Blockchain technology transforms real estate by enabling secure, transparent property transactions and smart contracts that reduce intermediaries and lower costs. Real Estate Investment Trusts (REITs) offer investors liquidity and diversification by pooling funds to invest in income-generating properties without direct property management. Explore how blockchain and REITs are reshaping real estate investment strategies.

Why it is important

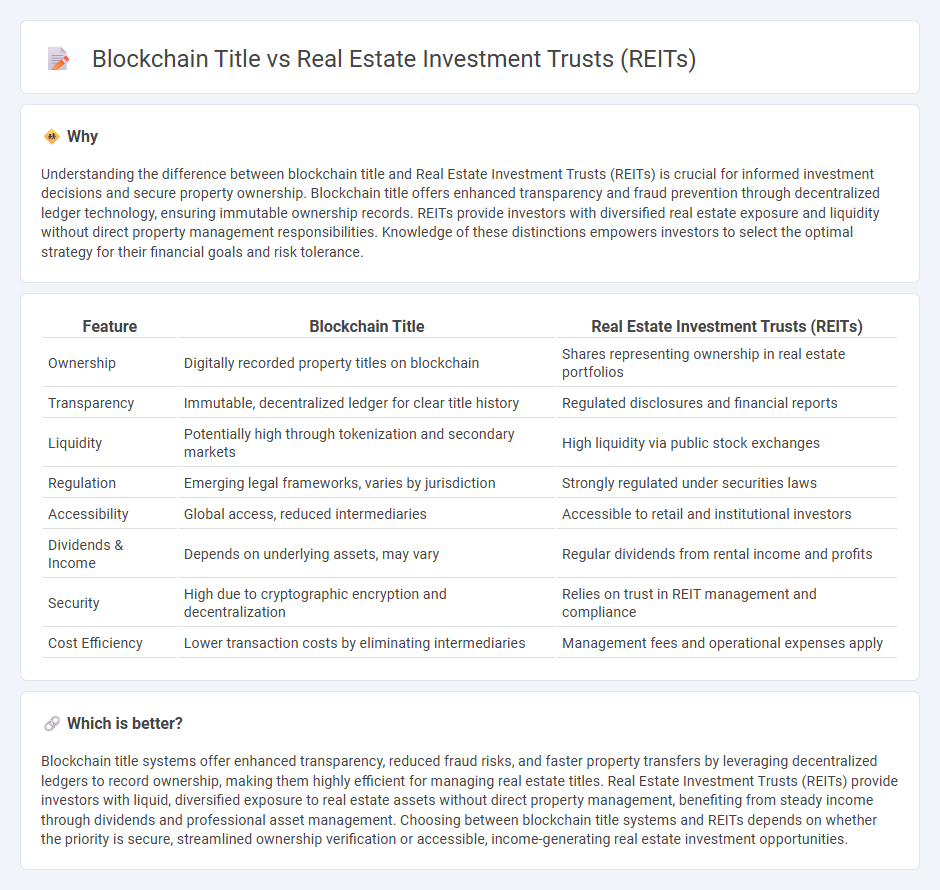

Understanding the difference between blockchain title and Real Estate Investment Trusts (REITs) is crucial for informed investment decisions and secure property ownership. Blockchain title offers enhanced transparency and fraud prevention through decentralized ledger technology, ensuring immutable ownership records. REITs provide investors with diversified real estate exposure and liquidity without direct property management responsibilities. Knowledge of these distinctions empowers investors to select the optimal strategy for their financial goals and risk tolerance.

Comparison Table

| Feature | Blockchain Title | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Ownership | Digitally recorded property titles on blockchain | Shares representing ownership in real estate portfolios |

| Transparency | Immutable, decentralized ledger for clear title history | Regulated disclosures and financial reports |

| Liquidity | Potentially high through tokenization and secondary markets | High liquidity via public stock exchanges |

| Regulation | Emerging legal frameworks, varies by jurisdiction | Strongly regulated under securities laws |

| Accessibility | Global access, reduced intermediaries | Accessible to retail and institutional investors |

| Dividends & Income | Depends on underlying assets, may vary | Regular dividends from rental income and profits |

| Security | High due to cryptographic encryption and decentralization | Relies on trust in REIT management and compliance |

| Cost Efficiency | Lower transaction costs by eliminating intermediaries | Management fees and operational expenses apply |

Which is better?

Blockchain title systems offer enhanced transparency, reduced fraud risks, and faster property transfers by leveraging decentralized ledgers to record ownership, making them highly efficient for managing real estate titles. Real Estate Investment Trusts (REITs) provide investors with liquid, diversified exposure to real estate assets without direct property management, benefiting from steady income through dividends and professional asset management. Choosing between blockchain title systems and REITs depends on whether the priority is secure, streamlined ownership verification or accessible, income-generating real estate investment opportunities.

Connection

Blockchain title technology enhances transparency and security in real estate transactions by providing immutable, easily verifiable property records. Real Estate Investment Trusts (REITs) benefit from blockchain by enabling more efficient, transparent share issuance and trading, reducing fraud risks and administrative costs. The integration of blockchain with REITs fosters increased investor confidence and liquidity in real estate markets.

Key Terms

Fractional Ownership

Fractional ownership in real estate investment trusts (REITs) allows investors to buy shares representing a portion of a diversified real estate portfolio, providing liquidity and professional management without the need for direct property involvement. Blockchain technology enhances fractional ownership by enabling transparent, secure, and immutable records of property shares, reducing intermediaries and simplifying transaction processes through smart contracts. Explore how blockchain-driven fractional ownership is revolutionizing access to real estate investments and increasing market efficiency.

Decentralization

Real Estate Investment Trusts (REITs) offer centralized management and regulatory oversight, enabling investors to access diversified property portfolios with relative transparency. Blockchain title systems leverage decentralization by recording property ownership on immutable ledgers, reducing fraud risks and increasing transaction speed without intermediaries. Explore how combining REIT structures with blockchain title innovations can transform real estate investment and ownership security.

Liquidity

Real Estate Investment Trusts (REITs) offer high liquidity by enabling investors to buy and sell shares on public exchanges, providing faster access to capital compared to traditional real estate ownership. Blockchain title technology enhances liquidity by streamlining property transactions through secure, transparent, and immutable records, reducing the time and costs associated with title transfers. Explore how combining REITs and blockchain title solutions can transform liquidity in real estate markets.

Source and External Links

Real Estate Investment Trust - A real estate investment trust (REIT) is a company that owns and operates income-producing real estate, providing tax benefits and income to shareholders.

Real Estate Investment Trusts (REITs) - REITs allow individuals to invest in large-scale, income-producing real estate by buying shares, which can be publicly traded on stock exchanges.

What's a REIT (Real Estate Investment Trust)? - REITs are modeled after mutual funds, providing investors with income streams, diversification, and long-term capital appreciation through ownership of income-producing real estate.

dowidth.com

dowidth.com