Micro private equity focuses on providing targeted capital investments to small and growing businesses, enabling rapid expansion and value creation through strategic financial support. Business incubators offer startups comprehensive mentorship, resources, and networking opportunities to nurture early-stage development and foster innovation. Explore how these distinct models empower entrepreneurs and drive business success.

Why it is important

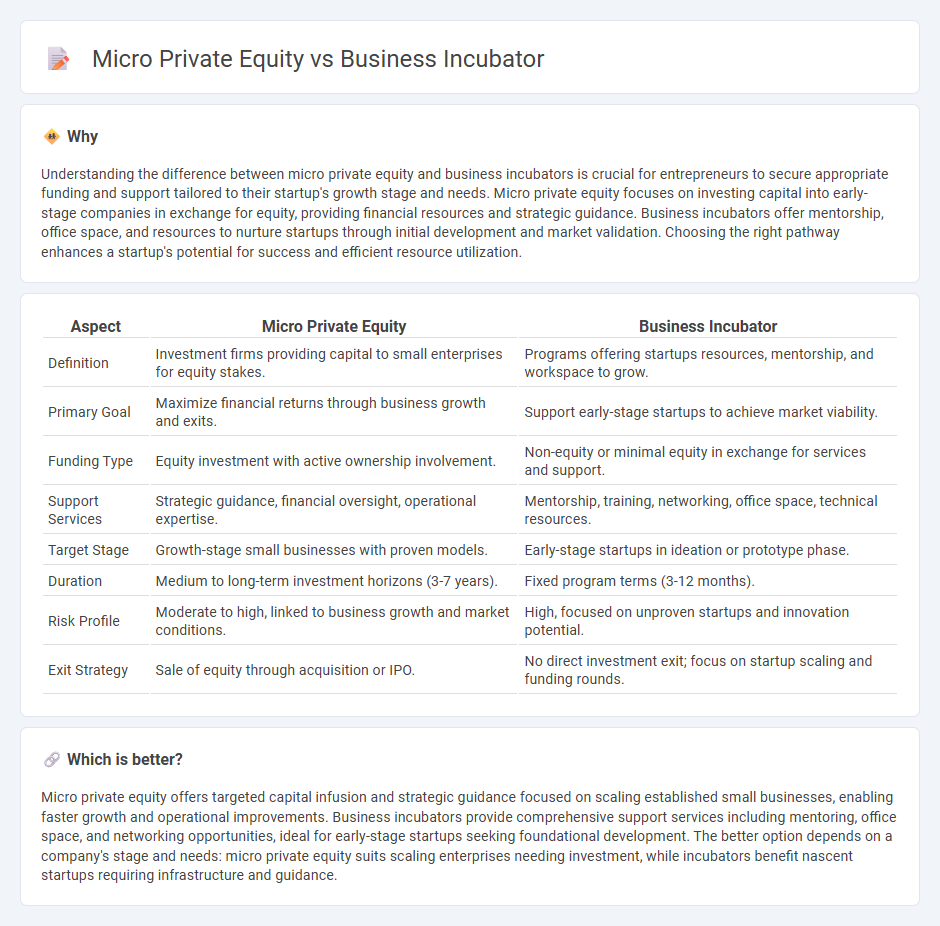

Understanding the difference between micro private equity and business incubators is crucial for entrepreneurs to secure appropriate funding and support tailored to their startup's growth stage and needs. Micro private equity focuses on investing capital into early-stage companies in exchange for equity, providing financial resources and strategic guidance. Business incubators offer mentorship, office space, and resources to nurture startups through initial development and market validation. Choosing the right pathway enhances a startup's potential for success and efficient resource utilization.

Comparison Table

| Aspect | Micro Private Equity | Business Incubator |

|---|---|---|

| Definition | Investment firms providing capital to small enterprises for equity stakes. | Programs offering startups resources, mentorship, and workspace to grow. |

| Primary Goal | Maximize financial returns through business growth and exits. | Support early-stage startups to achieve market viability. |

| Funding Type | Equity investment with active ownership involvement. | Non-equity or minimal equity in exchange for services and support. |

| Support Services | Strategic guidance, financial oversight, operational expertise. | Mentorship, training, networking, office space, technical resources. |

| Target Stage | Growth-stage small businesses with proven models. | Early-stage startups in ideation or prototype phase. |

| Duration | Medium to long-term investment horizons (3-7 years). | Fixed program terms (3-12 months). |

| Risk Profile | Moderate to high, linked to business growth and market conditions. | High, focused on unproven startups and innovation potential. |

| Exit Strategy | Sale of equity through acquisition or IPO. | No direct investment exit; focus on startup scaling and funding rounds. |

Which is better?

Micro private equity offers targeted capital infusion and strategic guidance focused on scaling established small businesses, enabling faster growth and operational improvements. Business incubators provide comprehensive support services including mentoring, office space, and networking opportunities, ideal for early-stage startups seeking foundational development. The better option depends on a company's stage and needs: micro private equity suits scaling enterprises needing investment, while incubators benefit nascent startups requiring infrastructure and guidance.

Connection

Micro private equity firms often partner with business incubators to identify and invest in high-potential startups at early stages, leveraging the incubators' support networks and resources. Business incubators provide mentorship, workspace, and business services that enhance a startup's growth trajectory, increasing the likelihood of successful exits for micro private equity investors. This symbiotic relationship accelerates innovation while facilitating targeted capital deployment in emerging ventures.

Key Terms

**Business Incubator:**

Business incubators provide startups with essential resources such as mentorship, office space, and business services to accelerate early-stage growth and innovation while reducing operational risks. Unlike micro private equity, which invests capital in mature small businesses seeking growth or restructuring, incubators emphasize nurturing ideas and entrepreneurial development from inception. Discover the strategic advantages of business incubators for launching successful startups.

Startup Support

Business incubators provide startups with essential resources such as mentorship, office space, and networking opportunities to accelerate early-stage growth. Micro private equity firms invest capital in small businesses, focusing on value creation through operational improvements and strategic guidance. Explore the differences in how these entities support startups and drive business success.

Mentorship

Business incubators emphasize mentorship by providing startups with expert guidance, industry connections, and hands-on support to scale their operations effectively. Micro private equity firms typically focus on capital investment and strategic oversight but offer limited mentorship compared to the comprehensive support in incubators. Explore the distinct mentorship advantages of both models to optimize your business growth strategy.

Source and External Links

What Is a Business Incubator and How Does It Work? | Indeed.com - A business incubator is a specialized program that provides startups with mentorship, training, networking opportunities, and cost-saving resources to help new businesses learn, grow, and plan effectively during an early stage of development.

Neighborhood Business Incubators - Neighborhood business incubators offer free or low-cost workspace, mentorship, investor access, and business development resources tailored to specific communities and industries, aiming to help entrepreneurs overcome capital, education, and networking challenges.

Business Incubator - Entrepreneur Small Business Encyclopedia - Business incubators are organizations sponsored by private or public entities to accelerate the growth and success of startups by providing below-market office space, expert advice, and shared services, typically supporting companies for about two years to reduce overhead and operational costs.

dowidth.com

dowidth.com