Short term rental arbitrage leverages leasing properties to rent them out on platforms like Airbnb, capitalizing on high cash flow without property ownership. BRRRR (Buy, Rehab, Rent, Refinance, Repeat) focuses on acquiring undervalued real estate, renovating it to increase value, then refinancing to fund subsequent investments, building long-term equity. Explore deeper insights into these strategies to optimize your real estate investment portfolio.

Why it is important

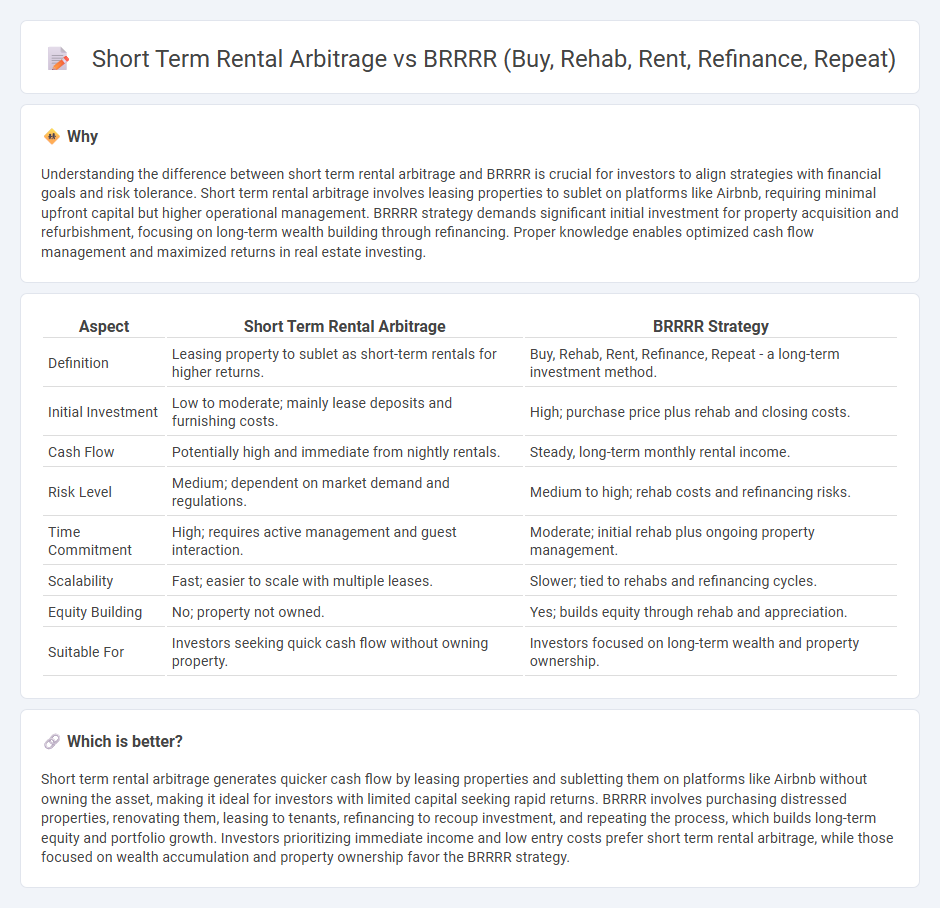

Understanding the difference between short term rental arbitrage and BRRRR is crucial for investors to align strategies with financial goals and risk tolerance. Short term rental arbitrage involves leasing properties to sublet on platforms like Airbnb, requiring minimal upfront capital but higher operational management. BRRRR strategy demands significant initial investment for property acquisition and refurbishment, focusing on long-term wealth building through refinancing. Proper knowledge enables optimized cash flow management and maximized returns in real estate investing.

Comparison Table

| Aspect | Short Term Rental Arbitrage | BRRRR Strategy |

|---|---|---|

| Definition | Leasing property to sublet as short-term rentals for higher returns. | Buy, Rehab, Rent, Refinance, Repeat - a long-term investment method. |

| Initial Investment | Low to moderate; mainly lease deposits and furnishing costs. | High; purchase price plus rehab and closing costs. |

| Cash Flow | Potentially high and immediate from nightly rentals. | Steady, long-term monthly rental income. |

| Risk Level | Medium; dependent on market demand and regulations. | Medium to high; rehab costs and refinancing risks. |

| Time Commitment | High; requires active management and guest interaction. | Moderate; initial rehab plus ongoing property management. |

| Scalability | Fast; easier to scale with multiple leases. | Slower; tied to rehabs and refinancing cycles. |

| Equity Building | No; property not owned. | Yes; builds equity through rehab and appreciation. |

| Suitable For | Investors seeking quick cash flow without owning property. | Investors focused on long-term wealth and property ownership. |

Which is better?

Short term rental arbitrage generates quicker cash flow by leasing properties and subletting them on platforms like Airbnb without owning the asset, making it ideal for investors with limited capital seeking rapid returns. BRRRR involves purchasing distressed properties, renovating them, leasing to tenants, refinancing to recoup investment, and repeating the process, which builds long-term equity and portfolio growth. Investors prioritizing immediate income and low entry costs prefer short term rental arbitrage, while those focused on wealth accumulation and property ownership favor the BRRRR strategy.

Connection

Short term rental arbitrage and the BRRRR strategy are connected through their focus on maximizing cash flow and property value in real estate investment. Investors use short term rental arbitrage to generate immediate rental income without owning the property, while BRRRR involves buying, rehabbing, renting, refinancing, and repeating to build equity and scale a rental portfolio. Combining these approaches can optimize returns by leveraging cash flow from short term rentals to fund rehab and refinancing stages in the BRRRR method.

Key Terms

Cash Flow

The BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) generates steady cash flow by acquiring undervalued properties, renovating them for higher rental income, and leveraging refinancing to fund subsequent purchases. Short-term rental arbitrage focuses on renting properties on long-term leases and subletting them as short-term rentals, capitalizing on higher nightly rates to maximize cash flow without property ownership. Explore detailed comparisons to determine which method aligns best with your investment goals and cash flow needs.

Leverage

BRRRR strategy leverages long-term real estate investments by buying undervalued properties, rehabbing them to increase value, renting for steady income, then refinancing to pull out equity for subsequent purchases, maximizing leverage through traditional mortgage financing. Short term rental arbitrage involves leasing properties long-term to rent them out short-term on platforms like Airbnb without owning the asset, relying on rental income differentials rather than building equity. Explore deeper insights on how leverage impacts cash flow, risk, and growth potential in both approaches.

Lease Agreement

The BRRRR strategy involves securing a traditional lease agreement with long-term tenants, providing stability and predictable cash flow through rental income before refinancing. Short-term rental arbitrage relies on a lease agreement that allows subleasing, enabling the property to be listed on platforms like Airbnb for higher nightly rates but with potentially variable income. Explore the intricacies of lease agreements to optimize investment returns between these two approaches.

Source and External Links

BRRRR Method | The Tax Benefits of Investment Property - This article explains the BRRRR strategy as a tax-savvy method for real estate investing involving buying, rehabbing, renting, refinancing, and repeating the process.

Buy, Rehab, Rent, Refinance, Repeat - BiggerPockets Bookstore - This product offers a comprehensive guide to the BRRRR strategy, making financial freedom more attainable through real estate investing.

Understanding the BRRRR method of real estate investment - This article provides a detailed overview of how the BRRRR method works, including buying distressed properties, rehabbing them, renting, refinancing, and repeating the process for continuous cash flow.

dowidth.com

dowidth.com