Lease to own models provide tenants the opportunity to rent a property with the option to purchase it later, often allowing a portion of the rent to apply toward the down payment. Contract for deed arrangements involve the buyer making payments directly to the seller until the full purchase price is paid, with the deed transferring after the final payment. Explore the differences and benefits of each approach to determine which real estate strategy aligns with your financial goals.

Why it is important

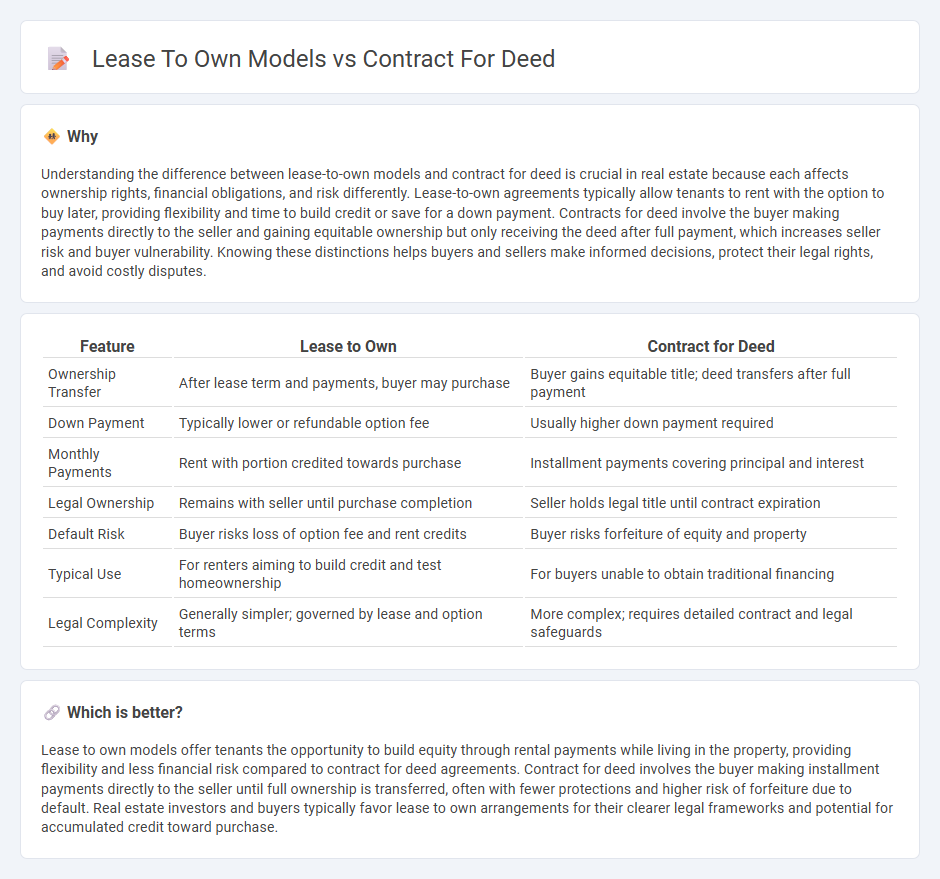

Understanding the difference between lease-to-own models and contract for deed is crucial in real estate because each affects ownership rights, financial obligations, and risk differently. Lease-to-own agreements typically allow tenants to rent with the option to buy later, providing flexibility and time to build credit or save for a down payment. Contracts for deed involve the buyer making payments directly to the seller and gaining equitable ownership but only receiving the deed after full payment, which increases seller risk and buyer vulnerability. Knowing these distinctions helps buyers and sellers make informed decisions, protect their legal rights, and avoid costly disputes.

Comparison Table

| Feature | Lease to Own | Contract for Deed |

|---|---|---|

| Ownership Transfer | After lease term and payments, buyer may purchase | Buyer gains equitable title; deed transfers after full payment |

| Down Payment | Typically lower or refundable option fee | Usually higher down payment required |

| Monthly Payments | Rent with portion credited towards purchase | Installment payments covering principal and interest |

| Legal Ownership | Remains with seller until purchase completion | Seller holds legal title until contract expiration |

| Default Risk | Buyer risks loss of option fee and rent credits | Buyer risks forfeiture of equity and property |

| Typical Use | For renters aiming to build credit and test homeownership | For buyers unable to obtain traditional financing |

| Legal Complexity | Generally simpler; governed by lease and option terms | More complex; requires detailed contract and legal safeguards |

Which is better?

Lease to own models offer tenants the opportunity to build equity through rental payments while living in the property, providing flexibility and less financial risk compared to contract for deed agreements. Contract for deed involves the buyer making installment payments directly to the seller until full ownership is transferred, often with fewer protections and higher risk of forfeiture due to default. Real estate investors and buyers typically favor lease to own arrangements for their clearer legal frameworks and potential for accumulated credit toward purchase.

Connection

Lease to own models and contract for deed arrangements both facilitate gradual property ownership by allowing tenants to apply rental payments toward the purchase price. In these agreements, buyers gain occupancy rights while making scheduled payments, combining elements of leasing and financing outside traditional mortgage frameworks. This connection provides alternative pathways for individuals with limited credit or down payment capabilities to secure real estate ownership.

Key Terms

Equitable Title

Contract for deed grants equitable title to the buyer after signing, allowing possession and future ownership upon full payment, while lease to own typically offers only possession without equitable title until exercising the purchase option. Equitable title in contract for deed provides legal rights such as tax benefits and protection against third-party claims during the installment period. Explore how equitable title impacts your property rights and financial advantages by learning more about these homeownership models.

Purchase Option

The contract for deed model involves the buyer making payments directly to the seller while holding equitable title, with legal title transferring only after the final payment, and often includes a clear purchase option embedded within the agreement. In lease-to-own models, tenants lease the property with an option to purchase after or during the lease term, typically requiring an upfront option fee and monthly rent credits toward the purchase price. Explore the detailed distinctions and legal implications of purchase options in both models to make an informed real estate decision.

Default Remedies

Contract for deed and lease-to-own models both serve as alternative home financing options where default remedies differ significantly. In a contract for deed, the seller retains legal title until the buyer completes payments, allowing quicker foreclosure processes upon default, while lease-to-own typically treats missed payments as rental breaches, often requiring formal eviction procedures. Explore detailed default remedy mechanisms and legal implications to optimize your decision between these models.

Source and External Links

Contract for Deed | Wex - A contract for deed is a real estate agreement where the buyer receives immediate possession and pays the purchase price in installments, with the seller retaining legal title until all payments are made.

A Guide to Contract for Deed - Docusign - This guide provides an overview of contracts for deed, emphasizing the importance of proper signing and notarization to ensure enforceability.

What is a Contract for Deed? | Consumer Financial Protection Bureau - Contracts for deed are loans where the seller retains legal title until all payments are made, often providing a path to homeownership but carrying risks.

dowidth.com

dowidth.com