Opportunity Zones offer significant tax incentives by allowing investors to defer and potentially reduce capital gains taxes when investing in designated low-income areas. In contrast, a 1031 Exchange enables real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of one property into another like-kind property, without geographic restrictions. Explore the differences and benefits of Opportunity Zones and 1031 Exchanges to optimize your real estate investment strategy.

Why it is important

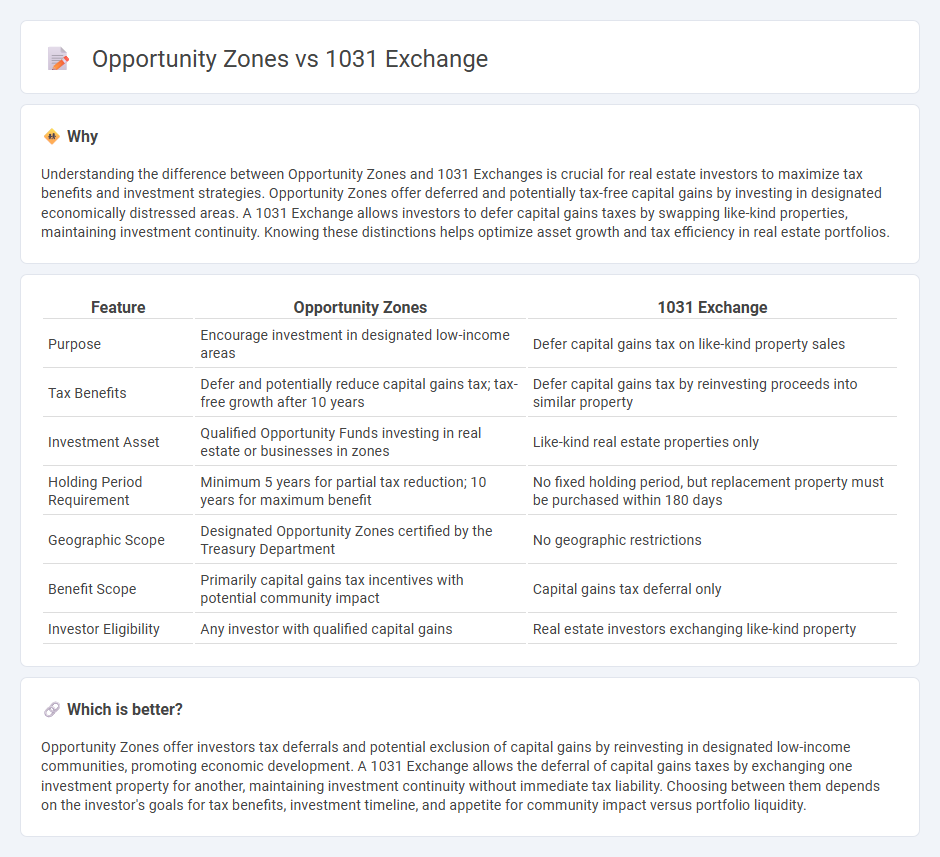

Understanding the difference between Opportunity Zones and 1031 Exchanges is crucial for real estate investors to maximize tax benefits and investment strategies. Opportunity Zones offer deferred and potentially tax-free capital gains by investing in designated economically distressed areas. A 1031 Exchange allows investors to defer capital gains taxes by swapping like-kind properties, maintaining investment continuity. Knowing these distinctions helps optimize asset growth and tax efficiency in real estate portfolios.

Comparison Table

| Feature | Opportunity Zones | 1031 Exchange |

|---|---|---|

| Purpose | Encourage investment in designated low-income areas | Defer capital gains tax on like-kind property sales |

| Tax Benefits | Defer and potentially reduce capital gains tax; tax-free growth after 10 years | Defer capital gains tax by reinvesting proceeds into similar property |

| Investment Asset | Qualified Opportunity Funds investing in real estate or businesses in zones | Like-kind real estate properties only |

| Holding Period Requirement | Minimum 5 years for partial tax reduction; 10 years for maximum benefit | No fixed holding period, but replacement property must be purchased within 180 days |

| Geographic Scope | Designated Opportunity Zones certified by the Treasury Department | No geographic restrictions |

| Benefit Scope | Primarily capital gains tax incentives with potential community impact | Capital gains tax deferral only |

| Investor Eligibility | Any investor with qualified capital gains | Real estate investors exchanging like-kind property |

Which is better?

Opportunity Zones offer investors tax deferrals and potential exclusion of capital gains by reinvesting in designated low-income communities, promoting economic development. A 1031 Exchange allows the deferral of capital gains taxes by exchanging one investment property for another, maintaining investment continuity without immediate tax liability. Choosing between them depends on the investor's goals for tax benefits, investment timeline, and appetite for community impact versus portfolio liquidity.

Connection

Opportunity Zones and 1031 Exchanges are interconnected tools in real estate investment strategies that offer significant tax advantages. Investors use 1031 Exchanges to defer capital gains taxes by reinvesting proceeds into like-kind properties, while Opportunity Zones provide a mechanism to defer and potentially reduce taxes by investing in designated low-income areas. Utilizing both strategies allows investors to maximize tax deferral and promote economic development in underserved communities.

Key Terms

Like-Kind Property

A 1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds from the sale of like-kind properties into similar real estate, strictly focusing on the exchange of tangible real estate assets. Opportunity Zones offer tax incentives for investments in designated economically-distressed areas, providing benefits like deferred and potentially reduced capital gains, but do not require like-kind property exchanges. Explore detailed strategies to maximize tax advantages in real estate through 1031 Exchanges and Opportunity Zones.

Capital Gains Deferral

1031 Exchange allows deferral of capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property within a specified timeframe. Opportunity Zones offer deferral and potential reduction of capital gains taxes when investments are made in designated economically distressed areas, with additional benefits for long-term holdings. Explore detailed comparisons to determine which strategy best aligns with your capital gains deferral goals.

Qualified Opportunity Fund (QOF)

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds into like-kind properties, while Opportunity Zones incentivize investment in underdeveloped areas through Qualified Opportunity Funds (QOFs), which offer tax deferral and potential exclusion of gains on appreciation. QOFs must invest at least 90% of their assets in designated Opportunity Zones, enabling investors to defer initial gains and reduce tax liability if held for certain periods. Explore how leveraging QOFs in Opportunity Zones can complement 1031 Exchanges to optimize tax strategies and boost community development.

Source and External Links

1031 Exchange: How it Works - TurboTax Tax Tips & Videos - Intuit - A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of one investment property into a similar "like-kind" property within set timeframes, typically 45 days to identify and 180 days to complete the exchange.

What is a 1031 exchange and how does it work? - Fidelity Investments - The 1031 exchange involves selling a property, identifying replacement properties within 45 days, and closing on one within 180 days, enabling deferral of capital gains taxes by ensuring the reinvestment of proceeds does not pass through the seller's hands.

1031 exchange | Wex | US Law | LII / Legal Information Institute - Under Section 1031, no gain or loss is recognized if investment property is exchanged solely for like-kind property with requirements including selection of replacement property within 45 days and completing the exchange within 135 days after identification, typically managed by a qualified intermediary.

dowidth.com

dowidth.com