Sweat equity marketplaces enable entrepreneurs to exchange their skills and labor for company ownership, fostering collaboration and growth without upfront capital. Revenue-based financing provides startups with capital in exchange for a fixed percentage of future revenue, aligning investor returns with business performance. Explore these innovative funding models to discover which best supports your entrepreneurial goals.

Why it is important

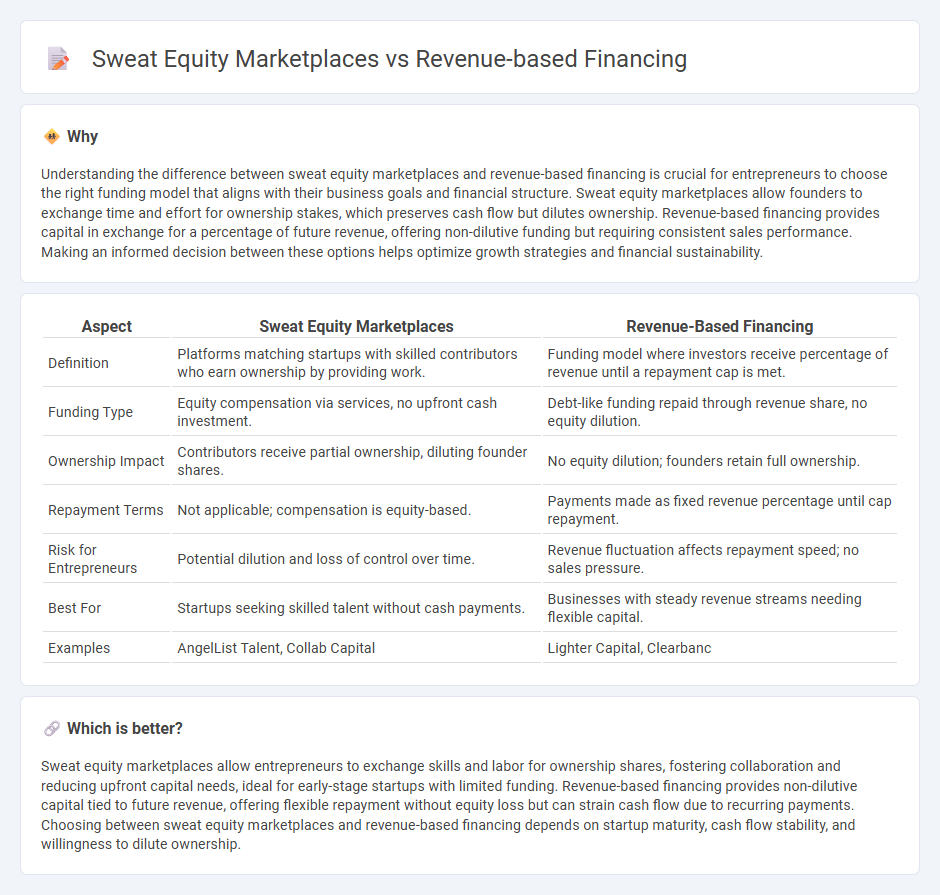

Understanding the difference between sweat equity marketplaces and revenue-based financing is crucial for entrepreneurs to choose the right funding model that aligns with their business goals and financial structure. Sweat equity marketplaces allow founders to exchange time and effort for ownership stakes, which preserves cash flow but dilutes ownership. Revenue-based financing provides capital in exchange for a percentage of future revenue, offering non-dilutive funding but requiring consistent sales performance. Making an informed decision between these options helps optimize growth strategies and financial sustainability.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Revenue-Based Financing |

|---|---|---|

| Definition | Platforms matching startups with skilled contributors who earn ownership by providing work. | Funding model where investors receive percentage of revenue until a repayment cap is met. |

| Funding Type | Equity compensation via services, no upfront cash investment. | Debt-like funding repaid through revenue share, no equity dilution. |

| Ownership Impact | Contributors receive partial ownership, diluting founder shares. | No equity dilution; founders retain full ownership. |

| Repayment Terms | Not applicable; compensation is equity-based. | Payments made as fixed revenue percentage until cap repayment. |

| Risk for Entrepreneurs | Potential dilution and loss of control over time. | Revenue fluctuation affects repayment speed; no sales pressure. |

| Best For | Startups seeking skilled talent without cash payments. | Businesses with steady revenue streams needing flexible capital. |

| Examples | AngelList Talent, Collab Capital | Lighter Capital, Clearbanc |

Which is better?

Sweat equity marketplaces allow entrepreneurs to exchange skills and labor for ownership shares, fostering collaboration and reducing upfront capital needs, ideal for early-stage startups with limited funding. Revenue-based financing provides non-dilutive capital tied to future revenue, offering flexible repayment without equity loss but can strain cash flow due to recurring payments. Choosing between sweat equity marketplaces and revenue-based financing depends on startup maturity, cash flow stability, and willingness to dilute ownership.

Connection

Sweat equity marketplaces facilitate entrepreneurs trading labor and expertise for ownership stakes, aligning incentives without upfront capital. Revenue-based financing complements this by providing flexible funding tied directly to future income, reducing investor risk. Together, these models empower startups to access resources and finance while preserving control and fostering sustainable growth.

Key Terms

Repayment Structure

Revenue-based financing offers flexible repayments tied directly to a percentage of the company's revenue, ensuring payments scale with cash flow and minimize financial strain during low-income periods. Sweat equity marketplaces, on the other hand, involve founders or contributors exchanging their time and skills for equity stakes, eliminating traditional repayment obligations but diluting ownership. Explore deeper insights into how repayment structures impact startup financing and ownership dynamics.

Founder Ownership

Revenue-based financing offers founders the advantage of maintaining significant ownership by repaying investors through a fixed percentage of future revenues without diluting equity. Sweat equity marketplaces allow founders to exchange ownership stakes for skills and services, leading to potential dilution but fostering collaboration and resource access. Explore deeper insights into Founder Ownership strategies across these funding models for your startup's growth optimization.

Capital Source

Revenue-based financing provides startups with capital in exchange for a percentage of future revenue, offering flexible repayment without equity dilution. Sweat equity marketplaces connect entrepreneurs and investors through service contributions, enabling growth through shared expertise rather than cash investment. Explore how these capital sources can impact your funding strategy.

Source and External Links

What is Revenue-Based Financing? Pros and Cons (2025) - Shopify - Revenue-based financing is a loan model where investors provide capital in exchange for a fixed percentage of a company's monthly revenue until a repayment cap, usually 1.2 to 3 times the loan amount, is reached, with payments fluctuating according to revenue levels.

Revenue-based financing - Wikipedia - Revenue-based financing (RBF) is a non-dilutive capital method where investors receive a percentage of ongoing gross revenues until they recover the principal plus a pre-agreed multiple, typically within 1 to 5 years, allowing business owners to retain full equity and control.

Revenue-based Financing | Compare & Apply Online - Kapitus - RBF offers flexible financing by exchanging funding for a percentage of business revenue with no fixed repayment timeline or interest, enabling payments to rise and fall in sync with revenue until the full amount plus fees is paid, without equity dilution.

dowidth.com

dowidth.com