Opportunity Zone investing offers investors significant tax incentives by deferring and potentially excluding capital gains on investments in designated low-income areas, while the 1031 Exchange allows for the deferral of capital gains taxes through the reinvestment of proceeds from one property into another like-kind property. Understanding both strategies is crucial for optimizing tax benefits and maximizing investment growth in the real estate market. Explore detailed comparisons and expert guidance to determine the best approach for your real estate investment portfolio.

Why it is important

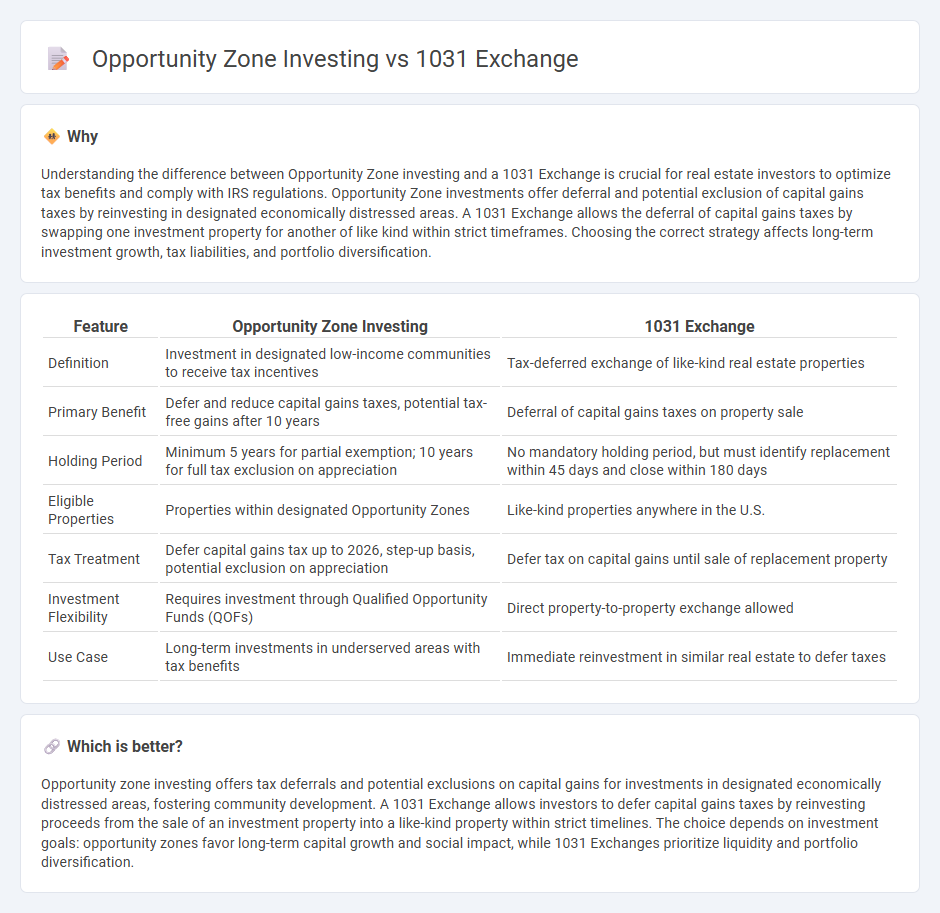

Understanding the difference between Opportunity Zone investing and a 1031 Exchange is crucial for real estate investors to optimize tax benefits and comply with IRS regulations. Opportunity Zone investments offer deferral and potential exclusion of capital gains taxes by reinvesting in designated economically distressed areas. A 1031 Exchange allows the deferral of capital gains taxes by swapping one investment property for another of like kind within strict timeframes. Choosing the correct strategy affects long-term investment growth, tax liabilities, and portfolio diversification.

Comparison Table

| Feature | Opportunity Zone Investing | 1031 Exchange |

|---|---|---|

| Definition | Investment in designated low-income communities to receive tax incentives | Tax-deferred exchange of like-kind real estate properties |

| Primary Benefit | Defer and reduce capital gains taxes, potential tax-free gains after 10 years | Deferral of capital gains taxes on property sale |

| Holding Period | Minimum 5 years for partial exemption; 10 years for full tax exclusion on appreciation | No mandatory holding period, but must identify replacement within 45 days and close within 180 days |

| Eligible Properties | Properties within designated Opportunity Zones | Like-kind properties anywhere in the U.S. |

| Tax Treatment | Defer capital gains tax up to 2026, step-up basis, potential exclusion on appreciation | Defer tax on capital gains until sale of replacement property |

| Investment Flexibility | Requires investment through Qualified Opportunity Funds (QOFs) | Direct property-to-property exchange allowed |

| Use Case | Long-term investments in underserved areas with tax benefits | Immediate reinvestment in similar real estate to defer taxes |

Which is better?

Opportunity zone investing offers tax deferrals and potential exclusions on capital gains for investments in designated economically distressed areas, fostering community development. A 1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property within strict timelines. The choice depends on investment goals: opportunity zones favor long-term capital growth and social impact, while 1031 Exchanges prioritize liquidity and portfolio diversification.

Connection

Opportunity Zone investing and 1031 Exchange strategies both offer tax advantages to real estate investors by deferring capital gains taxes, enhancing portfolio growth potential. Investors can defer taxes from a 1031 Exchange by reinvesting proceeds into designated Opportunity Zones, combining benefits of stepped-up basis and further deferral periods. Leveraging both tools allows for significant tax efficiency and increased capital deployment within targeted economic development areas.

Key Terms

Capital Gains Tax

1031 Exchange allows real estate investors to defer capital gains tax by reinvesting proceeds from a property sale into a like-kind property within a specific timeframe, preserving investment capital. Opportunity Zone investing offers temporary deferral, reduction, and potential elimination of capital gains tax by investing in designated low-income communities through Qualified Opportunity Funds. Explore the benefits and strategic differences further to optimize your capital gains tax strategy effectively.

Like-Kind Property

1031 Exchange allows deferral of capital gains taxes by reinvesting proceeds from the sale of like-kind property into another similar asset, primarily within real estate. Opportunity Zone investing offers tax incentives for long-term investments in designated economically distressed areas but does not require like-kind property reinvestment. Explore the nuances between these strategies to determine optimal tax benefits for your real estate portfolio.

Qualified Opportunity Fund

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds into a similar property, while Opportunity Zone investing offers tax incentives through investments in Qualified Opportunity Funds (QOFs) that support economically distressed areas. Qualified Opportunity Funds must deploy at least 90% of their assets into Opportunity Zones and provide benefits like deferral and potential exclusion of capital gains taxes if held for specific periods. Explore more about how QOFs can maximize tax advantages and support community revitalization.

Source and External Links

1031 exchange | Wex | US Law | LII / Legal Information Institute - A 1031 exchange allows property owners to defer capital gains taxes by reinvesting proceeds into a new property within 45 days of identification and completing the transaction within 135 days, with the new property costing at least as much as the original.

What Is a 1031 Exchange? - A like-kind exchange that defers capital gains taxes on investment property sales by reinvesting in a similarly valued or greater property, requiring adherence to IRS protocols and timelines.

What is a 1031 exchange and how does it work? - A tax deferral strategy enabling real estate investors to sell appreciated investment property and reinvest proceeds into replacement property without immediate tax, provided identification is made within 45 days and purchase closed within 180 days.

dowidth.com

dowidth.com