Passive income streams offer entrepreneurs scalable revenue sources requiring minimal ongoing effort, such as rental properties, dividends, or digital product sales. Franchise ownership demands active management but provides a proven business model, brand recognition, and franchisor support, reducing startup risks. Explore detailed comparisons to determine which approach best aligns with your financial goals and lifestyle preferences.

Why it is important

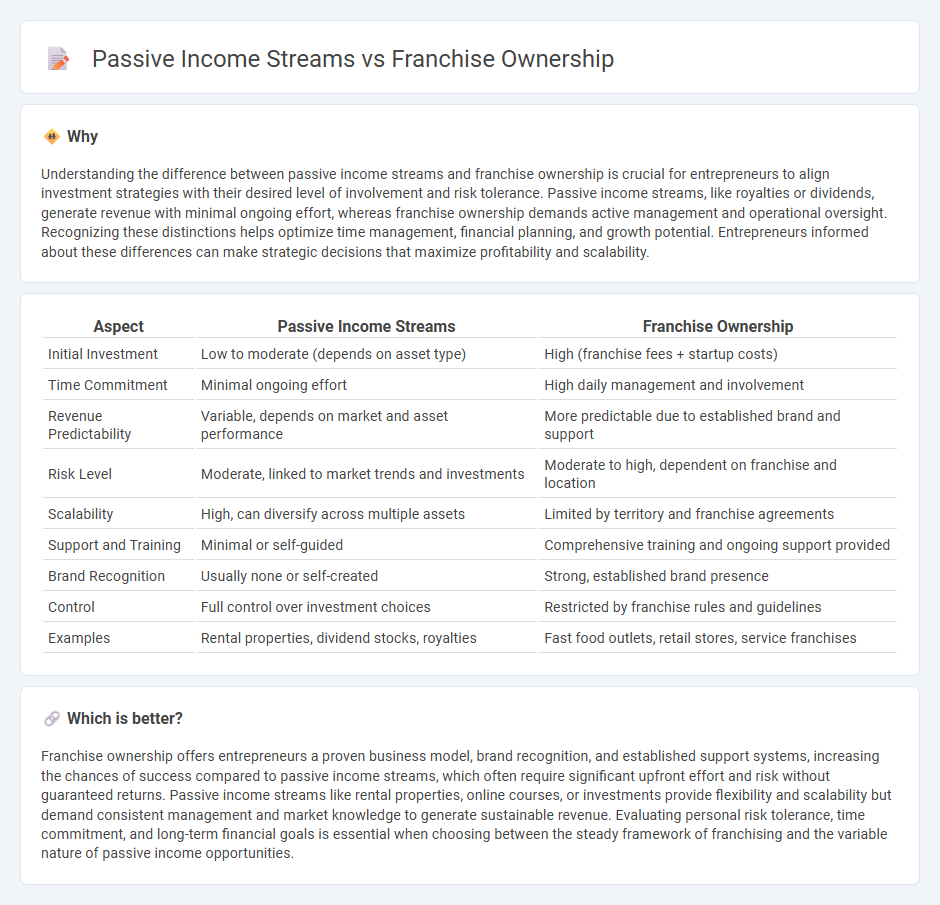

Understanding the difference between passive income streams and franchise ownership is crucial for entrepreneurs to align investment strategies with their desired level of involvement and risk tolerance. Passive income streams, like royalties or dividends, generate revenue with minimal ongoing effort, whereas franchise ownership demands active management and operational oversight. Recognizing these distinctions helps optimize time management, financial planning, and growth potential. Entrepreneurs informed about these differences can make strategic decisions that maximize profitability and scalability.

Comparison Table

| Aspect | Passive Income Streams | Franchise Ownership |

|---|---|---|

| Initial Investment | Low to moderate (depends on asset type) | High (franchise fees + startup costs) |

| Time Commitment | Minimal ongoing effort | High daily management and involvement |

| Revenue Predictability | Variable, depends on market and asset performance | More predictable due to established brand and support |

| Risk Level | Moderate, linked to market trends and investments | Moderate to high, dependent on franchise and location |

| Scalability | High, can diversify across multiple assets | Limited by territory and franchise agreements |

| Support and Training | Minimal or self-guided | Comprehensive training and ongoing support provided |

| Brand Recognition | Usually none or self-created | Strong, established brand presence |

| Control | Full control over investment choices | Restricted by franchise rules and guidelines |

| Examples | Rental properties, dividend stocks, royalties | Fast food outlets, retail stores, service franchises |

Which is better?

Franchise ownership offers entrepreneurs a proven business model, brand recognition, and established support systems, increasing the chances of success compared to passive income streams, which often require significant upfront effort and risk without guaranteed returns. Passive income streams like rental properties, online courses, or investments provide flexibility and scalability but demand consistent management and market knowledge to generate sustainable revenue. Evaluating personal risk tolerance, time commitment, and long-term financial goals is essential when choosing between the steady framework of franchising and the variable nature of passive income opportunities.

Connection

Passive income streams generate consistent revenue with minimal active involvement, aligning with franchise ownership where established business models offer predictable earnings. Franchise owners leverage brand recognition, proven systems, and operational support to create semi-automated income sources. This connection makes franchises an attractive option for entrepreneurs seeking scalable and relatively hands-off income opportunities.

Key Terms

Franchise Fee

Franchise ownership requires a significant initial investment known as the franchise fee, which grants the right to operate under an established brand and access to proprietary systems, training, and support. Passive income streams typically involve lower upfront costs and do not usually require a substantial franchise fee, focusing instead on investments such as rental properties, dividends, or online businesses. Explore the benefits and limitations of franchise fees compared to passive income models to determine the best fit for your financial goals.

Royalty Payments

Franchise ownership generates royalty payments based on a percentage of gross sales, creating a steady income tied to operational performance and brand strength. Passive income streams often involve royalties from intellectual property, such as books, music, or patents, providing earnings without day-to-day involvement. Explore how royalty payments differ in risk and effort to determine the optimal income strategy for your financial goals.

Automated Revenue

Franchise ownership offers a structured business model with proven brand recognition, but often requires active management and significant time investment, whereas automated revenue streams generate income with minimal day-to-day involvement by leveraging technology and recurring sales models. Passive income sources such as royalties, affiliate marketing, or digital product sales emphasize scalability and automation to maximize earnings without constant oversight. Explore strategies to optimize your financial portfolio by combining franchise opportunities with automated revenue streams.

Source and External Links

A Consumer's Guide to Buying a Franchise - Franchise ownership means operating a business using a franchisor's established brand and system, paying initial fees, ongoing royalties, and advertising fees, while receiving training and support from the franchisor.

What does a franchise owner do? - A franchise owner invests in and operates one or more franchise locations, managing daily operations, staffing, finances, and ensuring compliance with franchisor standards.

Different Types of Franchise Ownership - Franchise ownership can vary from single-unit owners who manage day-to-day operations to master franchisees who control large territories and sub-franchise rights, reflecting different levels of involvement and responsibility.

dowidth.com

dowidth.com