Micro private equity involves investing in smaller, established companies with stable cash flows, focusing on operational improvements and long-term growth. Venture capital targets early-stage startups with high growth potential, accepting greater risks in exchange for significant equity stakes. Explore the key differences and opportunities within these investment strategies to enhance your entrepreneurial ventures.

Why it is important

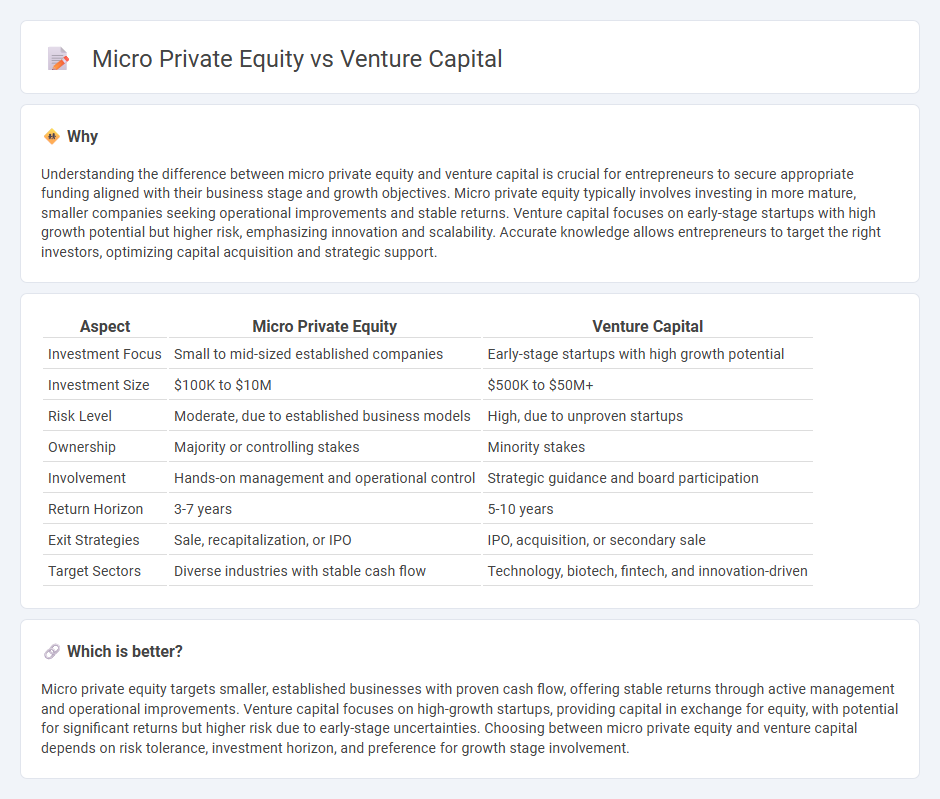

Understanding the difference between micro private equity and venture capital is crucial for entrepreneurs to secure appropriate funding aligned with their business stage and growth objectives. Micro private equity typically involves investing in more mature, smaller companies seeking operational improvements and stable returns. Venture capital focuses on early-stage startups with high growth potential but higher risk, emphasizing innovation and scalability. Accurate knowledge allows entrepreneurs to target the right investors, optimizing capital acquisition and strategic support.

Comparison Table

| Aspect | Micro Private Equity | Venture Capital |

|---|---|---|

| Investment Focus | Small to mid-sized established companies | Early-stage startups with high growth potential |

| Investment Size | $100K to $10M | $500K to $50M+ |

| Risk Level | Moderate, due to established business models | High, due to unproven startups |

| Ownership | Majority or controlling stakes | Minority stakes |

| Involvement | Hands-on management and operational control | Strategic guidance and board participation |

| Return Horizon | 3-7 years | 5-10 years |

| Exit Strategies | Sale, recapitalization, or IPO | IPO, acquisition, or secondary sale |

| Target Sectors | Diverse industries with stable cash flow | Technology, biotech, fintech, and innovation-driven |

Which is better?

Micro private equity targets smaller, established businesses with proven cash flow, offering stable returns through active management and operational improvements. Venture capital focuses on high-growth startups, providing capital in exchange for equity, with potential for significant returns but higher risk due to early-stage uncertainties. Choosing between micro private equity and venture capital depends on risk tolerance, investment horizon, and preference for growth stage involvement.

Connection

Micro private equity and venture capital both focus on funding early-stage companies, with micro private equity typically investing in smaller, established businesses seeking growth capital while venture capital targets startups with high growth potential. Both investment types provide not only capital but also strategic guidance, operational support, and access to networks, facilitating business expansion and innovation. These financing vehicles are essential components of the entrepreneurial ecosystem, enabling scalable business models and driving economic development through job creation.

Key Terms

Funding Size

Venture capital typically involves investments ranging from $1 million to $10 million, targeting early to growth-stage startups with high growth potential. Micro private equity funds generally invest larger amounts, often between $10 million and $50 million, focusing on small to medium-sized established companies seeking operational improvements or market expansion. Explore detailed comparisons to understand which funding size aligns best with your business goals.

Investment Stage

Venture capital primarily targets early-stage startups with high growth potential, providing seed and Series A funding to fuel product development and market entry. Micro private equity focuses on later-stage, established small to medium enterprises (SMEs) requiring capital for expansion, operational improvements, or ownership transitions. Explore further to understand how each investment stage aligns with your business growth strategy.

Ownership Structure

Venture capital typically involves minority ownership stakes in high-growth startups, allowing founders to retain control while investors seek significant returns. Micro private equity generally targets majority ownership in smaller, mature companies to implement operational improvements and drive value creation. Explore further to understand how these ownership structures impact investment strategies and company growth.

Source and External Links

What is Venture Capital? - Venture capital is funding that turns ideas and research into high-growth companies by providing risk capital that traditional financing won't, supporting new businesses typically for five to eight years, and partnering closely with entrepreneurs to scale innovative companies.

What is Venture Capital? - Venture capital provides financing to startups with novel technologies and innovations exhibiting high growth potential and risk, usually in exchange for equity, and takes a long-term portfolio approach due to the high risk of failure in individual investments.

Fund your business | U.S. Small Business Administration - Venture capital funds high-growth companies by investing capital in exchange for equity and often requires entrepreneurs to give up some ownership and control, with investments coming in rounds as companies achieve milestones.

dowidth.com

dowidth.com