Alternative funding platforms offer entrepreneurs diverse financing options such as crowdfunding, peer-to-peer lending, and equity platforms, providing faster access to capital than traditional microfinance institutions. Microfinance institutions focus on small loans and financial services for underserved populations, often emphasizing social impact and community development. Explore how these funding sources can empower your entrepreneurial journey with tailored financial solutions.

Why it is important

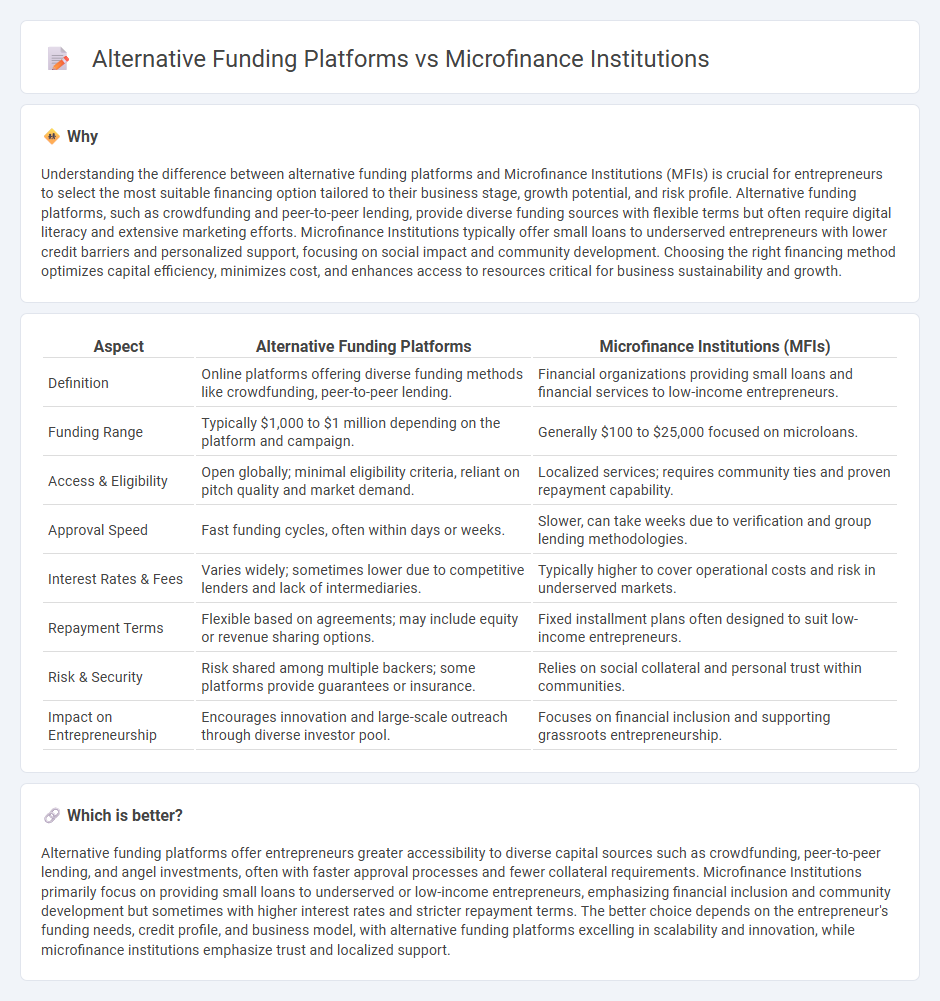

Understanding the difference between alternative funding platforms and Microfinance Institutions (MFIs) is crucial for entrepreneurs to select the most suitable financing option tailored to their business stage, growth potential, and risk profile. Alternative funding platforms, such as crowdfunding and peer-to-peer lending, provide diverse funding sources with flexible terms but often require digital literacy and extensive marketing efforts. Microfinance Institutions typically offer small loans to underserved entrepreneurs with lower credit barriers and personalized support, focusing on social impact and community development. Choosing the right financing method optimizes capital efficiency, minimizes cost, and enhances access to resources critical for business sustainability and growth.

Comparison Table

| Aspect | Alternative Funding Platforms | Microfinance Institutions (MFIs) |

|---|---|---|

| Definition | Online platforms offering diverse funding methods like crowdfunding, peer-to-peer lending. | Financial organizations providing small loans and financial services to low-income entrepreneurs. |

| Funding Range | Typically $1,000 to $1 million depending on the platform and campaign. | Generally $100 to $25,000 focused on microloans. |

| Access & Eligibility | Open globally; minimal eligibility criteria, reliant on pitch quality and market demand. | Localized services; requires community ties and proven repayment capability. |

| Approval Speed | Fast funding cycles, often within days or weeks. | Slower, can take weeks due to verification and group lending methodologies. |

| Interest Rates & Fees | Varies widely; sometimes lower due to competitive lenders and lack of intermediaries. | Typically higher to cover operational costs and risk in underserved markets. |

| Repayment Terms | Flexible based on agreements; may include equity or revenue sharing options. | Fixed installment plans often designed to suit low-income entrepreneurs. |

| Risk & Security | Risk shared among multiple backers; some platforms provide guarantees or insurance. | Relies on social collateral and personal trust within communities. |

| Impact on Entrepreneurship | Encourages innovation and large-scale outreach through diverse investor pool. | Focuses on financial inclusion and supporting grassroots entrepreneurship. |

Which is better?

Alternative funding platforms offer entrepreneurs greater accessibility to diverse capital sources such as crowdfunding, peer-to-peer lending, and angel investments, often with faster approval processes and fewer collateral requirements. Microfinance Institutions primarily focus on providing small loans to underserved or low-income entrepreneurs, emphasizing financial inclusion and community development but sometimes with higher interest rates and stricter repayment terms. The better choice depends on the entrepreneur's funding needs, credit profile, and business model, with alternative funding platforms excelling in scalability and innovation, while microfinance institutions emphasize trust and localized support.

Connection

Alternative funding platforms and Microfinance Institutions (MFIs) are connected through their shared goal of providing accessible financial resources to entrepreneurs, especially those underserved by traditional banks. Crowdfunding platforms and peer-to-peer lending complement MFIs by offering flexible funding options that cater to small businesses and startups. Both avenues leverage technology and community networks to enhance capital availability and support entrepreneurial growth.

Key Terms

Microloans

Microfinance institutions specialize in providing microloans typically ranging from $100 to $10,000, targeting underserved populations and small businesses with limited credit history. Alternative funding platforms, such as peer-to-peer lending and crowdfunding, offer diversified loan structures and rapid access to capital, often leveraging technology for efficient service delivery. Explore detailed comparisons and choose the best microloan option tailored to your financial needs.

Crowdfunding

Microfinance Institutions (MFIs) provide small loans and financial services primarily to low-income individuals in developing regions, emphasizing personalized assessments and community trust. Crowdfunding platforms leverage online networks to pool capital from numerous investors globally, offering diverse funding options such as rewards, equity, or donations without collateral requirements. Explore the dynamics between microfinance and crowdfunding to understand their unique benefits and risks in alternative funding landscapes.

Peer-to-Peer Lending

Microfinance Institutions (MFIs) offer structured financial services to underserved populations, emphasizing credit accessibility and social impact, while Peer-to-Peer (P2P) lending platforms leverage digital technology to connect individual borrowers directly with investors, often reducing costs and improving funding speed. P2P lending is gaining traction as an alternative funding platform due to its scalability, transparency, and user-friendly experience, challenging traditional MFIs' dominance in micro-lending markets. Explore the transformative potential and comparative benefits of P2P lending in microfinance by learning more about emerging trends and key performance indicators.

Source and External Links

Microfinance 101: All you need to know - Kiva - Provides an introductory guide explaining what microfinance is, its applications, and benefits for small-scale borrowers and communities.

Microfinance Institutions: Definition, Purpose, and Examples - Defines Microfinance Institutions as entities that support small businesses, especially MSMEs, by providing accessible loans with lighter terms to unbanked or underserved communities, aiming to empower economic growth.

Microfinance Institutions - Interest Rate & Eligibility - Describes MFIs in India that offer microloans and financial services to low-income individuals and small business owners to promote financial inclusion and poverty reduction.

dowidth.com

dowidth.com