Escrow crowdfunding and hard money lending are two distinct real estate financing methods that offer unique advantages for investors and developers. Escrow crowdfunding pools funds from multiple investors via a secure third-party escrow account, providing transparency and reducing risk, while hard money lending involves short-term, asset-based loans typically funded by private investors or companies, focusing on speed and flexibility. Explore the nuances and benefits of each to determine the best fit for your real estate financing needs.

Why it is important

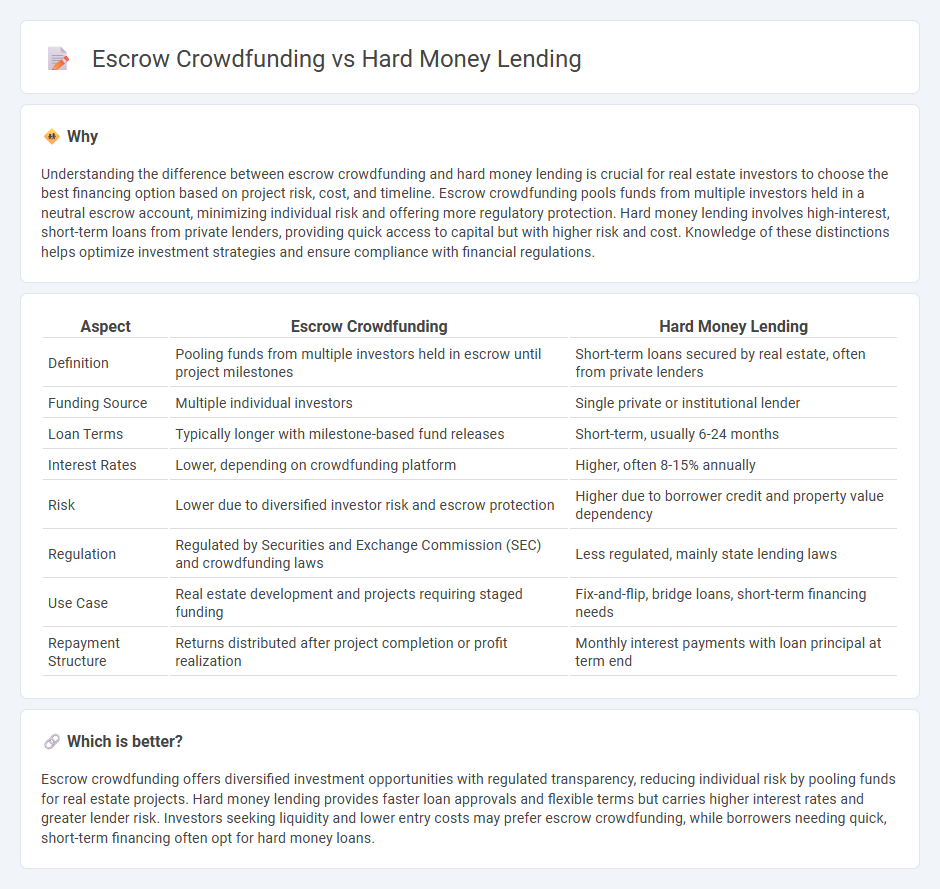

Understanding the difference between escrow crowdfunding and hard money lending is crucial for real estate investors to choose the best financing option based on project risk, cost, and timeline. Escrow crowdfunding pools funds from multiple investors held in a neutral escrow account, minimizing individual risk and offering more regulatory protection. Hard money lending involves high-interest, short-term loans from private lenders, providing quick access to capital but with higher risk and cost. Knowledge of these distinctions helps optimize investment strategies and ensure compliance with financial regulations.

Comparison Table

| Aspect | Escrow Crowdfunding | Hard Money Lending |

|---|---|---|

| Definition | Pooling funds from multiple investors held in escrow until project milestones | Short-term loans secured by real estate, often from private lenders |

| Funding Source | Multiple individual investors | Single private or institutional lender |

| Loan Terms | Typically longer with milestone-based fund releases | Short-term, usually 6-24 months |

| Interest Rates | Lower, depending on crowdfunding platform | Higher, often 8-15% annually |

| Risk | Lower due to diversified investor risk and escrow protection | Higher due to borrower credit and property value dependency |

| Regulation | Regulated by Securities and Exchange Commission (SEC) and crowdfunding laws | Less regulated, mainly state lending laws |

| Use Case | Real estate development and projects requiring staged funding | Fix-and-flip, bridge loans, short-term financing needs |

| Repayment Structure | Returns distributed after project completion or profit realization | Monthly interest payments with loan principal at term end |

Which is better?

Escrow crowdfunding offers diversified investment opportunities with regulated transparency, reducing individual risk by pooling funds for real estate projects. Hard money lending provides faster loan approvals and flexible terms but carries higher interest rates and greater lender risk. Investors seeking liquidity and lower entry costs may prefer escrow crowdfunding, while borrowers needing quick, short-term financing often opt for hard money loans.

Connection

Escrow crowdfunding and hard money lending intersect in real estate by providing alternative financing options that facilitate property acquisitions and development projects. Escrow crowdfunding pools capital from multiple investors held securely in escrow accounts until funding goals are met, while hard money lending offers short-term, asset-based loans typically used for fast transactions or renovations. Both methods address gaps left by traditional bank financing, enabling developers and investors to access funds with greater speed and flexibility.

Key Terms

Collateral

Hard money lending relies heavily on tangible collateral, such as real estate, to secure loans, providing lenders with a clear asset to recover funds if the borrower defaults. In escrow crowdfunding, collateral is less commonly used since funds are pooled from multiple investors and held in escrow until project milestones or conditions are met, reducing individual invest risk. Explore deeper insights into how collateral requirements reshape investor protection in these financing models.

Custodial Account

Hard money lending involves private individuals or companies offering short-term loans secured by real estate, often with higher interest rates and quicker approval times. Escrow crowdfunding utilizes a custodial account to securely hold investors' funds until project milestones are met, ensuring transparent and regulated transactions. Explore deeper insights into how custodial accounts enhance security and trust in funding models by learning more.

Investor Pool

Hard money lending typically attracts a smaller, specialized investor pool consisting of private individuals and institutional lenders seeking higher-interest returns in short-term real estate loans. Escrow crowdfunding, on the other hand, leverages a broader, more diversified group of individual investors pooling funds through online platforms under regulatory oversight. Explore the unique benefits and risks of each to determine the optimal investment strategy for your portfolio.

Source and External Links

Best Hard Money Lenders for 2025 + Hard Loans Explained - A hard money loan is a short-term, asset-based property loan from private investors or companies with faster approval and flexible qualification, typically used for real estate investing such as fix-and-flip projects or foreclosure prevention, with terms from one to three years and higher interest rates than traditional mortgages.

What Is a Hard Money Loan and How Does It Work? | LendingTree - Hard money loans are provided by private investors or real estate companies, usually covering 65%-75% of the property value, with advantages like no minimum credit score and quick closing, but they have higher interest rates, lower loan-to-value ratios, and risk of collateral loss.

Guide To Hard Money Loans And Lenders - Bankrate - Hard money loans offer flexible loan terms and fast funding based primarily on collateral value rather than credit history, making them popular for real estate investors, but they come with higher costs, large down payments, and less regulatory oversight compared to conventional mortgages.

dowidth.com

dowidth.com