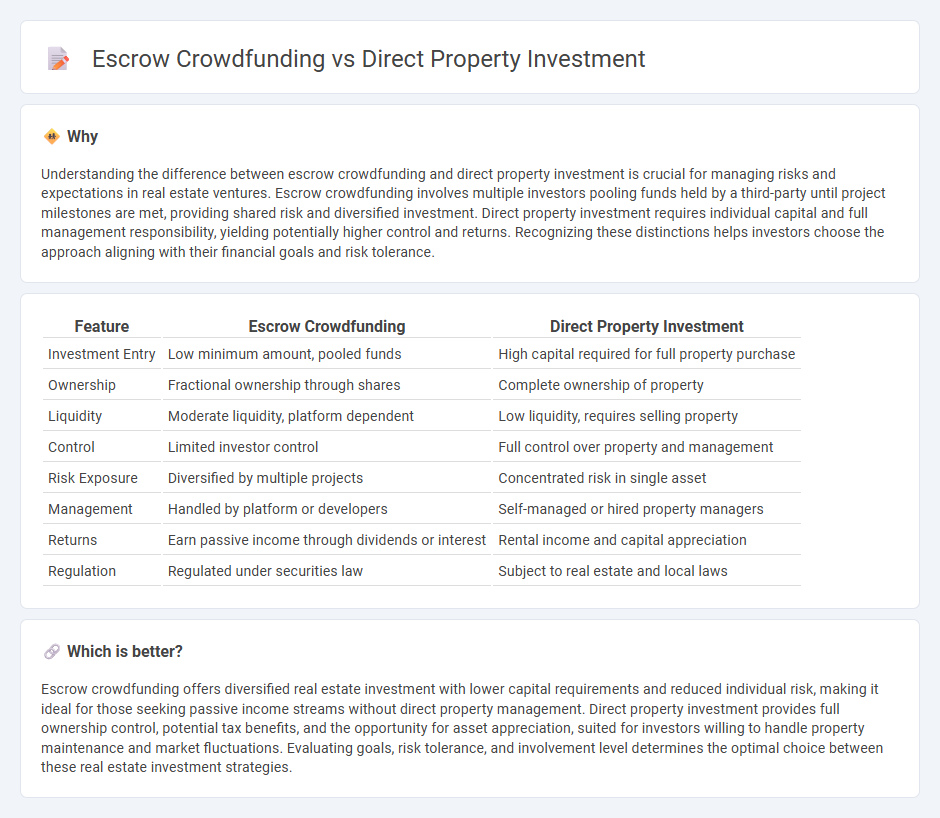

Understanding the difference between escrow crowdfunding and direct property investment is crucial for managing risks and expectations in real estate ventures. Escrow crowdfunding involves multiple investors pooling funds held by a third-party until project milestones are met, providing shared risk and diversified investment. Direct property investment requires individual capital and full management responsibility, yielding potentially higher control and returns. Recognizing these distinctions helps investors choose the approach aligning with their financial goals and risk tolerance.

Comparison Table

| Feature | Escrow Crowdfunding | Direct Property Investment |

|---|---|---|

| Investment Entry | Low minimum amount, pooled funds | High capital required for full property purchase |

| Ownership | Fractional ownership through shares | Complete ownership of property |

| Liquidity | Moderate liquidity, platform dependent | Low liquidity, requires selling property |

| Control | Limited investor control | Full control over property and management |

| Risk Exposure | Diversified by multiple projects | Concentrated risk in single asset |

| Management | Handled by platform or developers | Self-managed or hired property managers |

| Returns | Earn passive income through dividends or interest | Rental income and capital appreciation |

| Regulation | Regulated under securities law | Subject to real estate and local laws |

Which is better?

Escrow crowdfunding offers diversified real estate investment with lower capital requirements and reduced individual risk, making it ideal for those seeking passive income streams without direct property management. Direct property investment provides full ownership control, potential tax benefits, and the opportunity for asset appreciation, suited for investors willing to handle property maintenance and market fluctuations. Evaluating goals, risk tolerance, and involvement level determines the optimal choice between these real estate investment strategies.

Connection

Escrow crowdfunding facilitates direct property investment by securely holding investors' funds until predetermined conditions for property acquisition are met, ensuring transparency and trust in the transaction process. This mechanism protects both investors and sellers, enabling multiple stakeholders to pool capital efficiently for real estate ventures. By combining escrow services with crowdfunding, investors gain access to direct property ownership opportunities with reduced financial risk.

Key Terms

**Direct Property Investment:**

Direct Property Investment offers full ownership and control over physical real estate assets, allowing investors to benefit from rental income and property appreciation without intermediaries. This approach demands substantial capital, active management, and carries risks such as market fluctuations and maintenance costs. Explore the detailed advantages and challenges of direct property investment to determine if it fits your financial goals.

Title Deed

Direct property investment grants investors full ownership reflected on the title deed, providing clear legal rights and control over the asset. Escrow crowdfunding pools multiple investors' funds through a third party, often delaying individual title deed registration until project completion or sale. Explore detailed differences to determine which investment method aligns with your property ownership goals.

Equity Ownership

Direct property investment offers investors full equity ownership, allowing complete control over the asset, decision-making, and potential profit margins. Escrow crowdfunding provides fractional equity ownership through pooled funds, enabling access to real estate opportunities with lower capital requirements but limited control. Explore the key differences in equity ownership to determine which investment method aligns best with your financial goals.

Source and External Links

Understanding Direct vs. Indirect Real Estate Investments - Direct property investment involves acquiring physical property, providing control over management decisions, increased potential returns, and tax benefits.

Direct vs Indirect Real Estate Investing - Direct property investment allows investors to buy, control, and manage real estate, offering high dividends and passive income through renting or flipping properties.

Property Investment Options: REIT vs Direct Property - Direct property investment, such as syndication, offers high cash flow potential, tax benefits, and decision-making power, though it requires significant capital and risk tolerance.

dowidth.com

dowidth.com