Container pooling offers cost efficiency and flexibility by allowing multiple businesses to share containers, reducing capital investment and maintenance expenses. Asset leasing provides full control over logistics assets but requires higher upfront costs and ongoing management responsibilities. Explore the advantages and challenges of both container pooling and asset leasing to optimize your supply chain strategy.

Why it is important

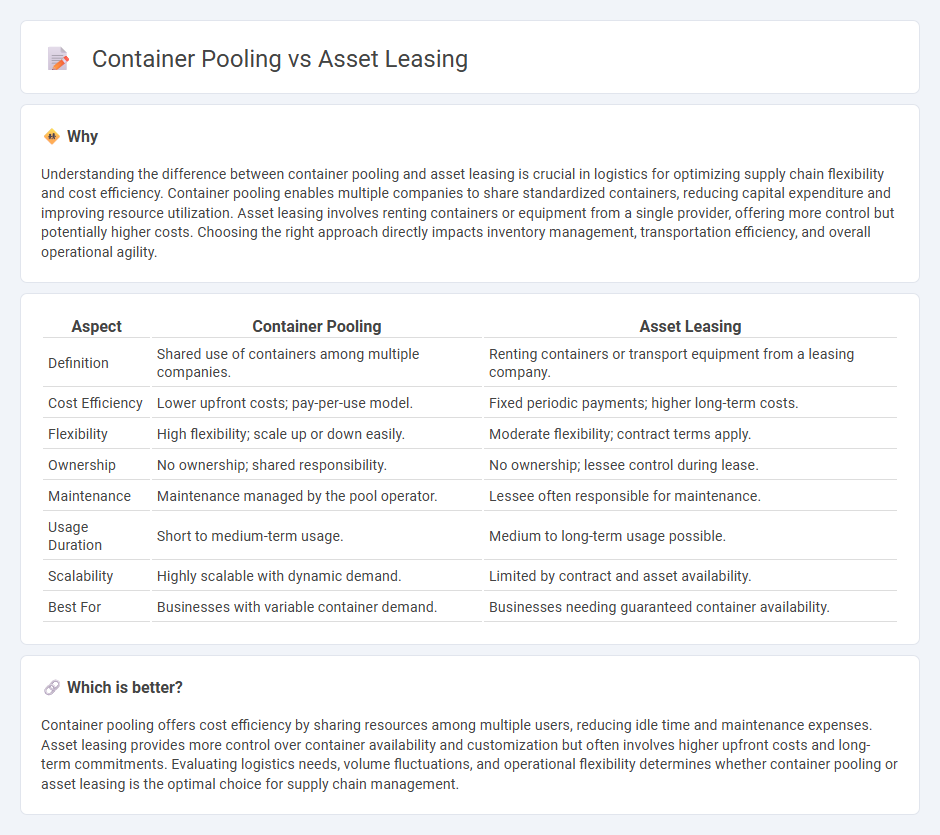

Understanding the difference between container pooling and asset leasing is crucial in logistics for optimizing supply chain flexibility and cost efficiency. Container pooling enables multiple companies to share standardized containers, reducing capital expenditure and improving resource utilization. Asset leasing involves renting containers or equipment from a single provider, offering more control but potentially higher costs. Choosing the right approach directly impacts inventory management, transportation efficiency, and overall operational agility.

Comparison Table

| Aspect | Container Pooling | Asset Leasing |

|---|---|---|

| Definition | Shared use of containers among multiple companies. | Renting containers or transport equipment from a leasing company. |

| Cost Efficiency | Lower upfront costs; pay-per-use model. | Fixed periodic payments; higher long-term costs. |

| Flexibility | High flexibility; scale up or down easily. | Moderate flexibility; contract terms apply. |

| Ownership | No ownership; shared responsibility. | No ownership; lessee control during lease. |

| Maintenance | Maintenance managed by the pool operator. | Lessee often responsible for maintenance. |

| Usage Duration | Short to medium-term usage. | Medium to long-term usage possible. |

| Scalability | Highly scalable with dynamic demand. | Limited by contract and asset availability. |

| Best For | Businesses with variable container demand. | Businesses needing guaranteed container availability. |

Which is better?

Container pooling offers cost efficiency by sharing resources among multiple users, reducing idle time and maintenance expenses. Asset leasing provides more control over container availability and customization but often involves higher upfront costs and long-term commitments. Evaluating logistics needs, volume fluctuations, and operational flexibility determines whether container pooling or asset leasing is the optimal choice for supply chain management.

Connection

Container pooling and asset leasing are interconnected strategies that enhance supply chain efficiency by reducing capital expenditure and optimizing container utilization. Businesses lease containers from a shared pool, enabling flexible capacity management and minimizing idle assets. This collaborative model supports sustainability goals by maximizing container reuse and lowering transportation costs across global logistics networks.

Key Terms

Ownership

Asset leasing involves a company renting equipment or assets from a lessor, maintaining operational control without the financial burden of ownership. Container pooling, by contrast, is a collaborative model where multiple users share ownership and management of containers, reducing individual capital investment. Explore detailed comparisons and benefits of both models to determine the best fit for your logistics strategy.

Maintenance Responsibility

Asset leasing often places full maintenance responsibility on the lessee, requiring regular upkeep and repairs to preserve asset value and ensure operational efficiency. Container pooling shifts maintenance duties toward the pool operator, who manages inspections, cleaning, and repairs to optimize container availability and condition. Explore the detailed differences in maintenance responsibilities to determine the best fit for your logistics strategy.

Flexibility

Asset leasing offers businesses the flexibility to access a wide range of equipment without the burden of ownership, enabling easy upgrades and scalability aligned with operational demands. Container pooling provides flexibility through shared usage, reducing capital expenditure while ensuring availability and maintenance of standardized containers across multiple users. Explore more to understand which option best enhances your supply chain adaptability.

Source and External Links

What Is Asset Leasing: Benefits, Models And More - Grip Invest - Asset leasing is a cost-efficient way for companies to access equipment or technology by leasing assets owned by originators, allowing optimization of cash flow without capital tie-up, supported by models like NBFC-originated leasing and LLP partnerships.

Asset Leasing as an Alternative Investment: A Guide for Investors - Asset leasing involves financial agreements where lessors lease tangible assets to lessees, enabling investors to earn steady returns through lease payments in models such as operating leases and lease-backs.

Asset leasing get started - Finance | Dynamics 365 - Learn Microsoft - Asset leasing in Microsoft Dynamics 365 automates financial tracking and accounting of leased assets, complying with IFRS 16 and ASC 842 standards, integrating lease lifecycle management within enterprise finance systems.

dowidth.com

dowidth.com