Opportunity zones offer significant tax incentives to real estate investors who deploy capital in designated low-income areas, fostering community revitalization while deferring capital gains taxes. Tax Increment Financing (TIF) allows municipalities to finance redevelopment projects by capturing future property tax increases resulting from improved property values, fueling infrastructure and public improvements. Explore the benefits and strategic uses of Opportunity Zones versus TIF to optimize your real estate investments.

Why it is important

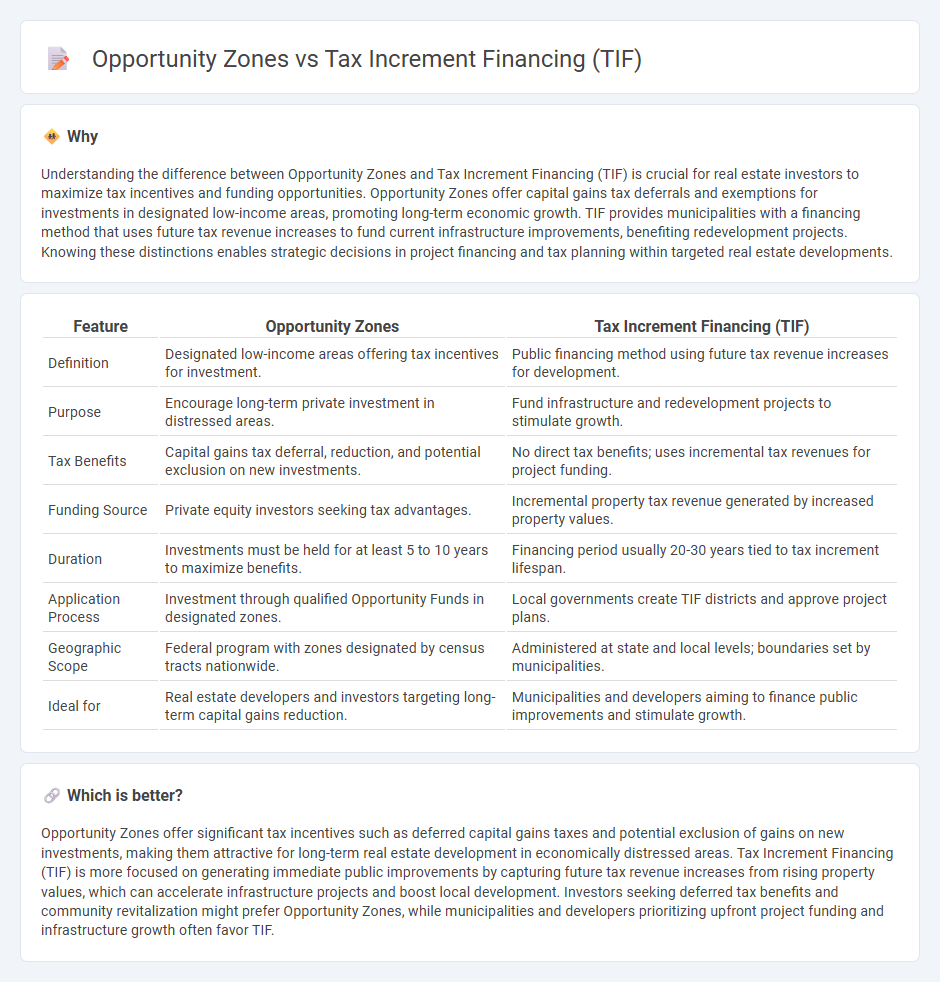

Understanding the difference between Opportunity Zones and Tax Increment Financing (TIF) is crucial for real estate investors to maximize tax incentives and funding opportunities. Opportunity Zones offer capital gains tax deferrals and exemptions for investments in designated low-income areas, promoting long-term economic growth. TIF provides municipalities with a financing method that uses future tax revenue increases to fund current infrastructure improvements, benefiting redevelopment projects. Knowing these distinctions enables strategic decisions in project financing and tax planning within targeted real estate developments.

Comparison Table

| Feature | Opportunity Zones | Tax Increment Financing (TIF) |

|---|---|---|

| Definition | Designated low-income areas offering tax incentives for investment. | Public financing method using future tax revenue increases for development. |

| Purpose | Encourage long-term private investment in distressed areas. | Fund infrastructure and redevelopment projects to stimulate growth. |

| Tax Benefits | Capital gains tax deferral, reduction, and potential exclusion on new investments. | No direct tax benefits; uses incremental tax revenues for project funding. |

| Funding Source | Private equity investors seeking tax advantages. | Incremental property tax revenue generated by increased property values. |

| Duration | Investments must be held for at least 5 to 10 years to maximize benefits. | Financing period usually 20-30 years tied to tax increment lifespan. |

| Application Process | Investment through qualified Opportunity Funds in designated zones. | Local governments create TIF districts and approve project plans. |

| Geographic Scope | Federal program with zones designated by census tracts nationwide. | Administered at state and local levels; boundaries set by municipalities. |

| Ideal for | Real estate developers and investors targeting long-term capital gains reduction. | Municipalities and developers aiming to finance public improvements and stimulate growth. |

Which is better?

Opportunity Zones offer significant tax incentives such as deferred capital gains taxes and potential exclusion of gains on new investments, making them attractive for long-term real estate development in economically distressed areas. Tax Increment Financing (TIF) is more focused on generating immediate public improvements by capturing future tax revenue increases from rising property values, which can accelerate infrastructure projects and boost local development. Investors seeking deferred tax benefits and community revitalization might prefer Opportunity Zones, while municipalities and developers prioritizing upfront project funding and infrastructure growth often favor TIF.

Connection

Opportunity Zones and Tax Increment Financing (TIF) are connected through their shared goal of stimulating real estate development and economic growth in underdeveloped or distressed areas. Opportunity Zones offer investors tax incentives for investing in designated economically disadvantaged communities, while TIF provides municipalities with a method to reinvest future property tax revenues generated by increased property values back into infrastructure and development projects. Together, they create a powerful financial framework that encourages private investment and public improvements, driving revitalization and long-term value in targeted real estate markets.

Key Terms

Property Tax Revenue

Tax Increment Financing (TIF) channels increased property tax revenue from designated districts to fund development projects within those areas, effectively reinvesting the tax gains into local infrastructure and improvements. Opportunity Zones offer federal tax incentives aimed at stimulating investment in economically distressed communities but do not directly influence property tax revenue streams. Explore how TIF and Opportunity Zones differently impact property tax dynamics and economic growth opportunities.

Capital Gains Tax Deferral

Tax Increment Financing (TIF) allows municipalities to finance redevelopment by capturing future property tax increases, but it does not provide direct capital gains tax deferral benefits to investors. Opportunity Zones offer significant capital gains tax incentives by allowing investors to defer and potentially reduce taxes on gains reinvested in designated low-income areas. Explore how each mechanism impacts investment strategies and tax planning for better financial decisions.

Infrastructure Investment

Tax Increment Financing (TIF) allocates future property tax increases within designated districts to fund immediate infrastructure projects, stimulating local development without raising taxes. Opportunity Zones provide tax incentives to investors who inject capital into economically distressed areas, promoting long-term infrastructure and economic growth. Explore detailed comparisons to identify the best infrastructure investment strategy for your community.

Source and External Links

Tax Increment Financing - Wikipedia - Tax Increment Financing (TIF) is a public financing method used to stimulate economic development in areas needing revitalization by diverting future property tax revenue increases towards development projects.

Tax Increment Financing - MN House Research - TIF is a financing method using additional property taxes from development to cover part of the costs, typically for real estate development or infrastructure improvements.

What is Tax Increment Financing (TIF) - Good Jobs First - TIF subsidizes companies by diverting taxes to finance redevelopment in designated districts, often used to support development projects through debt servicing or direct rebates.

dowidth.com

dowidth.com