Opportunity zone investing leverages tax incentives by focusing on properties in designated economically distressed areas, allowing investors to defer or reduce capital gains taxes. Fix-and-flip strategies emphasize purchasing undervalued homes, renovating them quickly, and selling at a profit, typically yielding faster returns but with higher active management. Explore the advantages and challenges of each approach to determine the ideal investment fit for your real estate goals.

Why it is important

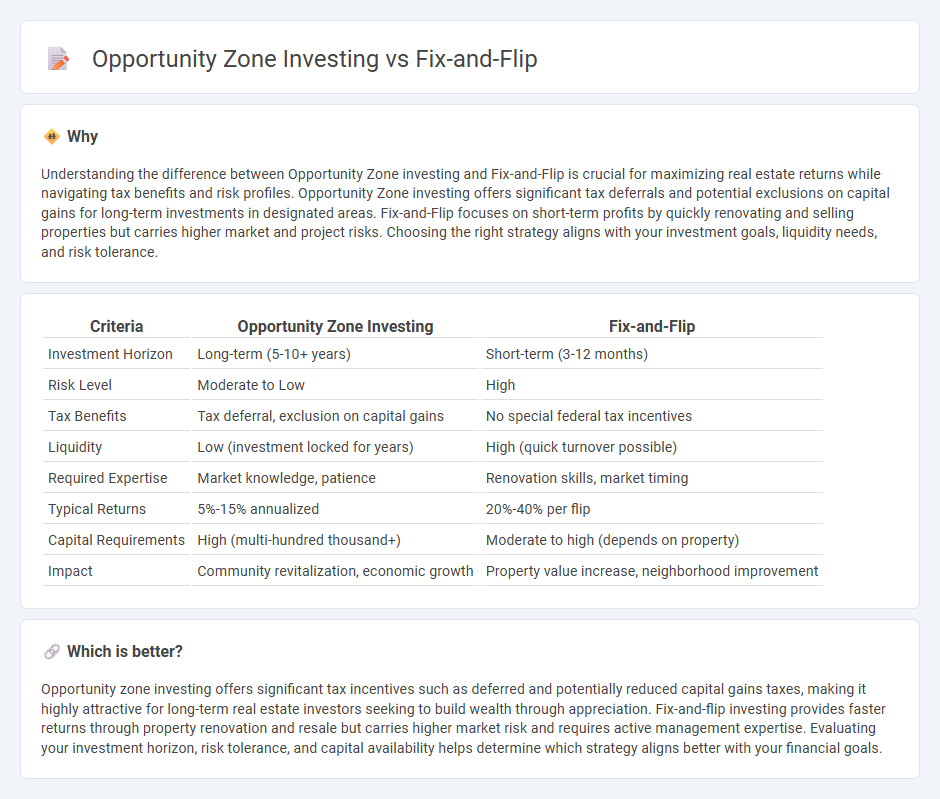

Understanding the difference between Opportunity Zone investing and Fix-and-Flip is crucial for maximizing real estate returns while navigating tax benefits and risk profiles. Opportunity Zone investing offers significant tax deferrals and potential exclusions on capital gains for long-term investments in designated areas. Fix-and-Flip focuses on short-term profits by quickly renovating and selling properties but carries higher market and project risks. Choosing the right strategy aligns with your investment goals, liquidity needs, and risk tolerance.

Comparison Table

| Criteria | Opportunity Zone Investing | Fix-and-Flip |

|---|---|---|

| Investment Horizon | Long-term (5-10+ years) | Short-term (3-12 months) |

| Risk Level | Moderate to Low | High |

| Tax Benefits | Tax deferral, exclusion on capital gains | No special federal tax incentives |

| Liquidity | Low (investment locked for years) | High (quick turnover possible) |

| Required Expertise | Market knowledge, patience | Renovation skills, market timing |

| Typical Returns | 5%-15% annualized | 20%-40% per flip |

| Capital Requirements | High (multi-hundred thousand+) | Moderate to high (depends on property) |

| Impact | Community revitalization, economic growth | Property value increase, neighborhood improvement |

Which is better?

Opportunity zone investing offers significant tax incentives such as deferred and potentially reduced capital gains taxes, making it highly attractive for long-term real estate investors seeking to build wealth through appreciation. Fix-and-flip investing provides faster returns through property renovation and resale but carries higher market risk and requires active management expertise. Evaluating your investment horizon, risk tolerance, and capital availability helps determine which strategy aligns better with your financial goals.

Connection

Opportunity zone investing and fix-and-flip strategies intersect by leveraging tax incentives to enhance returns on property renovations. Investors purchase undervalued properties in designated opportunity zones, execute value-adding repairs or improvements, and benefit from deferred or reduced capital gains taxes. This synergy accelerates profit potential while promoting economic revitalization in targeted communities.

Key Terms

Capital Gains

Fix-and-flip projects typically generate short-term capital gains taxed at higher ordinary income rates due to the quick turnaround of property sales. Opportunity zone investing offers the potential to defer and reduce capital gains taxes by reinvesting profits into designated low-income areas with long-term holding requirements. Explore more to understand which capital gains strategy aligns best with your investment goals.

Rehabilitation Costs

Rehabilitation costs in fix-and-flip projects typically range from 10% to 30% of the property's purchase price, depending on the property's condition and local labor expenses. Opportunity zone investing often involves longer-term capital improvements, allowing investors to leverage tax incentives while spreading rehab costs over an extended period. Explore detailed analyses on optimizing rehabilitation expenses in both investment strategies to maximize returns and tax benefits.

Tax Incentives

Opportunity zone investing offers significant tax incentives, including deferral of capital gains and potential exclusion of gains on new investments held for 10 years. Fix-and-flip projects generate immediate taxable income, lacking long-term tax benefits associated with opportunity zones. Explore how tax strategies differ between fix-and-flip ventures and opportunity zone investments for optimized financial planning.

Source and External Links

Fix-and-Flip - Fix-and-flip involves purchasing a property at a discount, renovating it, and selling it for a profit.

Fix & Flip: The Complete Guide to Flipping Houses - This guide provides a comprehensive overview of the fix-and-flip real estate strategy, including property assessment and renovation management.

Fix and Flip Financing - LendSure offers financing options for fix-and-flip projects, providing up to 90% of purchase costs and 100% for construction, with a streamlined application process.

dowidth.com

dowidth.com