Single family rental portfolios offer stable cash flow and potential property appreciation through residential properties leased to individual tenants. Land investment portfolios focus on undeveloped parcels that may yield high returns from future development, agricultural use, or resource extraction. Explore the benefits and risks of each investment strategy to determine the best fit for your real estate goals.

Why it is important

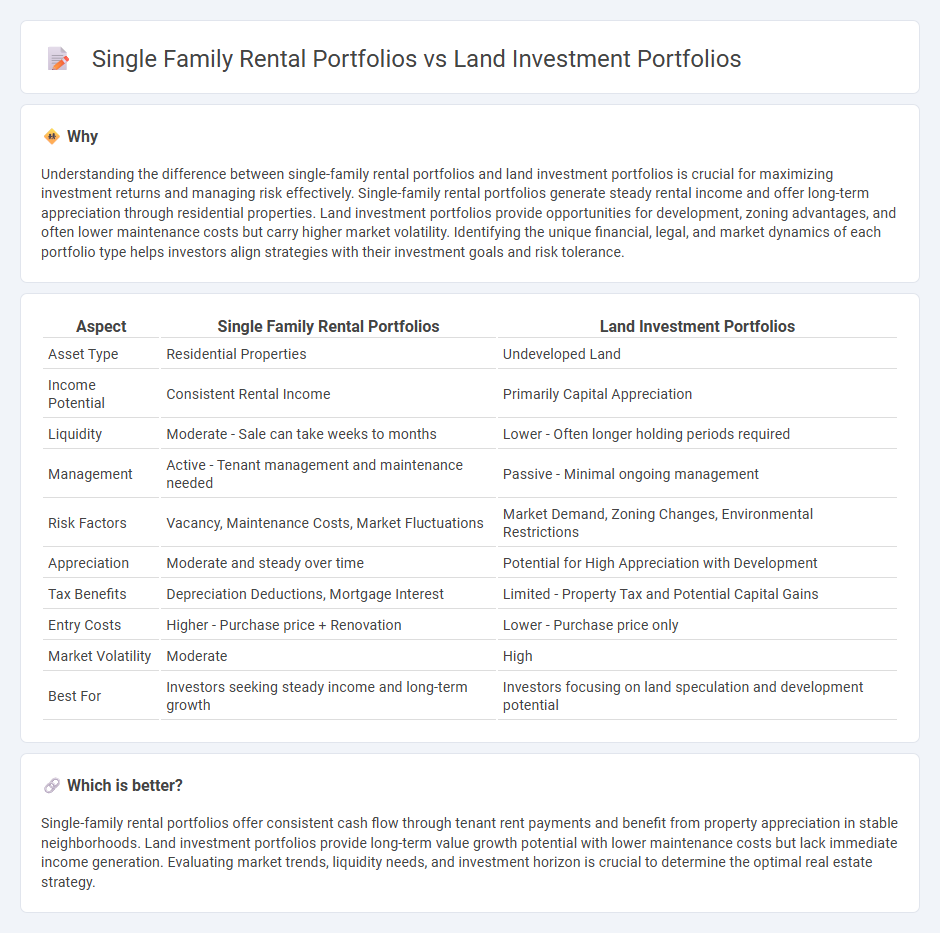

Understanding the difference between single-family rental portfolios and land investment portfolios is crucial for maximizing investment returns and managing risk effectively. Single-family rental portfolios generate steady rental income and offer long-term appreciation through residential properties. Land investment portfolios provide opportunities for development, zoning advantages, and often lower maintenance costs but carry higher market volatility. Identifying the unique financial, legal, and market dynamics of each portfolio type helps investors align strategies with their investment goals and risk tolerance.

Comparison Table

| Aspect | Single Family Rental Portfolios | Land Investment Portfolios |

|---|---|---|

| Asset Type | Residential Properties | Undeveloped Land |

| Income Potential | Consistent Rental Income | Primarily Capital Appreciation |

| Liquidity | Moderate - Sale can take weeks to months | Lower - Often longer holding periods required |

| Management | Active - Tenant management and maintenance needed | Passive - Minimal ongoing management |

| Risk Factors | Vacancy, Maintenance Costs, Market Fluctuations | Market Demand, Zoning Changes, Environmental Restrictions |

| Appreciation | Moderate and steady over time | Potential for High Appreciation with Development |

| Tax Benefits | Depreciation Deductions, Mortgage Interest | Limited - Property Tax and Potential Capital Gains |

| Entry Costs | Higher - Purchase price + Renovation | Lower - Purchase price only |

| Market Volatility | Moderate | High |

| Best For | Investors seeking steady income and long-term growth | Investors focusing on land speculation and development potential |

Which is better?

Single-family rental portfolios offer consistent cash flow through tenant rent payments and benefit from property appreciation in stable neighborhoods. Land investment portfolios provide long-term value growth potential with lower maintenance costs but lack immediate income generation. Evaluating market trends, liquidity needs, and investment horizon is crucial to determine the optimal real estate strategy.

Connection

Single family rental portfolios and land investment portfolios are connected through their shared focus on long-term wealth generation and diversification within the real estate market. Investors use single family rental properties to generate steady cash flow while acquiring land investments for appreciation potential and development opportunities. Both portfolio types complement each other by balancing income stability with growth prospects, optimizing overall real estate investment performance.

Key Terms

Diversification

Land investment portfolios offer broader diversification through varied geographic locations and land uses, reducing risk compared to single family rental portfolios, which are concentrated in residential real estate and subject to local market fluctuations. Incorporating a mix of land types--agricultural, commercial, and residential plots--enhances portfolio stability and growth potential by balancing income streams and capital appreciation opportunities. Explore comprehensive strategies for optimizing land and single family rental investments to maximize diversification benefits.

Cash Flow

Land investment portfolios typically generate cash flow through leasing or development opportunities, offering steady but often lower income compared to single family rental portfolios, which provide consistent monthly rental income with potential for property appreciation. Single family rentals benefit from higher liquidity and easier property management, while land investments may require longer holding periods and have less predictable cash flows. Explore comprehensive strategies to optimize cash flow in both land and single family rental portfolios.

Appreciation

Land investment portfolios typically offer higher appreciation potential due to scarcity and increasing demand for developable land, especially in rapidly growing regions. Single-family rental portfolios provide steady cash flow with moderate appreciation linked to housing market trends and rental demand. Discover the key factors affecting appreciation rates in both portfolio types to make informed investment decisions.

Source and External Links

Is Land a Good Investment? - Steers Global Real Assets - Land investment portfolios offer diversification benefits, passive income through leasing or renting, and a hedge against stock and bond market volatility, but require careful consideration of factors like liquidity and market dynamics.

How to Grow Your Land Portfolio - Expanding a land investment portfolio involves disciplined saving, securing a sizable down payment, and working with a knowledgeable buyer's agent to access off-market opportunities and targeted property types.

Benefits of Investing in Land - LandApp - Land portfolios provide stable long-term appreciation, income generation through agriculture, recreation, or renewable energy leases, and valuable tax advantages such as deductions for interest, property taxes, and depreciation.

dowidth.com

dowidth.com