Sweat equity marketplaces allow entrepreneurs to exchange their skills and time for ownership stakes, fostering collaborative growth without upfront cash investments. Venture capital provides substantial financial resources and strategic guidance but often requires equity dilution and control relinquishment. Explore how choosing between sweat equity and venture capital can shape your entrepreneurial journey and business success.

Why it is important

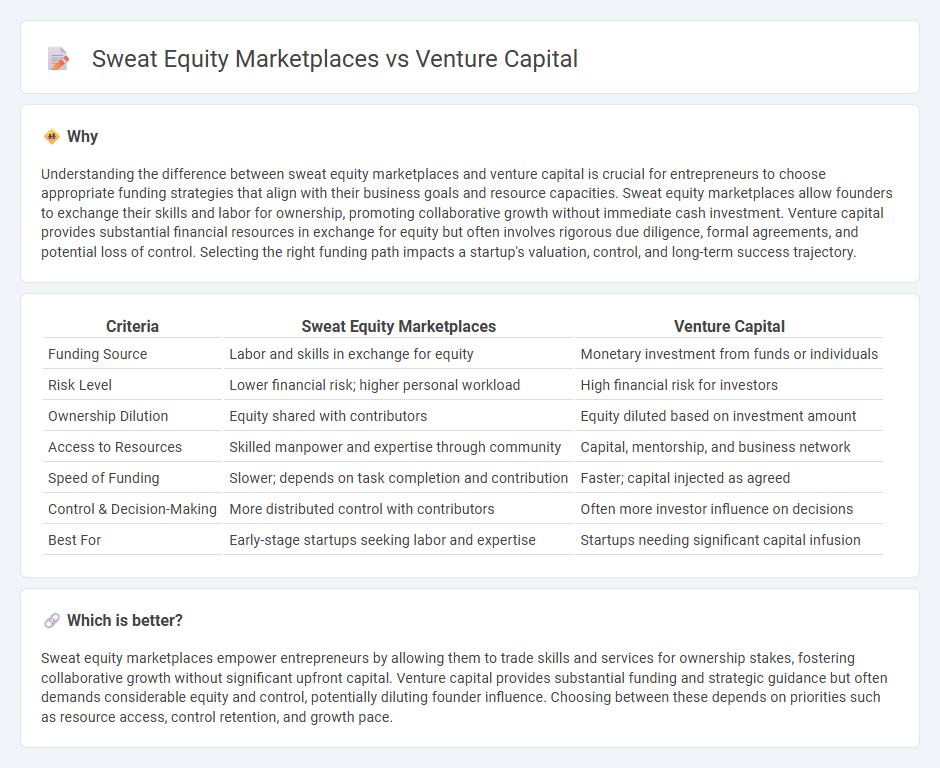

Understanding the difference between sweat equity marketplaces and venture capital is crucial for entrepreneurs to choose appropriate funding strategies that align with their business goals and resource capacities. Sweat equity marketplaces allow founders to exchange their skills and labor for ownership, promoting collaborative growth without immediate cash investment. Venture capital provides substantial financial resources in exchange for equity but often involves rigorous due diligence, formal agreements, and potential loss of control. Selecting the right funding path impacts a startup's valuation, control, and long-term success trajectory.

Comparison Table

| Criteria | Sweat Equity Marketplaces | Venture Capital |

|---|---|---|

| Funding Source | Labor and skills in exchange for equity | Monetary investment from funds or individuals |

| Risk Level | Lower financial risk; higher personal workload | High financial risk for investors |

| Ownership Dilution | Equity shared with contributors | Equity diluted based on investment amount |

| Access to Resources | Skilled manpower and expertise through community | Capital, mentorship, and business network |

| Speed of Funding | Slower; depends on task completion and contribution | Faster; capital injected as agreed |

| Control & Decision-Making | More distributed control with contributors | Often more investor influence on decisions |

| Best For | Early-stage startups seeking labor and expertise | Startups needing significant capital infusion |

Which is better?

Sweat equity marketplaces empower entrepreneurs by allowing them to trade skills and services for ownership stakes, fostering collaborative growth without significant upfront capital. Venture capital provides substantial funding and strategic guidance but often demands considerable equity and control, potentially diluting founder influence. Choosing between these depends on priorities such as resource access, control retention, and growth pace.

Connection

Sweat equity marketplaces connect entrepreneurs with skilled contributors who exchange labor and expertise for ownership stakes, facilitating startup growth without immediate cash investment. Venture capital often enters later to provide substantial funding based on the initial value created through sweat equity, accelerating scalability and market entry. This symbiotic relationship enables startups to optimize resources, validate their business models, and attract larger investments for expansion.

Key Terms

Funding Mechanism

Venture capital marketplaces facilitate funding by connecting startups with investors who provide capital in exchange for equity, enabling rapid scaling through substantial financial resources. Sweat equity marketplaces enable entrepreneurs to trade their skills and time for ownership stakes, offering a non-monetary funding mechanism that rewards operational contributions. Explore how each funding mechanism impacts startup growth and ownership distribution to determine the best fit for your business model.

Ownership Structure

Venture capital marketplaces typically offer external funding in exchange for equity stakes, diluting original ownership but providing substantial capital for growth. Sweat equity marketplaces emphasize contribution through labor or expertise, increasing ownership without immediate financial investment but requiring significant personal input. Explore how these ownership structures impact startup control and long-term value creation.

Risk-Reward Allocation

Venture capital marketplaces typically involve external investors providing significant funding in exchange for equity, with risk and reward shared between founders and investors based on valuation and ownership stakes. Sweat equity marketplaces allocate ownership through contributors' time, skills, and effort rather than cash, distributing risk and reward according to non-monetary contributions and project success. Explore the nuances of risk-reward allocation to understand which marketplace model best suits your startup's growth strategy.

Source and External Links

What is Venture Capital? - Venture capital is funding that transforms ideas and research into high-growth companies, providing financial and strategic support to startups that traditional financing cannot, often investing long-term to build companies that become major market players.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups with innovative technologies and high growth potential, taking equity stakes with a long-term outlook and diversifying investments across portfolios due to high risk and uncertain success.

Fund your business | U.S. Small Business Administration - Venture capital focuses on high-growth startups by investing capital in exchange for equity and often involves investors taking active roles such as board seats, following a due diligence process before funding rounds.

dowidth.com

dowidth.com