Build to rent properties offer long-term income through leasing, targeting tenants seeking quality rental homes, while build to sell focuses on quick returns by selling newly constructed homes to buyers. Investors in build to rent benefit from steady cash flow and asset appreciation, whereas build to sell appeals to developers aiming for immediate profits. Explore the key differences and investment opportunities between build to rent and build to sell in real estate.

Why it is important

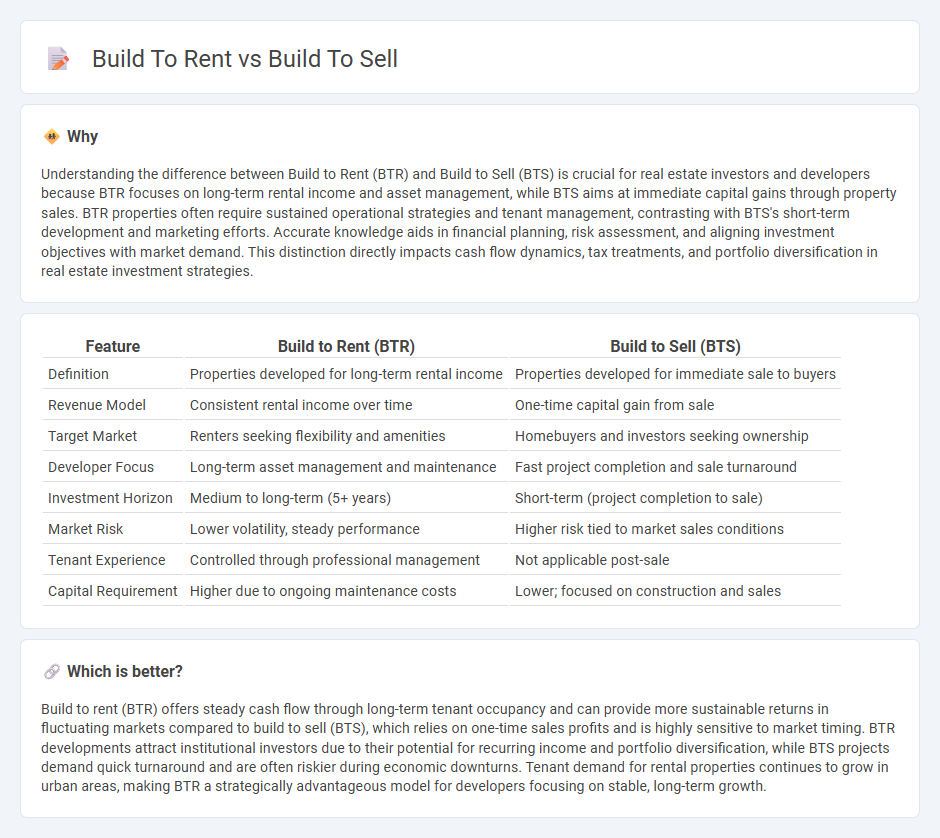

Understanding the difference between Build to Rent (BTR) and Build to Sell (BTS) is crucial for real estate investors and developers because BTR focuses on long-term rental income and asset management, while BTS aims at immediate capital gains through property sales. BTR properties often require sustained operational strategies and tenant management, contrasting with BTS's short-term development and marketing efforts. Accurate knowledge aids in financial planning, risk assessment, and aligning investment objectives with market demand. This distinction directly impacts cash flow dynamics, tax treatments, and portfolio diversification in real estate investment strategies.

Comparison Table

| Feature | Build to Rent (BTR) | Build to Sell (BTS) |

|---|---|---|

| Definition | Properties developed for long-term rental income | Properties developed for immediate sale to buyers |

| Revenue Model | Consistent rental income over time | One-time capital gain from sale |

| Target Market | Renters seeking flexibility and amenities | Homebuyers and investors seeking ownership |

| Developer Focus | Long-term asset management and maintenance | Fast project completion and sale turnaround |

| Investment Horizon | Medium to long-term (5+ years) | Short-term (project completion to sale) |

| Market Risk | Lower volatility, steady performance | Higher risk tied to market sales conditions |

| Tenant Experience | Controlled through professional management | Not applicable post-sale |

| Capital Requirement | Higher due to ongoing maintenance costs | Lower; focused on construction and sales |

Which is better?

Build to rent (BTR) offers steady cash flow through long-term tenant occupancy and can provide more sustainable returns in fluctuating markets compared to build to sell (BTS), which relies on one-time sales profits and is highly sensitive to market timing. BTR developments attract institutional investors due to their potential for recurring income and portfolio diversification, while BTS projects demand quick turnaround and are often riskier during economic downturns. Tenant demand for rental properties continues to grow in urban areas, making BTR a strategically advantageous model for developers focusing on stable, long-term growth.

Connection

Build to rent and build to sell models intersect through their reliance on strategic property development and market analysis. Both approaches focus on maximizing returns by targeting specific buyer or renter demographics and optimizing asset management or sales processes. Data on location demand, construction costs, and pricing strategies critically informs the decision-making in both build to rent and build to sell projects.

Key Terms

Exit Strategy

Build-to-sell developments focus on quickly delivering completed properties to buyers, optimizing for rapid capital recovery and market timing to maximize profit margins. Build-to-rent projects emphasize long-term asset appreciation and steady rental income, necessitating detailed exit strategies that consider market demand and property management efficiencies. Explore strategic approaches to balance profitability and liquidity in your real estate investment plans.

Cash Flow

Build-to-sell developments generate immediate revenue through property sales but offer limited ongoing cash flow, often requiring new projects to sustain income. Build-to-rent strategies prioritize long-term cash flow stability by creating continuous rental income streams, potentially yielding higher returns through property appreciation and tenant retention. Explore detailed comparisons to determine which model aligns best with your investment goals and financial priorities.

Capital Appreciation

Build to sell projects prioritize maximizing capital appreciation by targeting market demand and optimizing property value for resale profits. Build to rent developments emphasize steady income streams while also benefiting from long-term asset value growth in appreciating markets. Explore deeper insights into capital appreciation strategies within both investment models.

Source and External Links

Built to Sell by John Warrillow - This book emphasizes building a business that can thrive without the owner, focusing on specialization and scalability to maximize its sellability.

Built to Sell on Goodreads - A story about Alex, an entrepreneur who learns to transform his business into a sellable asset with the help of a mentor, Ted.

Built to Sell - Provides insights and tools to increase business value and improve negotiations during the sale process.

dowidth.com

dowidth.com