Single family rentals offer individual housing units ideal for long-term residential tenants, providing stable cash flow and lower entry costs compared to commercial real estate, which involves properties like office buildings, retail spaces, and industrial complexes with higher income potential and varied lease structures. Investors weigh factors such as tenant turnover, maintenance requirements, and market demand when choosing between these asset classes. Explore deeper insights into the pros and cons of single family rentals versus commercial real estate to make informed investment decisions.

Why it is important

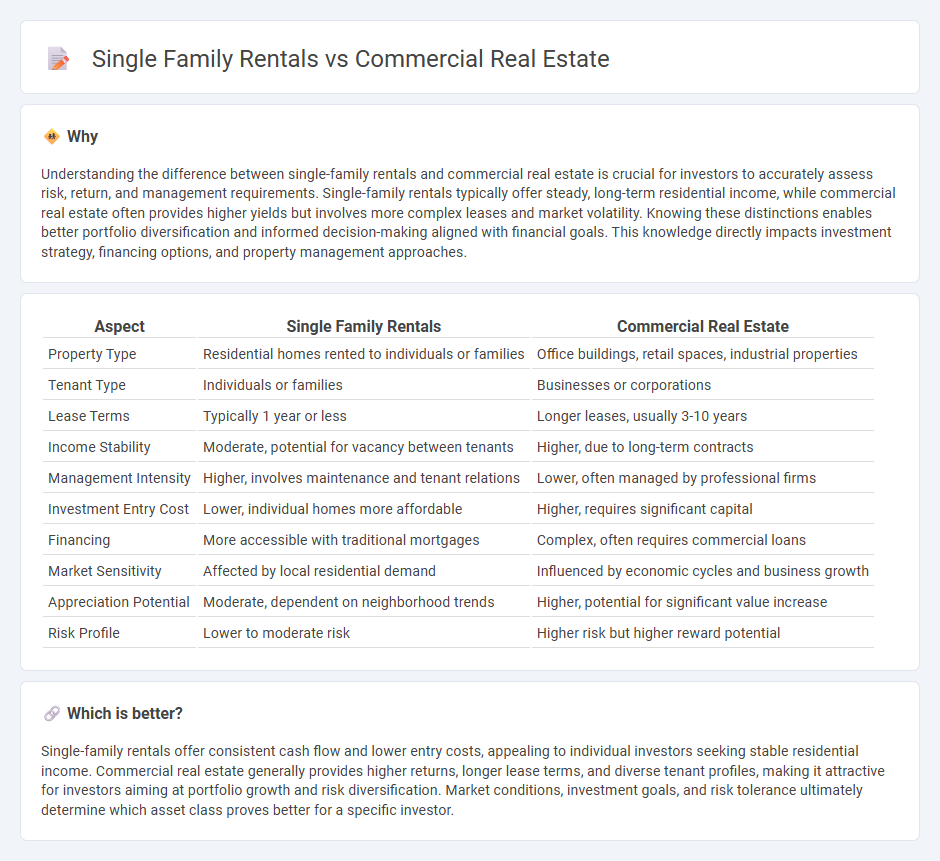

Understanding the difference between single-family rentals and commercial real estate is crucial for investors to accurately assess risk, return, and management requirements. Single-family rentals typically offer steady, long-term residential income, while commercial real estate often provides higher yields but involves more complex leases and market volatility. Knowing these distinctions enables better portfolio diversification and informed decision-making aligned with financial goals. This knowledge directly impacts investment strategy, financing options, and property management approaches.

Comparison Table

| Aspect | Single Family Rentals | Commercial Real Estate |

|---|---|---|

| Property Type | Residential homes rented to individuals or families | Office buildings, retail spaces, industrial properties |

| Tenant Type | Individuals or families | Businesses or corporations |

| Lease Terms | Typically 1 year or less | Longer leases, usually 3-10 years |

| Income Stability | Moderate, potential for vacancy between tenants | Higher, due to long-term contracts |

| Management Intensity | Higher, involves maintenance and tenant relations | Lower, often managed by professional firms |

| Investment Entry Cost | Lower, individual homes more affordable | Higher, requires significant capital |

| Financing | More accessible with traditional mortgages | Complex, often requires commercial loans |

| Market Sensitivity | Affected by local residential demand | Influenced by economic cycles and business growth |

| Appreciation Potential | Moderate, dependent on neighborhood trends | Higher, potential for significant value increase |

| Risk Profile | Lower to moderate risk | Higher risk but higher reward potential |

Which is better?

Single-family rentals offer consistent cash flow and lower entry costs, appealing to individual investors seeking stable residential income. Commercial real estate generally provides higher returns, longer lease terms, and diverse tenant profiles, making it attractive for investors aiming at portfolio growth and risk diversification. Market conditions, investment goals, and risk tolerance ultimately determine which asset class proves better for a specific investor.

Connection

Single-family rentals and commercial real estate are interconnected through shared market dynamics and investment strategies, as both asset classes respond to economic trends such as interest rates and population growth. Institutional investors often diversify portfolios by combining single-family rental properties with commercial real estate to balance risk and optimize cash flow. Property management practices in single-family rentals also influence commercial real estate operations, especially in sectors like multifamily housing and mixed-use developments.

Key Terms

Lease Structure

Commercial real estate lease structures typically include triple net (NNN) leases where tenants pay property taxes, insurance, and maintenance, offering landlords predictable income streams and lower management responsibilities. Single family rentals often use standard residential leases with shorter terms and more landlord involvement in upkeep and tenant relations. Explore the key differences in lease structures to optimize your real estate investment strategy.

Tenant Profile

Commercial real estate tenants typically include established businesses seeking long-term leases and stability, often resulting in lower turnover and consistent cash flow. Single-family rentals attract diverse tenants, including families and individuals, leading to more variable occupancy rates and management demands. Explore detailed tenant profiles to optimize investment strategies in both sectors.

Investment Yield

Commercial real estate typically offers higher investment yields ranging from 6% to 12%, driven by longer lease terms and multiple income streams. Single family rentals generally yield 4% to 8%, influenced by property location and tenant stability. Explore our detailed analysis to determine which investment suits your portfolio goals.

Source and External Links

Milford, NH Commercial Real Estate for Lease and Sale - Commercial real estate listings in Milford, NH, featuring offices, retail, and industrial spaces available for lease and sale.

NH Commercial Properties for Sale | Proctor & Greene Real Estate - Listings of commercial properties for sale in Southern New Hampshire, highlighting a vibrant business community and strategic location.

Lease Commercial Real Estate and Property in Amherst, NH - Crexi - A platform to lease commercial real estate, buildings, land, and business spaces in Amherst, NH, with diverse property listings.

dowidth.com

dowidth.com