Passive income streams generate revenue with minimal ongoing effort, often through investments, royalties, or automated online sales. Subscription businesses build consistent, recurring revenue by offering continuous value through products or services on a regular schedule. Explore how these models can transform your entrepreneurial ventures and financial stability.

Why it is important

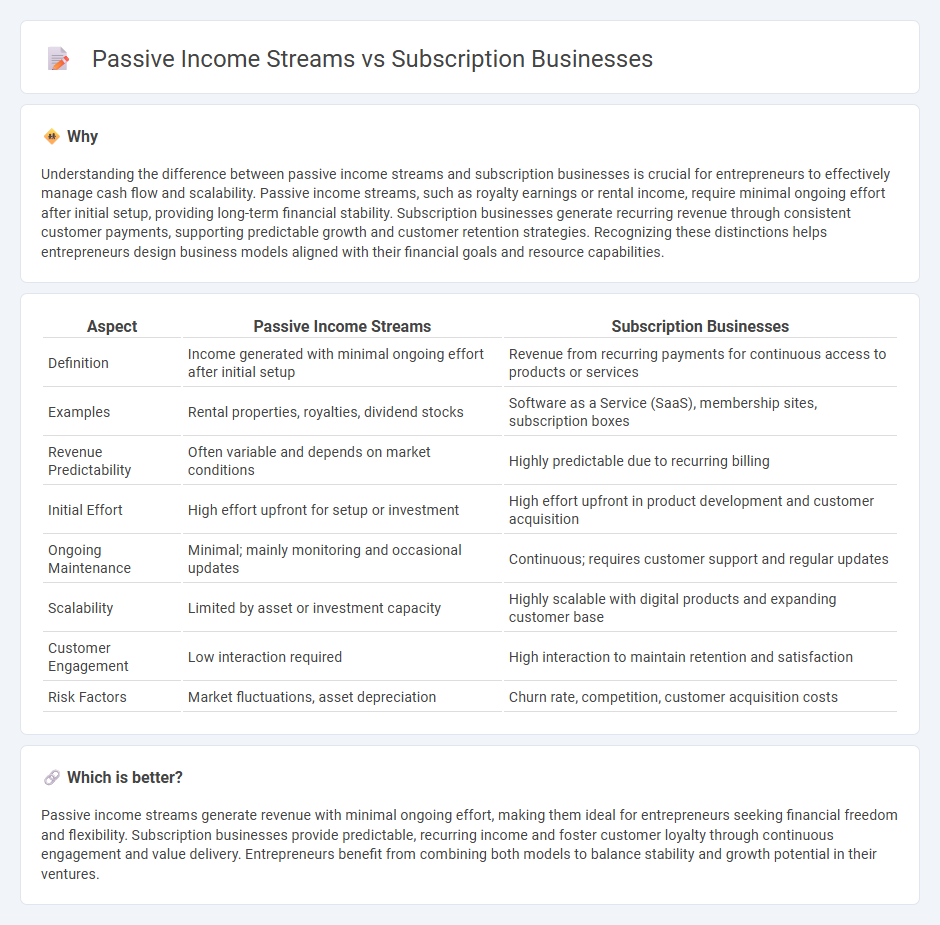

Understanding the difference between passive income streams and subscription businesses is crucial for entrepreneurs to effectively manage cash flow and scalability. Passive income streams, such as royalty earnings or rental income, require minimal ongoing effort after initial setup, providing long-term financial stability. Subscription businesses generate recurring revenue through consistent customer payments, supporting predictable growth and customer retention strategies. Recognizing these distinctions helps entrepreneurs design business models aligned with their financial goals and resource capabilities.

Comparison Table

| Aspect | Passive Income Streams | Subscription Businesses |

|---|---|---|

| Definition | Income generated with minimal ongoing effort after initial setup | Revenue from recurring payments for continuous access to products or services |

| Examples | Rental properties, royalties, dividend stocks | Software as a Service (SaaS), membership sites, subscription boxes |

| Revenue Predictability | Often variable and depends on market conditions | Highly predictable due to recurring billing |

| Initial Effort | High effort upfront for setup or investment | High effort upfront in product development and customer acquisition |

| Ongoing Maintenance | Minimal; mainly monitoring and occasional updates | Continuous; requires customer support and regular updates |

| Scalability | Limited by asset or investment capacity | Highly scalable with digital products and expanding customer base |

| Customer Engagement | Low interaction required | High interaction to maintain retention and satisfaction |

| Risk Factors | Market fluctuations, asset depreciation | Churn rate, competition, customer acquisition costs |

Which is better?

Passive income streams generate revenue with minimal ongoing effort, making them ideal for entrepreneurs seeking financial freedom and flexibility. Subscription businesses provide predictable, recurring income and foster customer loyalty through continuous engagement and value delivery. Entrepreneurs benefit from combining both models to balance stability and growth potential in their ventures.

Connection

Passive income streams and subscription businesses share a direct connection through recurring revenue models that provide entrepreneurs with steady cash flow and financial stability. Subscription businesses automate customer retention by charging regular fees, which transform active efforts into ongoing income with minimal additional work. This consistent revenue enables entrepreneurs to build scalable passive income streams that support long-term business growth and financial independence.

Key Terms

Recurring Revenue

Subscription businesses generate stable recurring revenue through consistent customer payments, enhancing cash flow predictability and scalability. Passive income streams often rely on one-time investments or intermittent earnings, potentially leading to fluctuating income. Explore comprehensive strategies to maximize recurring revenue and optimize long-term financial growth.

Automation

Subscription businesses leverage automation to streamline billing, customer management, and content delivery, ensuring consistent revenue with minimal manual intervention. Passive income streams, such as affiliate marketing or rental properties, benefit from automation tools that handle marketing, communication, or payments, enhancing efficiency and scalability. Explore how automation optimizes both models for sustained financial growth.

Churn Rate

Subscription businesses face challenges with churn rate, as customers frequently cancel recurring payments, directly impacting revenue stability and growth potential. Passive income streams typically experience lower churn since they often rely on one-time investments or automated systems, generating consistent income with minimal ongoing customer turnover. Explore effective strategies to reduce churn and enhance revenue predictability in subscription models.

Source and External Links

Subscription Business Model: How and Why It Works (2025) - Shopify - A subscription business model involves customers paying a recurring fee for products or services over time, offering convenience and predictable revenue, and it is widely used in industries from software to ecommerce with a growing market expected to reach $2.3 trillion by 2028.

Top 10 Examples of Subscription Business Models - Unicorn Group - Subscription businesses commonly include streaming, SaaS, curated boxes like Birchbox, and repeat product delivery with customization, focusing on customer delight and convenience through recurring orders.

Most popular subscription services & their growth strategies - Paddle - Subscription businesses benefit from scalable, predictable revenue and strong customer relationships, with successful models spanning software-as-a-service, wellness, delivery, and digital content industries.

dowidth.com

dowidth.com