Exit as a Service offers entrepreneurs a flexible and strategic alternative to the traditional Initial Public Offering (IPO) by providing tailored acquisition or merger options without the complexities of public market regulations. Unlike the lengthy and costly IPO process, Exit as a Service focuses on maximizing value through private transactions, often ensuring faster liquidity and reduced public scrutiny. Explore how these exit strategies can align with your business goals and growth plans.

Why it is important

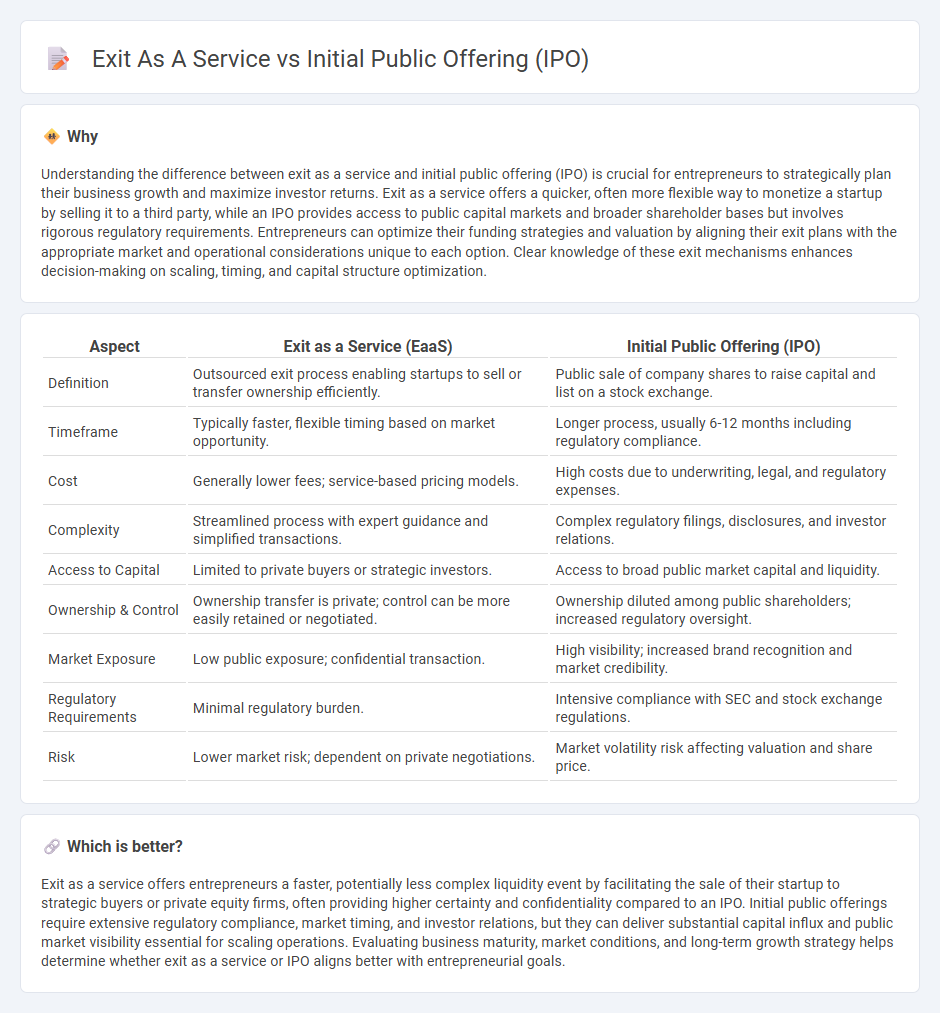

Understanding the difference between exit as a service and initial public offering (IPO) is crucial for entrepreneurs to strategically plan their business growth and maximize investor returns. Exit as a service offers a quicker, often more flexible way to monetize a startup by selling it to a third party, while an IPO provides access to public capital markets and broader shareholder bases but involves rigorous regulatory requirements. Entrepreneurs can optimize their funding strategies and valuation by aligning their exit plans with the appropriate market and operational considerations unique to each option. Clear knowledge of these exit mechanisms enhances decision-making on scaling, timing, and capital structure optimization.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Initial Public Offering (IPO) |

|---|---|---|

| Definition | Outsourced exit process enabling startups to sell or transfer ownership efficiently. | Public sale of company shares to raise capital and list on a stock exchange. |

| Timeframe | Typically faster, flexible timing based on market opportunity. | Longer process, usually 6-12 months including regulatory compliance. |

| Cost | Generally lower fees; service-based pricing models. | High costs due to underwriting, legal, and regulatory expenses. |

| Complexity | Streamlined process with expert guidance and simplified transactions. | Complex regulatory filings, disclosures, and investor relations. |

| Access to Capital | Limited to private buyers or strategic investors. | Access to broad public market capital and liquidity. |

| Ownership & Control | Ownership transfer is private; control can be more easily retained or negotiated. | Ownership diluted among public shareholders; increased regulatory oversight. |

| Market Exposure | Low public exposure; confidential transaction. | High visibility; increased brand recognition and market credibility. |

| Regulatory Requirements | Minimal regulatory burden. | Intensive compliance with SEC and stock exchange regulations. |

| Risk | Lower market risk; dependent on private negotiations. | Market volatility risk affecting valuation and share price. |

Which is better?

Exit as a service offers entrepreneurs a faster, potentially less complex liquidity event by facilitating the sale of their startup to strategic buyers or private equity firms, often providing higher certainty and confidentiality compared to an IPO. Initial public offerings require extensive regulatory compliance, market timing, and investor relations, but they can deliver substantial capital influx and public market visibility essential for scaling operations. Evaluating business maturity, market conditions, and long-term growth strategy helps determine whether exit as a service or IPO aligns better with entrepreneurial goals.

Connection

Exit as a service provides founders and investors with structured strategies to successfully transition ownership, often preparing startups for significant liquidity events such as an initial public offering (IPO). IPO serves as a high-profile exit route, allowing companies to raise capital by offering shares to the public while enabling early stakeholders to monetize their equity. Both exit as a service and IPO are integral in maximizing return on investment and facilitating company growth beyond private funding stages.

Key Terms

Liquidity Event

An initial public offering (IPO) is a liquidity event where a private company offers shares to the public for the first time, enabling investors to realize gains and the company to raise capital. Exit as a service provides tailored solutions for founders and investors to achieve liquidity through various strategies, including mergers, acquisitions, or secondary sales, without going public. Explore more about how each option can strategically impact shareholder value and business growth.

Valuation

Initial Public Offering (IPO) typically results in higher market-driven valuation through public trading, allowing companies to access significant capital and liquidity. Exit as a Service (EaaS) offers a flexible, technology-driven alternative to traditional exits, often prioritizing speed and operational efficiency over maximal valuation. Discover how choosing between IPO and EaaS can strategically impact your company's valuation and growth trajectory.

Acquisition

An initial public offering (IPO) enables companies to raise capital by selling shares to the public, while Exit as a Service (EaaS) specializes in facilitating acquisitions to provide founders and investors with liquidity. EaaS leverages strategic buyer matchmaking, deal negotiation, and post-acquisition integration to streamline the exit process compared to the complex regulatory environment of IPOs. Discover how EaaS can optimize your company's acquisition strategy and provide a seamless exit experience.

Source and External Links

Initial public offering - Wikipedia - An IPO is when a private company offers shares to institutional and retail investors to raise capital and transitions into a public company, usually underwritten by investment banks and traded on stock exchanges.

What is an Initial public offering (IPO)? - British Business Bank - An IPO is the first time a business raises finance publicly, allowing it to attract many investors, retain control, and access long-term capital markets, with different markets suited for companies by size and growth.

Understanding and Planning an Initial Public Offering (IPO) - The IPO process involves registering shares with the SEC, filing a prospectus, and demands extensive preparation including audited financials and due diligence before shares are listed and publicly traded.

dowidth.com

dowidth.com