Tiny acquisitions offer entrepreneurs rapid market entry by acquiring small, existing businesses with established customer bases and cash flow, minimizing startup risks. Microfunds provide targeted capital to early-stage ventures, empowering innovation and growth in niche markets with flexible financing options tailored to entrepreneurs' needs. Discover how these strategies can accelerate your entrepreneurial journey.

Why it is important

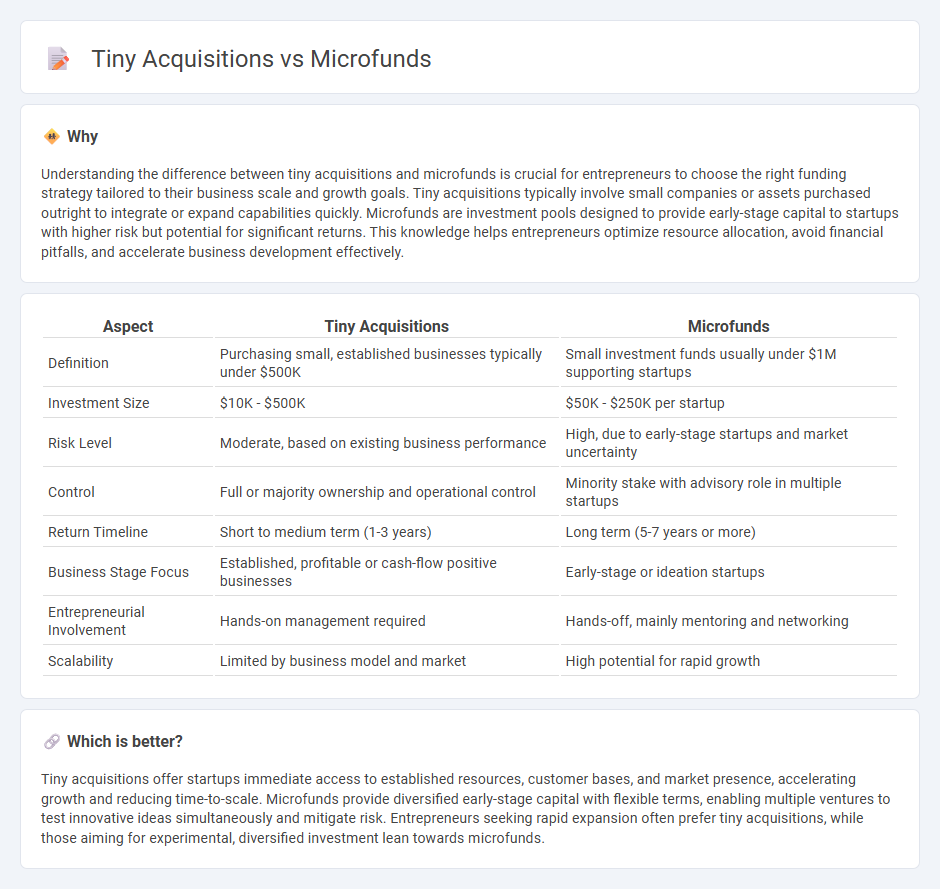

Understanding the difference between tiny acquisitions and microfunds is crucial for entrepreneurs to choose the right funding strategy tailored to their business scale and growth goals. Tiny acquisitions typically involve small companies or assets purchased outright to integrate or expand capabilities quickly. Microfunds are investment pools designed to provide early-stage capital to startups with higher risk but potential for significant returns. This knowledge helps entrepreneurs optimize resource allocation, avoid financial pitfalls, and accelerate business development effectively.

Comparison Table

| Aspect | Tiny Acquisitions | Microfunds |

|---|---|---|

| Definition | Purchasing small, established businesses typically under $500K | Small investment funds usually under $1M supporting startups |

| Investment Size | $10K - $500K | $50K - $250K per startup |

| Risk Level | Moderate, based on existing business performance | High, due to early-stage startups and market uncertainty |

| Control | Full or majority ownership and operational control | Minority stake with advisory role in multiple startups |

| Return Timeline | Short to medium term (1-3 years) | Long term (5-7 years or more) |

| Business Stage Focus | Established, profitable or cash-flow positive businesses | Early-stage or ideation startups |

| Entrepreneurial Involvement | Hands-on management required | Hands-off, mainly mentoring and networking |

| Scalability | Limited by business model and market | High potential for rapid growth |

Which is better?

Tiny acquisitions offer startups immediate access to established resources, customer bases, and market presence, accelerating growth and reducing time-to-scale. Microfunds provide diversified early-stage capital with flexible terms, enabling multiple ventures to test innovative ideas simultaneously and mitigate risk. Entrepreneurs seeking rapid expansion often prefer tiny acquisitions, while those aiming for experimental, diversified investment lean towards microfunds.

Connection

Tiny acquisitions enable startups to gain rapid access to new technologies and customer bases, often facilitated by microfunds that provide targeted, small-scale investments tailored for early-stage ventures. Microfunds specialize in seeding tiny acquisitions by supplying flexible capital, which accelerates innovation cycles and reduces barriers to market entry for entrepreneurs. This symbiotic relationship fosters agile growth strategies, fueling the entrepreneurial ecosystem through scalable, incremental expansion.

Key Terms

Seed Capital

Seed capital serves as the initial funding crucial for startups aiming to transform ideas into viable businesses, often sourced through microfunds characterized by small, strategic investments that mitigate risk while fostering innovation. Tiny acquisitions, by contrast, involve established companies acquiring small startups to enhance product lines or enter new markets, providing immediate scalability and resource integration but requiring more substantial buy-in than microfunds. To explore detailed strategies and benefits of seed capital through microfunds versus tiny acquisitions, delve deeper into the funding landscape.

Due Diligence

Due diligence in microfunds emphasizes thorough evaluation of startups' financials and market potential to minimize investment risks in early-stage ventures. Tiny acquisitions require meticulous assessment of target companies' operational synergies, legal compliances, and hidden liabilities to ensure alignment with strategic goals. Explore our detailed analysis to understand the critical due diligence distinctions between microfunds and tiny acquisitions.

Exit Strategy

Microfunds primarily emphasize early-stage investments with scalable exit strategies through equity sales or IPOs, targeting high-growth startups. Tiny acquisitions focus on purchasing small businesses to generate immediate cash flow, often aiming for quick resales or integrations as exit strategies. Explore detailed comparisons to optimize your investment approach.

Source and External Links

Micro-Fund - Superscout - A micro-fund is a type of venture capital fund that invests smaller amounts (typically PS1,000 - PS50,000) in early-stage startups and innovative projects, helping entrepreneurs access capital outside traditional sources.

Venture Capital Micro-Funds - VC Lab - VC micro-funds are small, focused venture capital funds that invest in niche early-stage companies, offering personalized attention and nimble strategies for emerging markets.

Micro venture capital - Wikipedia - Micro venture capital involves smaller seed investments (typically $25K to $500K) in early-stage companies that have not yet gained traction, functioning as an important funding source distinct from traditional VC.

dowidth.com

dowidth.com