Single family rental portfolios offer investors diversified residential properties with consistent rental income and lower tenant turnover compared to commercial real estate portfolios, which focus on office, retail, or industrial spaces with potentially higher returns but increased market volatility. The residential nature of single family rentals often results in more stable cash flow, while commercial portfolios require comprehensive management and are influenced by economic cycles and business trends. Explore the unique benefits and challenges of each real estate investment strategy to determine the best fit for your financial goals.

Why it is important

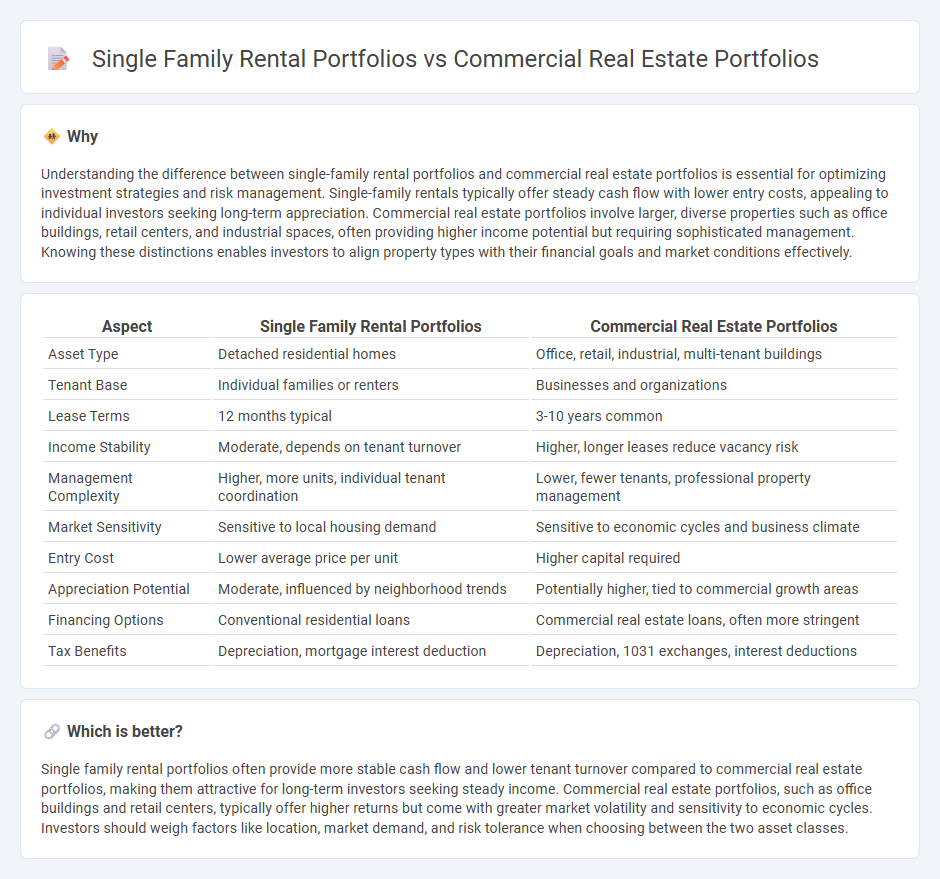

Understanding the difference between single-family rental portfolios and commercial real estate portfolios is essential for optimizing investment strategies and risk management. Single-family rentals typically offer steady cash flow with lower entry costs, appealing to individual investors seeking long-term appreciation. Commercial real estate portfolios involve larger, diverse properties such as office buildings, retail centers, and industrial spaces, often providing higher income potential but requiring sophisticated management. Knowing these distinctions enables investors to align property types with their financial goals and market conditions effectively.

Comparison Table

| Aspect | Single Family Rental Portfolios | Commercial Real Estate Portfolios |

|---|---|---|

| Asset Type | Detached residential homes | Office, retail, industrial, multi-tenant buildings |

| Tenant Base | Individual families or renters | Businesses and organizations |

| Lease Terms | 12 months typical | 3-10 years common |

| Income Stability | Moderate, depends on tenant turnover | Higher, longer leases reduce vacancy risk |

| Management Complexity | Higher, more units, individual tenant coordination | Lower, fewer tenants, professional property management |

| Market Sensitivity | Sensitive to local housing demand | Sensitive to economic cycles and business climate |

| Entry Cost | Lower average price per unit | Higher capital required |

| Appreciation Potential | Moderate, influenced by neighborhood trends | Potentially higher, tied to commercial growth areas |

| Financing Options | Conventional residential loans | Commercial real estate loans, often more stringent |

| Tax Benefits | Depreciation, mortgage interest deduction | Depreciation, 1031 exchanges, interest deductions |

Which is better?

Single family rental portfolios often provide more stable cash flow and lower tenant turnover compared to commercial real estate portfolios, making them attractive for long-term investors seeking steady income. Commercial real estate portfolios, such as office buildings and retail centers, typically offer higher returns but come with greater market volatility and sensitivity to economic cycles. Investors should weigh factors like location, market demand, and risk tolerance when choosing between the two asset classes.

Connection

Single family rental portfolios and commercial real estate portfolios are connected through diversified investment strategies that balance risk and income streams. Both asset classes benefit from market trends such as urbanization, interest rate fluctuations, and demographic shifts impacting rental demand and property values. Investors leverage data analytics and property management technologies to optimize occupancy rates and enhance portfolio performance across residential and commercial holdings.

Key Terms

Asset Diversification

Commercial real estate portfolios offer significant asset diversification by encompassing various property types such as office buildings, retail spaces, and industrial warehouses, reducing risk exposure compared to single family rental portfolios concentrated in residential units. Single family rental portfolios may provide steady cash flow and lower market entry costs but lack the broad sectorial risk mitigation found in diversified commercial holdings. Explore detailed strategies to optimize asset diversification in both portfolio types for enhanced financial stability and growth potential.

Cash Flow Stability

Commercial real estate portfolios typically offer more stable cash flow due to diversified rental income streams from multiple tenants across different property types such as office, retail, and industrial spaces. Single family rental portfolios may experience higher income variability influenced by tenant turnover, maintenance costs, and localized market fluctuations. Explore detailed strategies to enhance cash flow stability in both portfolio types.

Property Management Complexity

Commercial real estate portfolios demand advanced property management strategies due to diverse tenant needs, complex lease structures, and maintenance of large-scale facilities. Single family rental portfolios involve managing multiple discrete properties with individualized tenant relations and varied upkeep schedules, often requiring more hands-on coordination despite smaller property size. Explore detailed comparisons to understand property management challenges for each portfolio type.

Source and External Links

Commercial Real Estate Investment Strategies - J.P. Morgan - This webpage provides insights into common commercial real estate investment strategies, including core, core-plus, value-add, and opportunistic investments for tailored portfolios.

How to Build a Strong Commercial Real Estate Portfolio - This blog post outlines steps to build a strong commercial real estate portfolio, focusing on property type selection and diversification across different asset classes.

Portfolio - Ares Commercial Real Estate - Ares Commercial Real Estate features a diversified portfolio with significant commitments across various loans and asset classes, emphasizing diversification and geographic spread.

dowidth.com

dowidth.com